Native Ad Networks: A Review of Taboola, Outbrain, and Revcontent.

Native Ad Networks Compared: A Comprehensive Review of Taboola, Outbrain, and Revcontent for 2026

Introduction: The Power of Discovery Advertising

You’ve seen them everywhere. At the bottom of nearly every news article, blog post, and media site, a widget appears: “Around the Web,” “You May Have Missed,” “Recommended For You.” These content recommendation units have become as ubiquitous as the articles themselves, generating billions of clicks annually and representing a significant portion of digital advertising spend.

This is the world of native advertising platforms—and Taboola, Outbrain, and Revcontent are its dominant players.

Native advertising has fundamentally changed how brands reach audiences online. Unlike traditional display ads that interrupt the user experience, native ads blend seamlessly into the surrounding content, appearing as natural recommendations rather than paid promotions . The results speak for themselves: native ads are 53% more likely to grab users’ attention than conventional display ads, and they produce click-through rates nearly 9 times higher . Over 86% of impressions are now generated through native formats, and 71% of users report personally identifying with a brand after seeing its native ads—compared to just 50% for display advertising .

For e-commerce sellers, dropshippers, and performance marketers, these platforms represent a powerful channel for scaling traffic and conversions . For publishers, they offer significant monetization opportunities. But choosing between Taboola, Outbrain, and Revcontent requires understanding their distinct strengths, targeting philosophies, and ideal use cases.

This comprehensive guide provides a detailed, side-by-side comparison of the three major native advertising platforms in 2026, drawing on performance data, publisher requirements, and hundreds of aggregated user experiences.

Part 1: Understanding Native Advertising Platforms

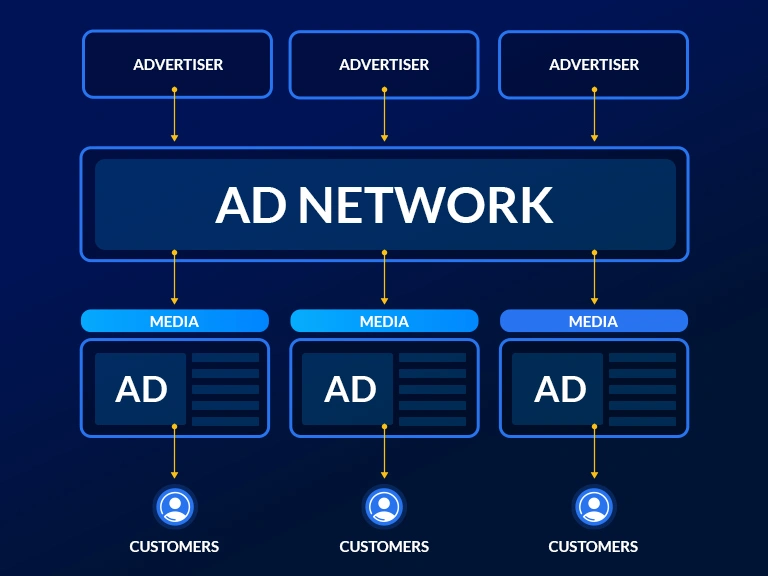

1.1 What Is a Native Ad Network?

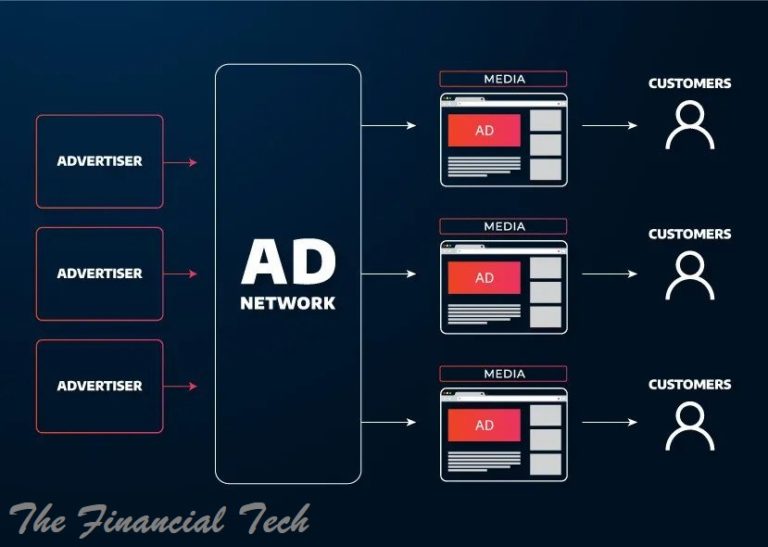

A native advertising platform is a technology medium that enables both publishers and advertisers to meet their advertising goals by synchronizing adverts with web content . Unlike traditional display networks that serve banner ads in designated placements, native platforms serve ads that appear to be a seamless part of the content the user is viewing.

