The Rise of Retail Media Networks (RMNs): Amazon, Walmart, and Beyond.

The Rise of Retail Media Networks (RMNs): Amazon, Walmart, and Beyond

Introduction: The Third Pillar of Digital Advertising

For decades, the digital advertising landscape was defined by a clear duopoly. Google owned intent—capturing users actively searching for solutions. Meta owned identity—understanding who users were through their social graphs and interests. Together, they commanded the majority of ad spend, and brands built their media plans around these two pillars.

That era is over.

Today, a third force has emerged, one that combines the purchase intent of search with the identity depth of social, while adding something neither can match: transactional certainty. Retail Media Networks (RMNs)—advertising platforms built by retailers that allow brands to promote products directly within the retailer’s ecosystem—have grown from experimental budgets to a foundational component of modern media strategy.

The numbers are staggering. Global retail media investment is projected to reach $196.7 billion in 2026, representing 16% of all ad spend worldwide and surpassing combined linear and connected TV advertising for the first time . This is not a niche channel; it is a fundamental restructuring of how advertising dollars flow.

This article explores the rise of retail media networks, examining the dominant players—Amazon and Walmart—the expanding ecosystem beyond them, the technological forces reshaping the space, and what the future holds for brands, retailers, and advertisers in this rapidly maturing market.

Part 1: What Are Retail Media Networks? Defining a New Category

1.1 The Core Concept

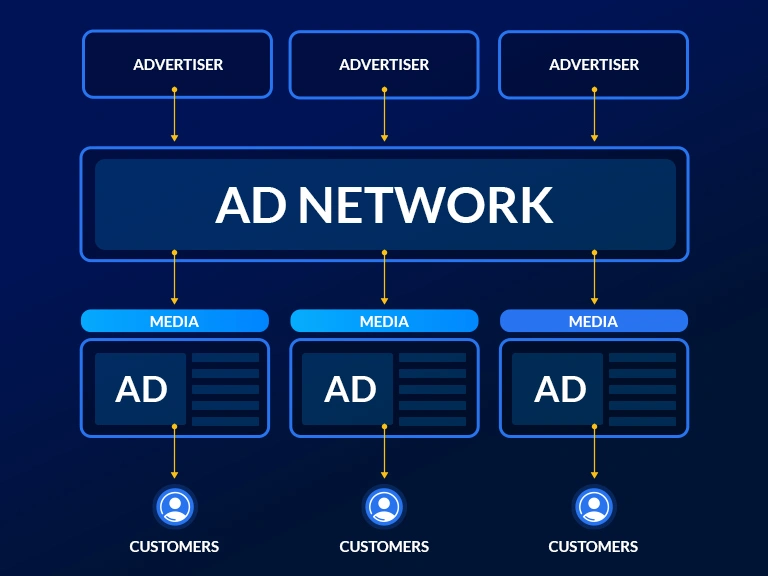

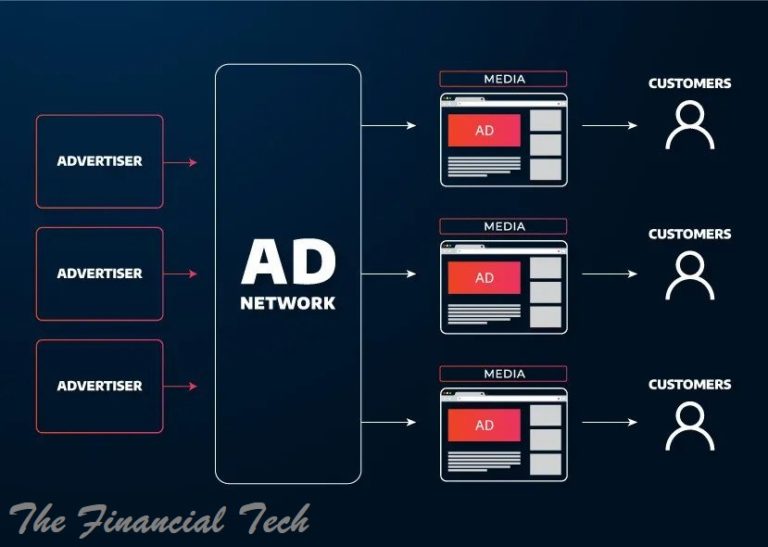

A retail media network is an advertising structure that includes digital channels such as websites and applications owned by a retailer, enabling third-party brands to purchase ad space within that ecosystem . At its simplest, an RMN allows a brand selling on Amazon to pay for prominent placement in search results, or a cereal company to display ads to shoppers browsing the Walmart app.

