Case Study: How [Publication Name] Successfully Diversified Its Ad Revenue.

Case Study: How The Associated Press Diversified Its Ad Revenue Streams

Introduction: From 5% to Sustainable Growth

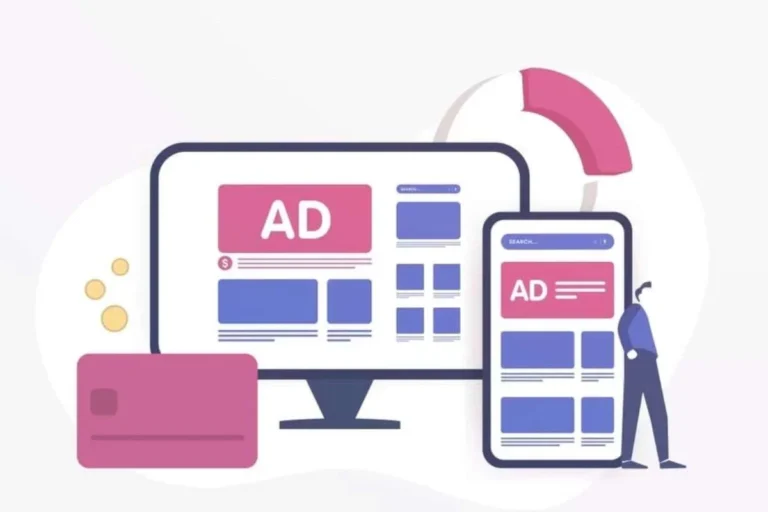

In 2023, The Associated Press faced a structural challenge common to many legacy news organizations: overwhelming reliance on a single revenue source. For the 178-year-old news cooperative, roughly 80% of revenue came from its lucrative licensing operation, while advertising contributed just 5% . This imbalance left the organization vulnerable to shifts in the media consumption landscape and the persistent decline of traditional advertising models.

What followed was a deliberate, multi-pronged strategy to diversify revenue—encompassing site redesign, direct sales hires, donation platforms, and affiliate commerce. By mid-2024, the AP reported 20% growth in ad revenue, alongside traffic upticks and increased video consumption . This case study examines how the AP achieved these results and what lessons other publishers can draw from its experience.

Part 1: The Challenge of Concentration

For decades, the AP’s business model centered on selling news content to member newspapers and digital outlets. This licensing model generated reliable income but created strategic vulnerabilities:

Single-source dependency: 80% of revenue from licensing meant any disruption to that stream would be catastrophic.

Underdeveloped advertising infrastructure: With only 5% of revenue coming from ads, the organization had not invested significantly in ad technology, sales teams, or yield optimization.

Changing media landscape: Member outlets faced their own revenue pressures, potentially affecting their ability to pay licensing fees.

The AP recognized that building a more balanced revenue portfolio was essential for long-term resilience. This recognition sparked a transformation effort spanning multiple fronts.

Part 2: The Transformation Strategy

2.1 Site Redesign: Creating a Premium Advertising Environment

The AP’s first major move was a comprehensive website redesign aimed at enhancing both user experience and monetization potential. Key changes included:

Insertion of more ad units: The redesign strategically added new placements without overwhelming users, increasing available inventory .

Multimedia integration: Richer visual and video content was incorporated to improve engagement and create opportunities for higher-CPM video advertising.

Recirculation tools: Features encouraging users to explore more content increased page views and session depth, directly boosting impression volumes.

The redesign reflected a fundamental principle: advertising inventory is only as valuable as the environment surrounding it. By improving site quality, the AP positioned itself to attract premium advertiser demand.