The defining characteristic: A native ad doesn’t look like an ad. It matches the form, feel, and function of the platform on which it appears, making it less intrusive and more engaging for users .

1.2 Types of Native Advertising

Native ads manifest in several formats across the web :

| Format Type | Description | Where You See It |

|---|---|---|

| Content Recommendations | Suggested articles and content that appear below or within editorial content | Bottom of news articles (“Around the Web” widgets) |

| In-Feed Advertising | Ads that appear like regular posts in a social media or content feed | Facebook, Instagram, discovery feeds |

| Search and Promoted Listings | Paid placements at the top of search results | Google search results, product listings |

Taboola, Outbrain, and Revcontent primarily operate in the content recommendation space, serving their widgets on premium publisher sites across the globe.

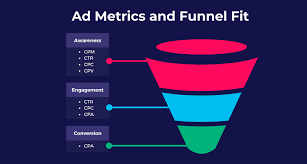

1.3 Why Native Ads Outperform Display

The performance advantage of native advertising is well-documented and substantial :

53% higher attention rate than display ads

9x higher click-through rates compared to conventional banners

86%+ of impressions now generated through native formats

71% of users personally identify with brands after seeing native ads (vs. 50% for display)

This performance gap stems from fundamental user psychology: native ads don’t trigger “banner blindness” because they don’t look like banners. They provide value through content discovery rather than interrupting the user experience .

Part 2: Taboola – The Global Scale Leader

2.1 Overview and Market Position

Taboola is one of the largest and most widely used native advertising platforms globally, offering unparalleled reach across the open web . The platform powers content recommendations for some of the world’s top publishers, including CNN, MSN, NBC, USA Today, and The Huffington Post . Through its massive publisher network, Taboola reaches hundreds of millions of users monthly across desktop and mobile devices.

The 2026 landscape: Taboola’s merger with Outbrain (which was explored but ultimately structured as a commercial agreement rather than a full merger) has created a duopoly in the premium native space, though both platforms continue to operate distinct market positions and technology stacks .

2.2 Key Features and Capabilities

Publisher Requirements:

Minimum traffic: 1 million+ monthly page views

Premium publisher focus: Taboola curates its network to maintain quality

Advertiser Targeting:

Taboola’s targeting model builds around contextual signals and content consumption patterns . Advertisers can target users based on:

The types of content they read across the publisher network

Interest categories derived from browsing activity

Lookalike audiences built from engagement behavior

Retargeting of users who previously engaged with content

Advanced capabilities include:

Geo-targeting for precise geographic placement

Device targeting across desktop and mobile

Vertical and interest-based segmentation

DMP and CRM integration for custom audiences

Retargeting capabilities for re-engaging past visitors

Ad Formats:

In-feed native display ads

In-article native placements

Video advertising units

Mobile-optimized formats

2.3 Pricing Model

| Metric | Taboola |

|---|---|

| Primary Pricing Model | CPC (Cost Per Click) |

| Maximum CPM/RPM | Approximately $2.00 |

| Minimum Payment Threshold | $100 |

| Payment Terms | Net 30–60 (varies by contract) |

Taboola’s pricing remains relatively straightforward compared to the complexity of Google’s ecosystem. CPC dominates, with CPM options available for awareness-focused campaigns. SmartBid handles automated optimization within advertiser parameters, with spending caps operating at the campaign level .