But this simple description undersells the transformation. Retail media networks are fundamentally different from traditional advertising channels because they sit at the intersection of media and commerce . When a user clicks an ad on a retail media network, they don’t leave the environment to complete a transaction elsewhere—they remain within the retailer’s ecosystem, where purchase data is captured, attributed, and fed back into the advertising system.

1.2 The Trifecta of Value

What makes RMNs so powerful is their unique combination of assets that neither search nor social can fully replicate:

| Asset | Description | Why It Matters |

|---|---|---|

| First-Party Transaction Data | Actual purchase history, not inferred interest | Advertisers know exactly what customers bought, enabling precise targeting and measurement |

| Closed-Loop Attribution | The entire journey from impression to purchase occurs within the same ecosystem | Advertisers can directly measure ROAS with confidence, eliminating attribution guesswork |

| Point-of-Purchase Proximity | Ads appear when users are already in shopping mode | Higher conversion rates and lower funnel friction |

As Walmart’s Khurrum Malik, VP of Business and Product Marketing for Walmart Connect, puts it: “Retail media exists to derive value for advertisers. We think about retail media as being built to spark sales” .

1.3 The Market Size Story

The growth trajectory of retail media is nothing short of extraordinary:

The global retail media networks market was valued at $35 billion in 2025

It is projected to grow to $86.89 billion by 2034, a CAGR of 10.63%

Worldwide investment in RMNs is set to reach $174.9 billion in 2025 and $196.7 billion in 2026

Retail media will overtake combined linear and connected TV ad spend in 2026

Commerce media (a broader category including travel, financial services, and other non-retail transaction platforms) will account for 17.2% of total ad revenue by 2030

To put this in perspective, retail media now commands a larger share of ad budgets than traditional television—a medium that dominated advertising for half a century.

Part 2: The Dominant Force—Amazon’s Advertising Empire

2.1 By the Numbers

When discussing retail media, one name looms above all others. Amazon is not just the largest e-commerce platform; it is the largest retail media network by an enormous margin.

Key metrics for Amazon’s advertising business:

Amazon will earn $60.6 billion in retail media ad revenue in 2025 (excluding spend on Amazon-owned properties like Prime Video and Twitch)

This is forecast to climb to $69.7 billion in 2026

Advertising revenue accounts for just 9.2% of Amazon’s total revenue, yet it continues to post significant double-digit year-on-year growth

In Q1 2025, Amazon achieved +17.7% ad growth, outpacing the +16% expansion forecast for the global retail media market

Amazon’s ad growth also surpassed its overall sales growth of 8.6%

Together, Alphabet, Meta, and Amazon accounted for over half (53.6%) of global ad spend (excluding China) in 2024, up from 51.9% in 2023 and 49.7% in 2022 . The duopoly has become a tripoly.

2.2 Beyond Sponsored Products

While paid search formats—particularly Sponsored Products—remain the core of Amazon’s advertising offering, the company has achieved incremental growth through upper-funnel ad spend and strategic expansion .

Display Advertising Growth:

By the end of 2025, Amazon will have doubled the size of its display ad revenue over the last four years . This reflects a deliberate strategy to capture brand-building budgets, not just performance dollars.

Prime Video Integration:

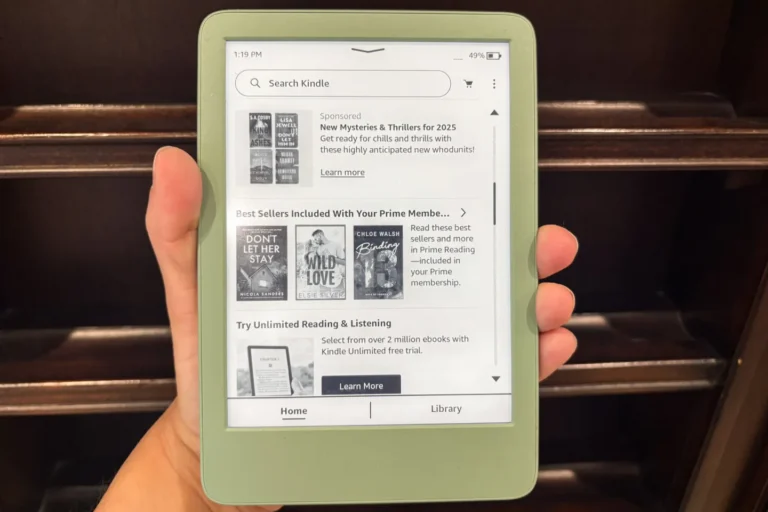

Amazon now offers advertisers the ability to reach over 200 million shoppers worldwide through Prime Video . This represents a significant expansion beyond the core e-commerce site, allowing brands to build awareness in a premium video environment before capturing demand within the retail ecosystem.