2.2 Building a Direct Sales Team

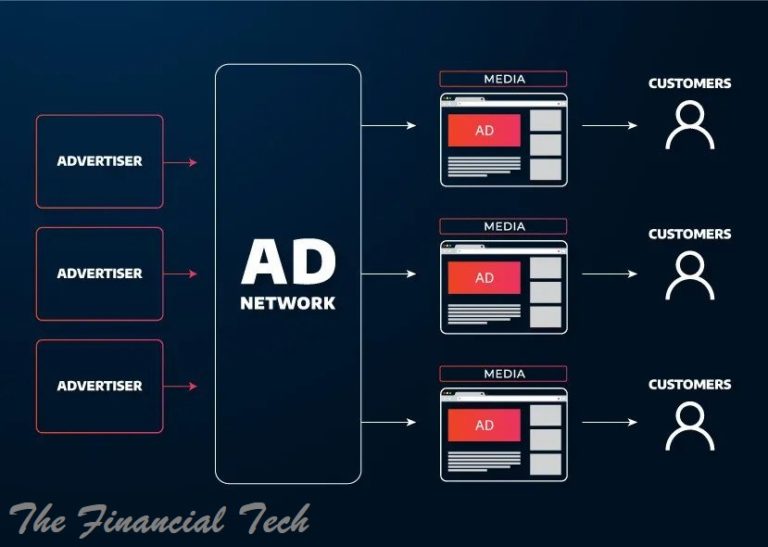

For the first time in its 178-year history, the AP hired a dedicated direct sales team . This represented a philosophical shift from relying on programmatic channels to actively cultivating relationships with advertisers.

Why direct sales matter:

Higher CPMs: Direct-sold inventory commands premium pricing compared to programmatic remnant.

Strategic partnerships: Direct relationships enable customized sponsorships and integrated campaigns.

Brand safety control: Direct sales give publishers greater say in which brands appear alongside their content.

The AP’s investment in sales talent signaled commitment to treating advertising as a core revenue pillar rather than a passive income stream.

2.3 Launching a Donation Platform

In November 2023, the AP introduced a donation platform, allowing readers to financially support the organization directly . While donations typically represent a smaller revenue stream for most publishers, they serve several strategic purposes:

Audience engagement: Donors are highly engaged readers with stronger loyalty.

Revenue diversification: Even modest donation income adds to the revenue mix.

Reader revenue learning: Donation platforms can serve as stepping stones toward more sophisticated reader revenue models.

2.4 Entering Affiliate Commerce

In March 2024, the AP launched an affiliate marketing operation . Affiliate commerce involves earning commissions when readers purchase products through links in AP content.

Why affiliate commerce works for publishers:

Aligns with editorial content naturally (e.g., product reviews, gift guides)

Taps into consumer purchase intent without intrusive advertising

Creates performance-based revenue that scales with audience engagement

The AP’s entry into affiliate commerce followed broader industry trends. Condé Nast, for example, saw its commerce revenues grow approximately 200% in the five years leading to 2025, leading to the launch of Vette, a creator shopping platform .

2.5 Video Expansion

Though not explicitly detailed in the AP’s initial announcement, the subsequent uptick in video consumption reported by Chief Revenue Officer Kristin Heitmann suggests video played a significant role in the diversification strategy . Video advertising commands higher CPMs than display and opens opportunities for partnerships with platforms like YouTube and streaming services.

Part 3: The Results

By mid-2024, the AP’s diversification push yielded measurable results:

| Metric | Outcome |

|---|---|

| Ad revenue growth | 20% increase |

| Traffic | Upticks across AP properties |

| Video consumption | Increased engagement |

| Overall performance | “Pacing ahead of budget” |

These results demonstrate that even a 178-year-old organization can successfully pivot toward new revenue streams with deliberate strategy and execution.

Part 4: Lessons from the AP’s Experience

4.1 Diversification Requires Investment

The AP’s success was not accidental—it required meaningful investment in people, technology, and content. Hiring a direct sales team, redesigning the website, and launching new products all demanded resources. Publishers seeking to diversify must be prepared to spend money to make money.

4.2 Site Quality Underpins Everything

The redesign came first for a reason. Ad inventory is only valuable if the environment attracts engaged audiences. By improving user experience, the AP created a foundation upon which other revenue streams could be built.

