Ad Density and User Experience: Finding the Right Balance.

Ad Density and User Experience: Finding the Right Balance in 2026

Introduction: The Pendulum Swings from Quantity to Quality

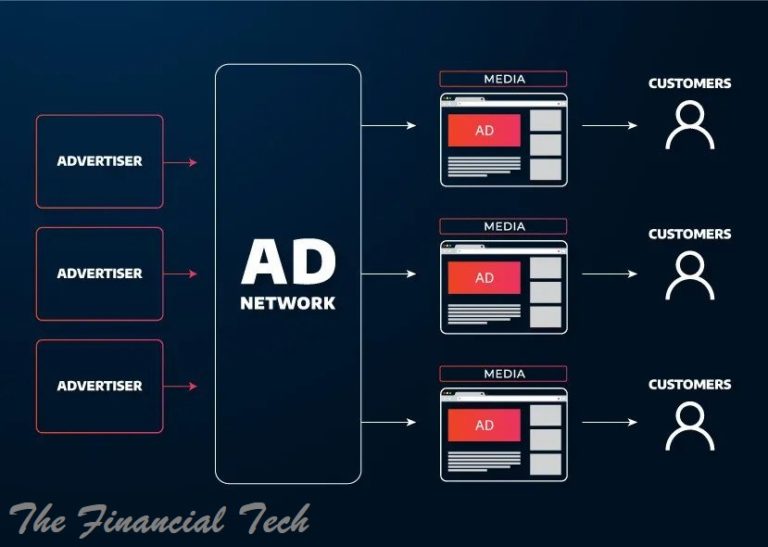

For years, the conventional wisdom in digital publishing was simple: more ads equal more revenue. Fill every available space, stack the placements, and maximize the number of impressions served. This volume-driven approach delivered short-term gains but created a long-term problem: users grew fatigued, banner blindness became endemic, and the very foundation of publisher revenue—trust and engagement—began to erode.

In 2026, that era is decisively ending.

The advertising industry is experiencing a fundamental reorientation. With 91% of users already ignoring social ads and most consumers reporting their feeds have “too many ads,” overload and repetition are driving performance down. Fatigue cuts click-through rates by a third and raises cost-per-click by about 20% . The math is inescapable: more ads are producing less value for everyone.

This guide provides a comprehensive framework for publishers navigating the critical balance between ad density and user experience. Drawing on 2026 data, industry research, and proven optimization strategies, you will learn how to measure the right metrics, design for attention rather than volume, and build a monetization strategy that prioritizes long-term audience relationships over short-term impression counts.

Part 1: The New Reality – Why Ad Density Matters More Than Ever

1.1 The Fatigue Factor: Consumers Are Tuning Out

The “attention economy” that has driven digital advertising for the past decade is showing unmistakable signs of collapse. Industry leaders are sounding the alarm:

*”What started as fatigue becomes outright avoidance. In 2026, consumers won’t just tune out social ads; they’ll choose platforms specifically because they’re less ad-dense.”* — Chris Gadek, CEO of AdQuick

This is not anecdotal speculation; it’s backed by data. Ninety-one percent of users already ignore social ads, and the majority believe their feeds contain “too many ads” . The consequences are measurable: fatigue cuts click-through rates by a third and raises cost-per-click by approximately 20% .

1.2 The Quality Revolution: Advertisers Demand Better

Simultaneously, the buy side is evolving. Programmatic advertising budgets continue to chase efficiency and performance, which translates to sustained downward pressure on open market CPMs . The only sustainable defense for publishers is creating differentiated value that commands premium pricing.

Key industry shifts for 2026:

| Trend | Impact on Publishers |

|---|---|

| Buy-side platforms enforcing new ad quality/density standards | Open internet must rebrand as safe, efficient, and effective |

| Continued efforts to resolve identity for measurable outcomes | Value shifts to publishers with strong first-party data |

| Open market CPMs and search traffic declining at accelerated pace | Premium, curated inventory becomes the growth channel |

As one industry analyst notes: “Buyers want confidence in quality, targeting and outcomes, pushing more budget toward curated inventory and walled-garden platforms” .

1.3 The Attention Economy Is Dead – Long Live the Engagement Economy

Perhaps the most significant shift is philosophical. The industry is moving from measuring served impressions to measuring human attention:

“The ‘attention economy’ is dead. We are entering a renaissance for long-form, authentic content as ‘snackable’ media becomes overly saturated and commoditized by AI. Brands that invest in deep, valuable and well-crafted long-form reads, videos and stories will win.” — Jordan Leschinsky, Codeword

This shift has profound implications for ad density. Pages cluttered with low-value inventory signal low-quality environments to both users and advertisers. Clean, focused layouts signal the opposite: a premium destination worthy of attention.