Twitch and Gen Z:

The company’s gaming platform, Twitch, enables advertisers to launch campaigns targeted particularly at Gen Z audiences, extending reach to younger consumers who may not be primary Amazon shoppers .

2.3 Consumer Perception and Platform Strength

Perhaps most impressively, Amazon’s advertising platform enjoys remarkable consumer goodwill. Research indicates that Amazon is, alongside TikTok, the consumer’s preferred platform for viewing advertising . Consumers find Amazon’s ad formats relevant and useful, and the company is also viewed as having the most trustworthy and innovative ads .

This matters because consumer ad tolerance is finite. Platforms that deliver relevant, non-intrusive advertising earn the right to show more ads—and command higher prices for them.

However, despite pleasing consumers, Amazon has not yet broken into the top five platforms favored by advertisers themselves—a perception the company hopes to change through AI investment and more advanced ad creation tools .

2.4 Amazon’s Ecosystem Strategy

At CES 2026, Amazon’s presence reinforced a vision of ambient intelligence—systems that anticipate needs and reduce friction across devices . Rather than spotlighting a single hero product, Amazon emphasized how its devices and services work together across Fire TV, Ring, and Alexa to create seamless experiences.

Shopping, in this model, becomes an extension of daily routines rather than a discrete activity. When consumers can buy through voice commands, smart screens, or AI assistants, the boundaries between media and commerce blur entirely—and Amazon is positioned at the center of that blur.

Part 3: Walmart Connect—The Omnichannel Challenger

3.1 Scale as a Strategic Advantage

If Amazon’s strength lies in its digital dominance, Walmart’s advantage is its physical scale and omnichannel reach. As Khurrum Malik explains: “We have 150 million omnichannel customers every week, both in-store and digital. And we have 4,600 stores” .

This scale is not a talking point—it is an operating reality that shapes everything Walmart Connect builds. When you reach that many customers across both physical and digital channels, retail media must work at a different level of complexity.

3.2 The AI Push: Sparky and Marty

Walmart has been doubling down on its retail media strategy with a clear AI focus:

Sparky (Consumer-Facing AI):

Walmart’s customer-facing AI assistant, Sparky, is embedded directly into the shopping journey on the app and web . Rather than positioning AI as a novelty layer, Walmart uses it to help customers discover products. Survey data shows that 81% of customers want to use Sparky for discovering new products—helping them prepare for moments like a birthday party or solve specific problems .

Marty (Advertiser-Facing AI):

First introduced in 2025 and now being rolled out more widely, Marty acts as an advertising assistant inside Walmart Connect . It helps brands plan, optimize, and troubleshoot campaigns through conversational prompts rather than dashboards alone.

What has surprised Walmart most is how advertisers are using Marty: 97% of the inquiries coming through are new—advertisers asking for new things, new ways to help, and probing performance more deeply . This suggests that AI is reducing friction rather than replacing judgment, enabling advertisers to interrogate their activity more thoroughly.

3.3 The Vizio Acquisition and CTV Integration

Walmart’s acquisition of Vizio pushes the company further into connected television territory, giving it owned CTV inventory alongside search, display, in-store, and delivery touchpoints . This creates what Malik describes as a full-funnel system: “Create demand and fulfil demand—all in one” .

For advertisers, this means the ability to reach consumers with video advertising in living rooms, measure the impact on in-store and online purchases, and close the loop with transaction data—all within Walmart’s ecosystem.

3.4 Measurement Innovation: Search Incrementality

In January 2026, Walmart launched search incrementality measurement . This tool allows advertisers running search campaigns on Walmart to see the incremental lift they generated—separating sales that would have happened anyway from those genuinely driven by advertising.

In food categories, this translated into a $2.30 incremental return on ad spend . Walmart has also published research with Circana showing Walmart Connect delivering incremental ROAS 2.5 times higher than social benchmarks, across both digital and in-store activity .