2.4 Ideal Use Cases

Taboola excels for:

| Advertiser Type | Why Taboola Works |

|---|---|

| Lifestyle and consumer brands | Massive reach across premium lifestyle publishers |

| Gadget and trending product sellers | Broad exposure drives discovery and viral potential |

| E-commerce and dropshipping stores | Extensive network for testing and scaling winning products |

| Content marketers | Native format perfect for article-style promotions |

| Brand awareness campaigns | Unmatched scale across top-tier media properties |

Specific strengths highlighted by dropshipping experts: Taboola is particularly effective for lifestyle products, gadgets, trending items, and consumer goods that benefit from broad exposure. Its advanced targeting features allow audience segmentation by interests, demographics, location, and behavior, while retargeting capabilities help re-engage users who have previously interacted with your content .

2.5 Data and Analytics

Taboola’s reporting focuses on content performance . Campaign dashboards show:

CTR and engagement metrics

Spend and ROI tracking

Audience insights revealing which segments perform best

Publisher-level reporting breaking down performance by placement site

The Taboola API enables programmatic data extraction for warehouse integration, though API architecture differs from Google’s more granular approach. Rate limits and reporting latency windows require consideration when building integration pipelines .

2.6 User Sentiment and Limitations

Advertisers generally report positive experiences with Taboola’s reach and performance. However, some limitations emerge consistently in reviews:

Limited campaign editing: Some users report that once campaigns go live, certain aspects cannot be edited—requiring campaign recreation for substantial changes

Learning curve: The platform requires initial training to navigate effectively

Premium pricing: Minimum spends may exclude smaller advertisers

Part 3: Outbrain – The Premium Content Discovery Engine

3.1 Overview and Market Position

Outbrain positions itself as a premium content discovery platform, emphasizing quality over pure scale. The platform works with top-tier publishers including BBC, The Guardian, The Wall Street Journal, and Time Inc. . This focus on premium inventory attracts advertisers who prioritize brand safety and editorial alignment alongside reach.

The 2026 structure: Outbrain operates as a subsidiary of Teads, combining Outbrain’s native discovery capabilities with Teads’ video and advertising technology . This integration enables cross-format campaigns that leverage both native and video inventory.

3.2 Key Features and Capabilities

Publisher Requirements:

Minimum traffic: 10 million+ monthly page views

Highly selective: Outbrain maintains the most stringent publisher criteria among major native networks

Advertiser Targeting:

Outbrain’s targeting philosophy emphasizes contextual alignment and audience quality:

Geo, device, vertical, and retargeting capabilities

DMP and CRM integration (partners include Axciom LiveRamp, Oracle BlueKai, Quantcast)

Interest-based targeting derived from content consumption patterns

Lookalike audiences from engagement behavior

Ad Verification and Brand Safety:

Outbrain demonstrates strong commitment to measurement and safety, partnering with:

DoubleVerify

Integral Ad Science

Fraudlogix

Comscore

Nielsen

Ad Formats:

In-feed native placements

In-article advertising

Display ads across the network

Mobile-optimized formats

3.3 Pricing Model

| Metric | Outbrain |

|---|---|

| Starting Price | $20.00 one-time (minimum campaign spend) |

| Primary Pricing Model | CPC and CPM options |

| Minimum Payment Threshold | Varies by contract |

| Free Trial | Available (limited) |

Outbrain Amplify, the platform’s self-service interface, provides real-time updates and reporting through a detailed activity dashboard where users can track, manage, and optimize campaigns .

3.4 Ideal Use Cases

Outbrain excels for:

| Advertiser Type | Why Outbrain Works |

|---|---|

| Storytelling-focused brands | Premium publisher environments ideal for narrative content |

| Long-form content marketers | Educational and informative posts perform well |

| Mid-size eCommerce brands | Growing traffic with focus on brand authority |

| Products needing context | Editorial placements allow explanation before selling |

| B2B and professional services | Premium publisher alignment with professional audiences |

Outbrain’s network supports engaging content formats like “Top 10 lists,” how-to guides, and product roundups, which can subtly lead readers toward purchases without feeling pushy. By leveraging editorial-style placements, advertisers can build trust and increase engagement, especially for products that need context or explanation to appeal to buyers .

3.5 Data and Analytics

Outbrain’s analytics capabilities mirror Taboola’s in many respects, with campaign dashboards showing CTR, engagement, and spend. However, Outbrain’s integration with Teads expands measurement options for video campaigns.