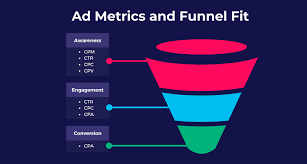

Part 2: The Metrics That Matter – Moving Beyond Vanity

2.1 Why Fill Rate Is Misleading

Fill rate—the percentage of ad requests that receive an ad—has historically been a primary publisher metric. It’s intuitive: higher fill rate means more inventory sold. But this metric hides a uncomfortable truth.

The reality: Only 1 in 100 ad requests actually receives a bid. The rest disappear due to strict buyer filtering, poor placement visibility, slow load times, or low-quality signals . A perfect 95-100% fill rate often means you’re accepting low-value ads just to keep the metric high, sacrificing long-term revenue for short-term vanity .

Key insight from AdPushup: “A perfect fill rate may hide the fact that half your impressions never make it into a user’s view. Invisible ads don’t generate revenue” . Google research confirms that 56% of display ads go unseen, often buried below the fold or ignored in less than a second .

2.2 The New Trinity: Attention-Driven Metrics

In 2026, sophisticated publishers track three metrics that directly correlate with both user experience and revenue.

| Metric | Definition | Why It Matters |

|---|---|---|

| vCPM (Viewable CPM) | Counts only impressions where at least 50% of pixels are visible for at least one second | Aligns bids with actual visibility; advertisers pay more for viewable inventory |

| Time-in-View | Measures how long a user keeps an ad on screen | Ads viewed for 15+ seconds show 25% increase in brand recall |

| qCPM (Quality CPM) | Blended metric accounting for viewability, attention, brand safety, layout, and content environment | Represents your reputation score in programmatic auctions |

The relationship is straightforward: cleaner pages lead to longer reading times, higher viewability, better placement performance, stronger brand advertiser interest, and higher eCPMs .

2.3 ARPU and LTV: The Ultimate Measures

Beyond individual ad metrics, successful publishers are adopting a user-centric measurement framework. Average Revenue Per User (ARPU) and Lifetime Value (LTV) provide the holistic view necessary for evaluating the ad density trade-off.

“A lighter ad experience that reduces short-term revenue per session may increase total revenue by driving repeat visits, longer sessions and higher engagement over time. Optimize for user value, not just pageview yield.”

This reframing is critical. A high-density page might generate more revenue in a single session, but if it drives users away permanently, the long-term cost far exceeds the short-term gain.

Part 3: The Research – What the Data Says About Ad Density

3.1 The Case of The Financial Times

The Financial Times pioneered a revolutionary approach with its Cost Per Hour (CPH) model, where advertisers buy actual human attention instead of pixel impressions. The results demonstrated that cleaner pages lead to:

Longer reading times

Higher viewability

Better placement performance

Stronger brand advertiser interest

Higher eCPMs and qCPMs

The underlying principle is now widely accepted: Fewer ads = more attention = higher revenue.

3.2 The 30% Threshold

Research indicates that pages with over 30% ad density often signal low-quality inventory to both users and algorithms, lowering effectiveness by up to 55% . This threshold appears to be a tipping point where the negative impacts of density—slow load times, poor readability, banner blindness—outweigh any incremental revenue from additional placements.

3.3 Viewability Benchmarks

The Media Rating Council standard requires 50% of an ad’s pixels to be visible for at least one second to count as viewable . High-density pages struggle to meet this benchmark because:

Ads placed “below the fold” may never be scrolled into view

Slow load times cause users to leave before ads render

Banner blindness means users actively ignore ad-dense areas

Part 4: The Density Trade-Off – A Publisher’s Decision Framework

4.1 The Fundamental Equation

Every ad placement represents a trade-off between:

| Short-Term Revenue | Long-Term Value |

|---|---|

| + Immediate impression revenue | – Potential user experience degradation |

| + More demand opportunities | – Increased page load time |

| + Higher fill rate | – Higher bounce rates |

| – Lower return visits | |

| – Reduced time-on-site |

The optimal density is not zero—ads are how publishers fund content—but it is almost always lower than the maximum technically possible.

4.2 User Segmentation Strategy

Sophisticated publishers apply different density strategies to different user segments :

| User Segment | Ad Density Approach | Rationale |

|---|---|---|

| Anonymous first-time visitors | Moderate density | Balance monetization with positive first impression |

| Registered users | Lower density | Reward registration; encourage loyalty |

| High-value engaged users | Minimal density | Maximize LTV through exceptional experience |

| Non-registered heavy users | Registration prompt + standard density | Convert to registered segment |

This segmentation requires user registration as the foundational capability. Registered users enable segmentation by traffic source, content type, and life cycle stage—the building blocks for differentiated monetization .