For Malik, the implication is clear: stores and screens shouldn’t be measured separately. “We think about store conversions and digital conversions as one and the same. The store is just another way for people to engage and shop—just like the web” .

3.5 The Omnicom Partnership

At CES 2026, Omnicom highlighted a partnership with Walmart integrating purchase data into influencer planning on Meta platforms . This goes beyond simple sponsored listings: it uses real transaction history to identify which creators’ audiences are most likely to buy certain products.

This treats retail purchase data as a source of truth for influencer ROI, helping brands quantify not just impressions or clicks, but purchase-probable audiences. It represents a new level of sophistication in connecting retail data to broader media execution.

Part 4: Beyond the Giants—The Expanding Ecosystem

4.1 The Proliferation of Networks

While Amazon and Walmart dominate headlines, the retail media landscape includes dozens of players across categories:

| Retailer | Network Name | Distinctive Strength |

|---|---|---|

| The Kroger Co. | Kroger Precision Marketing | Grocery purchase data; in-store digital screens |

| Target | Roundel | Millennial/Gen Z audience; owned brand affinity |

| Instacart | Instacart Ads | Grocery delivery; quick-commerce context |

| Best Buy | Best Buy Ads | Electronics shoppers; high-intent purchase data |

| eBay | eBay Ads | Marketplace scale; auction-based buying behavior |

| Macy’s | Macy’s Media Network | Department store shoppers; premium brand alignment |

According to IAB Europe’s Retail & Commerce Media Committee, 2026 will see continued expansion in the volume of networks entering the space . But this proliferation brings a challenge: differentiation. As Ollie Shayer, Senior Director at SMG, notes: “Retailers will need to move beyond capability checklists to articulate what makes their proposition truly distinctive” .

4.2 The Evolution to Commerce Media

A significant shift occurring in 2026 is the expansion from “retail media” to “commerce media” —recognizing that transaction-enabled advertising extends beyond traditional retailers .

WPP recently expanded its commerce-driven ad revenue reporting to include travel and financial services media networks, reflecting this evolution. According to Nick Van Sicklen, CEO of Interluxe Group: “Travel, hospitality, automotive, and experience-led brands are increasingly behaving like retailers, owning first-party demand signals and transaction data” .

Examples include:

Marriott’s Media Network: Allowing brands to target travelers based on loyalty program data

Uber’s Journey Ads: Reaching users based on location and ride history

Delta’s SkyMiles Media: Leveraging frequent flyer data for travel-adjacent advertising

4.3 Non-Endemic Advertising Opportunities

Historically, retail media networks focused on endemic advertisers—brands that sell products through the retailer. A cereal brand advertises on a grocery chain’s network; a shoe brand advertises on a footwear retailer’s site.

But 2026 is seeing significant growth in non-endemic advertising—brands that don’t sell through the retailer but want access to its audience . A car manufacturer might advertise on Instacart to reach grocery shoppers. A hotel chain might advertise on Walmart to reach families planning vacations. These non-endemic budgets represent a massive growth opportunity for RMNs.

4.4 The Consolidation Trend

While new networks continue to launch, the market is also showing signs of consolidation. As Avery Akkineni, CMO at VaynerX, observes: “There was a lot of energy in the last three years around building new retail media teams… but there’s only so much money and testing marketers will be able to endure” .

Rather than working with dozens of commerce media players, marketers are increasingly keen to test new opportunities through ad-tech vendors that streamline spend across multiple platforms . Companies like Criteo and Skai are expanding their connectivity, allowing brands to activate across multiple RMNs through a single interface .

Part 5: The AI Revolution in Retail Media

5.1 Beyond Optimization to Transformation

Artificial intelligence is not just optimizing retail media—it is fundamentally reshaping the entire commerce layer. According to IAB Europe’s experts, AI’s potential extends far beyond efficiency gains .

Ollie Shayer describes AI’s role: “It will increasingly streamline the day-to-day operations of Retail Media Networks, automating planning, targeting, and reporting to free teams for more strategic work. The real opportunity lies in using AI not just to increase efficiency, but to elevate the quality and intelligence of the entire Retail Media ecosystem” .

5.2 The Rise of Agentic Commerce

Perhaps the most significant development on the horizon is agentic commerce—shopping powered by AI agents that act on behalf of consumers .