The Outbrain API enables programmatic data extraction, though like Taboola, it aggregates at higher levels than Google’s auction-level granularity. Data teams building unified marketing analytics pipelines should consider the API characteristics, including rate limits, reporting latency, and historical data retention periods .

3.6 User Sentiment and Limitations

Outbrain’s verified user reviews on Software Advice show an overall rating of 3.9 out of 5, with the following breakdown :

| Category | Rating (out of 5) |

|---|---|

| Ease of Use | 4.0 |

| Functionality | 3.9 |

| Customer Support | 3.7 |

| Value for Money | 3.6 |

Positive feedback highlights:

“Easy to utilize user interface that enables real-time updates and reporting”

“Outbrain brings us the best ROI we ever seen from other PPC platforms”

“Great way to reach the best audience at the right time”

“Allows you to take a piece of important content and push it out beyond what most agencies are capable of”

Consistent criticisms:

Limited exclusions: Some advertisers report wasting clicks on low-quality websites they cannot adequately exclude

Editing restrictions: Once campaigns are live, certain elements cannot be modified

Setup time: Requires test campaigns and continuous fine-tuning before achieving optimal results

Customer service concerns: Some users report difficulty reaching support or delayed responses

Account approval issues: Some applicants report being banned with minimal explanation, often due to content policies

Part 4: Revcontent – The Performance-Focused Challenger

4.1 Overview and Market Position

Revcontent positions itself as the world’s fastest-growing content discovery and native advertising platform, emphasizing performance-driven advertising within premium content environments . Unlike the duopoly leaders, Revcontent has built its reputation on lower CPCs, responsive support, and a focus on advertiser ROI .

The platform partners with major publishers including Forbes and Wayfair, delivering what the company claims is 250 billion unique content recommendations per month . Its focus on the U.S. market makes it particularly attractive for sellers targeting high-intent, high-spending American audiences .

4.2 Key Features and Capabilities

Publisher Requirements:

Minimum traffic: 3 million+ monthly page views

Selective but potentially more accessible than Outbrain’s 10M threshold

Advertiser Targeting:

Revcontent’s targeting capabilities include :

Granular audience segmentation

Partnership with the world’s leading media brands

Real-time reporting for audience optimization

Advanced options for reaching audiences at all funnel stages

Key Features:

Widgets: Customizable recommendation units

SEM capabilities: Search-focused advertising options

Recording and analytics: Performance tracking tools

AI-powered optimization: Machine learning for campaign performance

Custom reports: Flexible reporting for advanced analytics

Ad Verification and Support:

Revcontent offers 24/7 support and AI-powered assistance, along with email support for ongoing campaign management .

4.3 Pricing Model

| Metric | Revcontent |

|---|---|

| Primary Pricing Model | CPC and vCPM options |

| Minimum Payment Threshold | $50 |

| Typical CPC | Lower than major competitors (cost-effective for testing) |

Revcontent’s cost-effectiveness is a primary differentiator. The platform is known for its lower CPCs compared to Taboola and Outbrain, making it perfect for dropshippers who want to experiment with ad creatives on a budget .

4.4 Ideal Use Cases

Revcontent excels for:

| Advertiser Type | Why Revcontent Works |

|---|---|

| Budget-conscious advertisers | Lower CPCs enable testing with minimal risk |

| U.S.-focused campaigns | Strong reach in American markets |

| Creative testing | Cost-effective platform for testing headlines, images, and angles |

| Performance marketing | Focus on ROI and conversion-driven campaigns |

| Small to medium businesses | Accessible entry point with responsive support |

Revcontent’s business priorities align closely with performance goals: Increase Sales & Revenue and Acquire Customers are the most popular business priorities that customers achieve using the platform . This performance focus makes it particularly attractive for direct-response advertisers.

4.5 Data and Analytics

Revcontent’s analytics capabilities include :

Custom Reports: Flexible reporting tailored to advertiser needs

Analytics: Comprehensive performance tracking

Real-time data: Up-to-date campaign metrics

AI-powered insights: Machine learning for optimization recommendations

The platform’s focus on performance is reflected in its use cases, with customers recommending it for Advertisement, Sending & Publishing Communications, and Engagement Management .