Practical tip: Identify your highest-value content and gate it behind lightweight registration (email only, no password required). This builds your first-party data asset while creating a clear value exchange for users .

4.3 The 2026 Publisher’s Checklist

Before adding any new ad placement, ask:

Will this ad be viewable? Is it above the fold or in a high-scroll zone?

What is the expected time-in-view? Will users linger long enough for meaningful exposure?

How does this affect page speed? Will it trigger layout shifts or delay content rendering?

What is the opportunity cost? Could this space be better used for engagement features or premium formats?

How will this affect qCPM? Will it signal quality or clutter to programmatic buyers?

Part 5: Implementation Strategies – Optimizing for Attention

5.1 Strategic Reduction: Quality Over Quantity

The most effective density optimization often involves removing placements, not adding them.

High-impact reduction strategies:

| Strategy | Implementation | Expected Outcome |

|---|---|---|

| Request throttling | Limit requests when fill rates drop below threshold | Improved scarcity and efficiency |

| Dynamic refresh | Refresh based on CTR data, not uniform rules | Higher-performing placements; less user disruption |

| Format consolidation | Replace multiple commodity placements with single high-impact units | Premium CPMs; cleaner layout |

| Placement pruning | Remove placements with low viewability or CTR | Better qCPM; faster pages |

5.2 High-Impact Format Selection

Not all ad formats are created equal. Some naturally command higher attention and justify their density.

Premium formats for 2026:

| Format | Attention Profile | Density Impact |

|---|---|---|

| Sticky ads | Persistent visibility; high time-in-view | One placement replaces multiple |

| Native units | Matches content style; lower banner blindness | Integrated design reduces perceived density |

| Outstream video | Auto-plays when in view; high CPMs | Premium revenue in single placement |

| High-impact display | Custom sizes, rich media | Commands premium through direct sales |

5.3 Lazy Loading and Viewability Optimization

Lazy loading—loading ads only when they’re about to enter the viewport—is no longer optional. It:

Preserves page speed

Reduces server load

Ensures impressions are countable toward viewability metrics

Improves Core Web Vitals scores

Implementation tip: Configure lazy loading with appropriate thresholds (e.g., load when ad is 200px from entering viewport) to balance user experience with revenue capture.

5.4 Designing for Engagement

“Clean designs and fast-loading pages increase engagement, viewability, and time-in-view—all of which drive higher eCPM” .

Design principles for attention optimization:

Strategic whitespace improves readability and makes ads more noticeable

Clear content hierarchy guides users naturally past ad placements

Mobile-first layouts ensure ads display appropriately on all devices

Stable layouts prevent disruptive shifts that frustrate users

Part 6: The Buyer’s Perspective – What Advertisers Actually Want

6.1 Following the Money

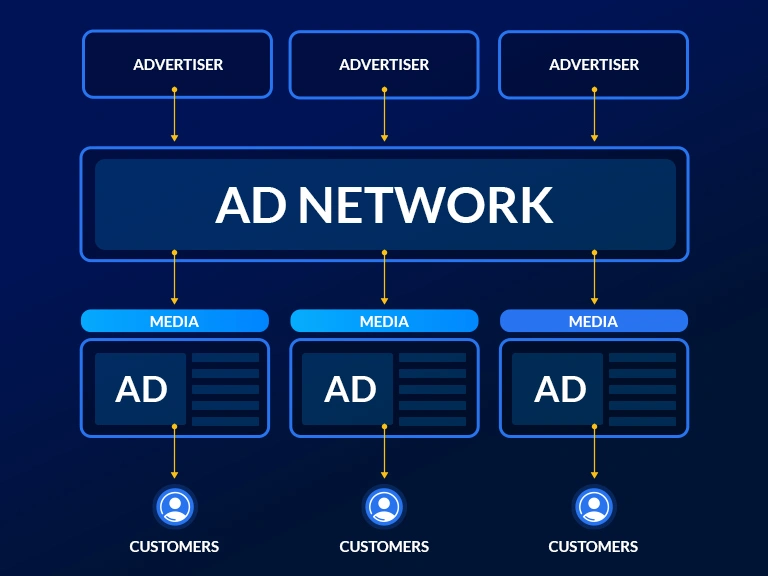

To succeed in 2026, publishers must understand what buyers optimize for and engineer inventory to deliver it . Programmatic budgets are shifting from open exchanges to:

Curated deals (packages of premium inventory assembled by publishers or SSPs)

Private marketplaces (PMPs) with select buyers

Programmatic guaranteed direct deals

These channels command premium pricing because they offer something the open market cannot: confidence in quality, targeting, and outcomes.