The numbers are staggering:

The total addressable market for agentic commerce has an estimated value of $136 billion in 2025

This is forecast to grow to a potential $1.7 trillion by 2030

Lucie Laurendon, Product Marketing Director at Equativ, explains the implications: “AI tools and APIs are moving toward integrated product recommendations and shoppable features in Large Language Models environments. AI agents will guide shopping decisions, not just product searches. Soon or later, AI Agents will become true virtual personal shoppers, buying products and services at the best deals and the fastest delivery time” .

For retailers, this creates an urgent imperative: “Retailers must build strong data and tech infrastructure so AI can find, read, and trust their catalogues, ensuring their products remain part of the shopper journey” .

5.3 The Existential Question

Tyler Murray, Chief Enterprise Solutions Officer at VML North America, frames the challenge starkly: “AI agents really become not just a threat to retail media, but truly an existential threat” .

If referral traffic to commerce media players’ websites craters as people use AI agents or search on LLMs, the entire monetization model could be disrupted. Murray predicts “a real battle for the soul of retail media next year” as retailers decide where to place their bets .

His proposed counter-strategy? A refocus on in-store retail media . “The best strategic moat retailers can do to combat AI is to shift dollars towards in-store retail media, because there’s no AI that’s impacting shoppers as they’re in Walmart going down aisle seven” . Walmart’s investment in 170,000 digital screens throughout its stores exemplifies this approach.

5.4 Walmart’s Cautious AI Integration

Khurrum Malik at Walmart Connect takes a measured view of AI’s potential. “It’s very early,” he says when asked about bot-to-bot commerce. “We’re really focused on people-to-agent experiences” .

This discipline extends to creative applications. Walmart uses generative AI to help brands scale creative output—from automated lifestyle backgrounds to faster display asset generation—particularly for smaller advertisers. But Malik notes the trade-off: “We can generate display creative and save about 80% of the time. But if that creative doesn’t perform as well as something they did on their own, it’s a trade-off” .

The principle remains consistent: “It doesn’t matter whether it’s created by a person or a machine. What matters is whether it drives sales” .

Part 6: Measurement—The Industry’s Biggest Challenge and Opportunity

6.1 The Current State

Despite retail media’s growth, measurement remains the industry’s most significant hurdle . As Ollie Shayer notes: “Measurement remains both the biggest challenge and the most important opportunity” .

The core problem is fragmentation. Different networks use different metrics, attribution windows, and reporting frameworks, making cross-network comparison nearly impossible. Retailers, brands, and agencies lack a shared language for what effectiveness really means.

6.2 The Path to Standardization

Industry bodies are working to address this gap. IAB Europe is actively developing common definitions for metrics like ROAS, incrementality, and attribution . As Lucie Laurendon explains: “Common definitions for metrics like ROAS, incrementality, and attribution are the base. IAB Europe is already working on these standards, and this is helping to move the market in the same direction” .

But standards alone are insufficient. “Retailers, brands, agencies, and tech partners must work together and align on how data is tracked, calculated, and reported” .

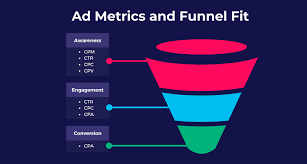

6.3 Beyond ROAS: The Need for Holistic Measurement

The industry has focused heavily on performance-based metrics—particularly ROAS—in recent years. But 2026 requires a more holistic understanding of success that connects short-term performance with long-term growth .

Lars Djuvik, CRO of Pentaleap, acknowledges that “achieving a truly transparent and standardised Retail Media measurement ecosystem is a complex, long-term challenge due to inherent differences in retail purchase cycles and attribution” . His recommended approach focuses on “solving incrementality through AI-driven reporting” and developing “actionable standards within specific vertical sub-categories like grocery and apparel” .

6.4 The Promise of Incrementality

Incrementality measurement—isolating what advertising actually caused versus what would have happened anyway—represents the gold standard . Walmart’s launch of search incrementality tools demonstrates that this is moving from theoretical ideal to practical reality.

The implications are significant. If advertisers can confidently measure incremental sales across channels, budgets will flow to the networks that deliver true business growth, not just last-click attribution winners.

Part 7: The 2026 Outlook—Trends to Watch

7.1 Market Maturity and Spend Consolidation

After years of explosive growth, the retail media market is showing signs of maturity :

Growth peaked at 38.6% in 2021

Slowed to 13.7% in 2025

Expected to ease further to 11.6% by 2027

Brands are consolidating their spend across fewer retail media networks . The era of testing every new network is giving way to strategic focus on platforms that deliver measurable results.