4.6 User Sentiment and Limitations

Revcontent user reviews on Cuspera highlight specific strengths :

Peer review: “This ad network performs much better than other native advertising units I’ve put on my websites”

Business priorities achieved: Sales growth, revenue increase, customer acquisition

Industry adoption: Popular in Marketing and Advertising, widely used by Small Business

Limitations noted across sources:

Lower scale than Taboola or Outbrain in international markets

U.S. focus may limit reach for global campaigns

Less publisher transparency than larger competitors in some regions

Part 5: Head-to-Head Comparison

5.1 Quick Reference Comparison Table

| Criteria | Taboola | Outbrain | Revcontent |

|---|---|---|---|

| Publisher Minimum | 1M+ monthly views | 10M+ monthly views | 3M+ monthly views |

| Pricing Model | CPC (CPM options) | CPC, CPM | CPC, vCPM |

| Typical CPC | Moderate | Moderate-High | Lower |

| Min Payment | $100 | $20 (campaign start) | $50 |

| Primary Strength | Global scale, broad reach | Premium publishers, storytelling | Cost-effectiveness, U.S. focus |

| Best For | Lifestyle, gadgets, trending products | Content-driven campaigns, brand authority | Testing, budget-conscious advertisers |

| Self-Service | Yes | Yes (Amplify) | Yes |

| Support | Standard | Mixed reviews | 24/7 + AI-powered |

| Targeting Philosophy | Contextual + consumption | Contextual + premium alignment | Performance-driven |

5.2 Platform Strengths by Advertiser Type

| Advertiser Need | Best Platform | Why |

|---|---|---|

| Maximum global reach | Taboola | Largest publisher network, broadest international footprint |

| Premium brand alignment | Outbrain | Top-tier publishers like BBC, WSJ, Guardian |

| Cost-effective testing | Revcontent | Lower CPCs enable experimentation with minimal budget |

| Storytelling campaigns | Outbrain | Editorial placements ideal for narrative content |

| Gadget/lifestyle products | Taboola | Strong performance in trending consumer categories |

| U.S.-focused campaigns | Revcontent | Particularly strong American reach |

| Performance marketing | Revcontent | ROI-focused platform design |

| Retargeting at scale | Taboola | Advanced retargeting capabilities across massive network |

5.3 Publisher Perspective

For publishers considering native ad monetization, the requirements differ significantly:

| Platform | Traffic Required | Publisher Profile |

|---|---|---|

| Taboola | 1M+ monthly views | Broad range of content sites |

| Outbrain | 10M+ monthly views | Top-tier, premium publishers only |

| Revcontent | 3M+ monthly views | Growing publishers with quality content |

Smaller publishers (under 1M monthly views) may need to consider alternative native platforms like MGID, Nativo, or TripleLift, which often have lower or no traffic minimums .

Part 6: Strategic Considerations for Advertisers

6.1 The Content-First Approach

Native advertising success requires a fundamentally different creative strategy than search or social advertising. Content is not just the vehicle; it is the advertisement itself.

Best practices for native creative :

Educate before selling: Advertorial-style content that provides genuine value outperforms direct sales pitches

Use curiosity-driven headlines: Examples like “These 7 Kitchen Tools Are Going Viral for a Reason” or “What Happens When You Try This Posture Corrector for a Week?” generate clicks without being misleading

Match publisher tone: Content should feel native to the publication where it appears

Test multiple angles: Emotional storytelling vs. practical problem-solving—run both to identify winning approaches

Pro Tip: Before launching your campaign, create two versions of your advertorial—one focused on emotional storytelling and one focused on practical, problem-solving value. Run both simultaneously with small budgets. Native audiences often respond very differently depending on the angle, and this quick A/B test helps you learn the winning narrative style before scaling .

6.2 Attribution and Measurement Challenges

Running campaigns across multiple native platforms creates data integration complexity that data teams must address .