6.2 What Premium Buyers Look For

| Buyer Priority | Publisher Response |

|---|---|

| Brand safety | Content exclusions, placement controls, verification partnerships |

| Viewability | Clean layouts, above-the-fold placements, lazy loading |

| Attention metrics | Time-in-view optimization, engagement-focused design |

| Audience quality | First-party data, registered user segments |

| Contextual relevance | Category-specific inventory packages |

6.3 The SSP Partnership

If you’re not in a sales organization, your gateway to buyers is through SSP curation packages. Educate your partners on what makes your inventory special and make it easy for them to curate your inventory . This means:

Providing detailed audience insights

Highlighting unique content verticals

Offering flexible packaging options

Maintaining consistent quality standards

Part 7: The 2026 Publisher’s Playbook – Five Essential Strategies

7.1 Understand Your Users

“Who are they, how do they discover your content and why do they engage with it? With these fundamentals, you can build meaningful relationships that drive monetization” .

Action items:

Implement user registration for anonymous tracking

Segment by traffic source, content type, and lifecycle stage

Calculate ARPU and LTV by segment

Use these insights to inform density decisions

7.2 Create Value for Advertisers

“Protect your inventory by delivering outcomes, not just impressions” .

Action items:

Develop curated inventory packages for key advertiser verticals

Partner with SSPs on curation initiatives

Engineer placements for maximum viewability and attention

Maintain strict brand safety controls

7.3 Optimize Relentlessly

“The opportunities are in the details” .

Action items:

Review performance data daily

Audit technical setup for bid density issues

Optimize viewport ad layouts for common screen dimensions

Review block lists to balance safety with revenue

7.4 Innovate Where It Matters

“Separate ad tech innovation from publisher monetization innovation” .

Action items:

Focus near-term energy on editorial products creating premium sponsorship moments

Build first-party data strategies enabling better targeting

Form partnerships with complementary publishers for scaled curation deals

7.5 Test, Learn, Optimize Continuously

Regular A/B testing identifies which layouts, formats, or placements truly drive revenue . Monetization is not a set-it-and-forget-it proposition; it is a long-term optimization process requiring ongoing attention.

Part 8: Common Mistakes and How to Avoid Them

| Mistake | Why It Hurts | Better Approach |

|---|---|---|

| Chasing 100% fill rate | Accepts low-value ads; degrades qCPM | Optimize for vCPM and attention, not fill |

| Uniform ad density across all users | Misses segmentation opportunities; may drive away high-value users | Differentiate by user segment (registered vs. anonymous) |

| Ignoring Core Web Vitals | Slow pages drive users away; reduce time-in-view | Prioritize speed and layout stability |

| Static price floors | Misses revenue opportunities in dynamic markets | Use machine-learning models that adjust in real-time |

| No placement pruning | Hidden or low-performing placements dilute inventory quality | Regularly review and remove underperformers |

Part 9: The Future – Beyond the Screen

Looking beyond 2026, the very nature of screen-based interaction is evolving. Industry leaders predict:

“We’ll see the beginning of the end for screen-based interaction as technology moves beyond typing, clicking and swiping into a more ambient, intuitive and anticipatory ecosystem of voice commands, intelligent devices and proactive AI agents” .

For marketers, this means designing new models of interaction, shifting focus from capturing attention on a screen to providing utility in the world—and perhaps finally allowing users to experience the world outside the confines of their phones .

The publishers best positioned for this future are those focusing on what makes them valuable today: deep audience relationships that create differentiated monetization opportunities .

Conclusion: The Balance Is the Business

The question of ad density versus user experience is not a technical puzzle to be solved once and optimistically forgotten. It is a continuous strategic tension that defines the publisher’s relationship with both audiences and advertisers.

The winning publishers of 2026 share common characteristics:

They understand their users at a segment level, not just as aggregate traffic numbers.

They optimize for attention metrics—vCPM, time-in-view, qCPM—rather than vanity measures like fill rate.

They design for engagement, creating clean, fast-loading environments where ads can actually be seen.

They build first-party data assets that command premium pricing from advertisers.

They maintain operational discipline, obsessing over daily performance data and continuous optimization.

The industry consensus is clear: fewer, better-quality ads consistently outperform high-density clutter . Pages with over 30% ad density signal low-quality inventory, while strategic whitespace improves readability, engagement, and ultimately revenue .

*”The publishers best positioned for 2026 are focusing on what makes them valuable: deep audience relationships that create differentiated monetization opportunities. They’re balancing optimization with sales capability. They’re building first-party data assets while maintaining operational excellence in the details”* .

The open market will remain an important revenue channel, but growth increasingly comes from the strategies outlined above. These fundamentals have always been important differentiators for publishers. In 2026, they are becoming critical to sustainable success.

The balance is not a compromise. It is the business itself.

OTHER POSTS