7.2 Format Evolution: From Search to Display

Sponsored search has been the dominant format, but this is changing. Display advertising currently represents less than 30% of total on-site retail media spend, but this balance will shift as retail media becomes more integrated with brand digital budgets .

New formats are emerging rapidly, particularly video and shoppable formats, which offer opportunities to drive performance and create differentiation . Off-site advertising is becoming key to grow beyond the point of purchase .

7.3 The Off-Site Opportunity

As Lucie Laurendon notes: “Off-site is becoming key to grow beyond the main point of purchase. It can expand faster with simpler tech and data activation. With AI coming into the market and the impact it may have on on-site traffic, off-site becomes an even stronger opportunity. It lets retailers reach their audiences everywhere and prepare for new behaviours” .

7.4 In-Store as the Next Frontier

Walmart’s Khurrum Malik is unequivocal: “In-store is the next great frontier” . With investments in digital screens, in-store radio, and connected displays, retailers are building physical media networks that can reach shoppers at the moment of purchase.

The advantage is clear: as Tyler Murray points out, “there’s no AI that’s impacting shoppers as they’re in Walmart going down aisle seven” . In-store media is immune to the disruption facing digital channels.

Part 8: What This Means for Advertisers

8.1 Strategic Implications

For brands and advertisers, the rise of retail media networks requires fundamental strategic shifts:

| Strategic Area | Implication |

|---|---|

| Budget Allocation | Retail media deserves dedicated budget, not just experimental dollars |

| Full-Funnel Thinking | RMNs now offer upper-funnel formats (video, display, CTV) not just search |

| Data Integration | First-party data becomes more valuable when activated across RMNs |

| Measurement Maturity | Move beyond ROAS to incrementality and long-term value |

| Creative Adaptation | Different RMNs require different creative approaches; one-size-fits-all fails |

8.2 Navigating Fragmentation

With dozens of RMNs available, advertisers must be selective. The experts suggest focusing on networks that:

Reach your core customer segments effectively

Offer robust measurement and incrementality tools

Integrate with your existing ad-tech stack

Demonstrate clear differentiation beyond basic capabilities

8.3 Preparing for Agentic Commerce

The rise of AI shopping agents represents both a threat and an opportunity. Brands must ensure their product catalogs are structured for AI consumption—complete, accurate, and machine-readable. When AI agents begin making purchase decisions on behalf of consumers, being findable in AI-driven commerce will be as important as being visible in search today.

Conclusion: The Retail Media Revolution Is Just Beginning

Retail media networks have evolved from experimental budgets to a foundational pillar of digital advertising. With investment surpassing $196 billion in 2026 and overtaking television spend, RMNs now command the attention of every brand, agency, and advertiser .

The Amazon juggernaut continues to dominate, with $69.7 billion in ad revenue and ambitious expansion into display, video, and AI-powered formats . Its combination of transaction data, scale, and consumer trust makes it the network to beat.

Walmart Connect represents the omnichannel challenger, leveraging 150 million weekly customers, 4,600 stores, and aggressive AI investment to build a full-funnel advertising system . Its focus on incrementality measurement and physical retail media positions it uniquely in the landscape.

Beyond the giants, dozens of networks from Kroger to Instacart to Best Buy offer specialized audiences and data assets, while the broader commerce media category expands to include travel, hospitality, and financial services .

The technological frontier is defined by AI—both as an optimization tool and as a potential disruptor. Agentic commerce could reshape how consumers shop, forcing retailers and brands to adapt or become irrelevant .

Measurement remains the critical challenge. Without standardized metrics, shared definitions, and reliable incrementality measurement, the industry cannot fully mature. Organizations like IAB Europe are working to address this gap, but progress requires collaboration across the ecosystem .

As Khurrum Malik observed at CES 2026, retail media is following a familiar trajectory—much like social media did a decade ago—expanding beyond a single format into a broader digital media ecosystem. “What’s different is the roots,” he notes. “And how we use that data to influence better media” .

Those roots—transaction data, closed-loop attribution, and point-of-purchase proximity—give retail media networks a fundamental advantage that search and social cannot replicate. As the market matures, consolidates, and integrates with AI, that advantage will only grow.

The question is no longer whether retail media matters. It is which networks will win your share of the $196 billion—and how you’ll measure the return when they do.

OTHER POSTS