Key challenges:

Different attribution models: Each platform may use different attribution windows and methodologies

Deduplication complexity: A user might see a Taboola ad, later click an Outbrain ad, then convert. Both platforms may claim the conversion

API differences: Rate limits, reporting latency, and historical data retention vary by platform

Metric definitions: What one platform calls a “conversion” may differ from another’s definition

Solutions for data teams :

Create a unified schema mapping equivalent metrics across platforms

Standardize attribution windows before comparing performance data

Build common dimension tables for dates, currencies, and regions

Implement data quality checks to catch API changes or anomalies

Consider using pre-built connectors to handle schema changes automatically

6.3 Budget Allocation Strategy

Smart advertisers diversify across native platforms based on campaign stage:

| Stage | Platform Strategy |

|---|---|

| Testing (low budget) | Start with Revcontent for cost-effective creative testing |

| Mid-funnel scaling | Add Taboola for broader reach once winners are identified |

| Premium brand campaigns | Incorporate Outbrain for top-tier publisher alignment |

| Retargeting | Use platform retargeting capabilities, particularly Taboola’s |

| Full-funnel integration | Run all three with unified attribution tracking |

Part 7: The Future of Native Advertising – 2026 and Beyond

7.1 Consolidation and Competition

The native advertising landscape continues to evolve. The Taboola-Outbrain commercial relationship has created a de facto duopoly in premium native inventory, while Revcontent maintains its challenger position with performance-focused differentiation .

7.2 Integration with Commerce Media

Native platforms are increasingly integrating with commerce media networks, allowing advertisers to leverage purchase data for targeting. This trend will accelerate as third-party cookies continue to deprecate.

7.3 AI-Driven Optimization

All three platforms are investing heavily in AI-powered optimization :

Automated bidding and targeting

Predictive audience modeling

Creative optimization algorithms

Real-time performance adjustments

7.4 Video-Native Convergence

The lines between native display and video advertising are blurring, particularly with Outbrain’s integration into Teads’ video ecosystem . Advertisers should expect increasingly seamless multi-format campaigns.

Part 8: Decision Framework – Which Platform Is Right for You?

8.1 Choose Taboola If:

You need maximum global scale and broad audience reach

You sell lifestyle products, gadgets, or trending consumer goods

You want to test and scale products across diverse international markets

You require advanced retargeting capabilities within a massive network

You have the budget for moderate CPCs and can meet the $100 minimum payment threshold

8.2 Choose Outbrain If:

Brand safety and premium alignment are your top priorities

Your campaigns rely on storytelling, long-form content, or educational angles

You’re building brand authority alongside direct response

Your products need context and explanation before purchase

You can meet higher CPCs and work within Outbrain’s stricter content guidelines

8.3 Choose Revcontent If:

You’re on a budget and need cost-effective testing

Your primary market is the United States

You want to experiment with multiple creative angles, headlines, and images before scaling

Performance marketing and ROI are your primary drivers

You value responsive support and lower minimum payments ($50)

8.4 Multi-Platform Strategy

For sophisticated advertisers, the optimal approach often involves all three platforms in a coordinated strategy :

Test creative on Revcontent’s lower-cost inventory

Scale winning creatives on Taboola’s broader network

Reinforce brand authority with premium Outbrain placements

Retarget across all platforms with unified conversion tracking

Conclusion: Matching Platform to Purpose

Taboola, Outbrain, and Revcontent are not interchangeable options. They represent distinct approaches to native advertising, each optimized for different advertiser goals, budgets, and campaign types.

Taboola delivers unparalleled scale. Choose it when your primary need is broad reach across diverse audiences, particularly for lifestyle and trending products .

Outbrain delivers premium alignment. Choose it when brand safety, publisher quality, and editorial context matter as much as reach—particularly for storytelling and content-driven campaigns .

Revcontent delivers cost-effective performance. Choose it when you’re testing on a budget, focusing on U.S. audiences, or prioritizing ROI above all else .

The unifying principle across all platforms: Native advertising rewards a content-first mindset. The platforms provide the reach; your content provides the reason for users to click. The advertisers who succeed are those who invest in understanding their audience, crafting compelling narratives, and continuously testing and optimizing their approach .

Native advertising in 2026 is more sophisticated, more measurable, and more essential than ever. Whether you’re a global brand seeking massive reach, a content marketer building authority, or a dropshipper scaling profitable products, understanding these platforms’ distinct strengths will determine your success.

Choose your platform strategically. Craft your content thoughtfully. Measure your results relentlessly. Scale what works.

OTHER POSTS