4.3 Multiple Streams Create Resilience

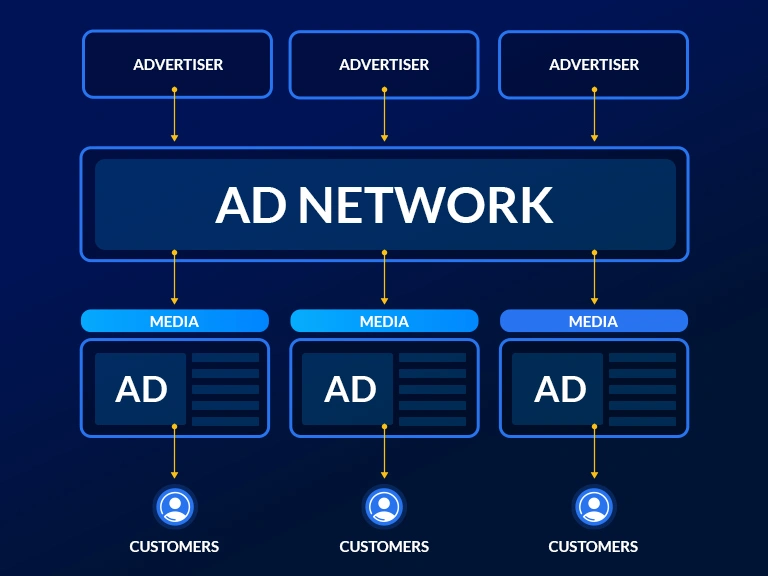

The AP simultaneously pursued direct sales, programmatic optimization, donations, and affiliate commerce. This multi-pronged approach ensures that if one channel underperforms, others can compensate—exactly the logic of demand diversity advocated by industry experts .

4.4 Affiliate Commerce Complements Editorial

Affiliate commerce works best when integrated naturally with editorial content. The AP’s move into this space reflects a broader industry recognition that commerce and content can coexist productively without compromising editorial integrity.

4.5 Direct Relationships Build Premium Value

By investing in a direct sales team, the AP signaled to the market that it was open for premium partnerships. Direct-sold inventory consistently outperforms programmatic in both CPMs and brand safety control.

Part 5: Broader Industry Context

5.1 The Events Revenue Model

While the AP focused on digital diversification, other publishers have found success with events. The Atlantic Festival generated 36% year-over-year revenue growth in 2025, with events now comprising 25% of The Atlantic’s commercial revenue . The festival attracted nearly 2,000 in-person attendees and more than 10,000 virtual tickets, with 56% of attendees at director level or higher.

Semafor built an even more event-centric model, with events accounting for more than 50% of revenue and projections to grow 150% year-over-year from 2024 to 2025 . CEO Justin Smith described the approach as “events-first, journalism-powered,” noting that the World Economy Summit alone generated eight-figure revenue.

5.2 Local Event Strategies

The Minnesota Star Tribune is pursuing a regional approach with its inaugural North Star Summit, aiming for 25% of revenue from non-traditional sources . The event focuses on sponsorships rather than ticket sales, with a strict policy that “you’re not buying your way onto the stage”—preserving editorial independence while generating commercial support.

5.3 Creator Commerce Platforms

Condé Nast’s Vette platform, launching in early 2026, addresses friction in social commerce by giving creators tools to build e-commerce sites without managing inventory . This represents a significant evolution in publisher-led commerce, leveraging brand trust to facilitate transactions across the creator economy.

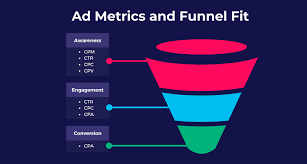

5.4 Demand Diversity Principles

Industry analysis from Magnite emphasizes that cultivating diverse advertising demand—across buyer types, verticals, regions, and formats—creates more resilient revenue engines . In 2025, search and retail media grew by 8% while the overall ad market grew 4.9%, highlighting how diversification captures pockets of growth even during broader economic uncertainty.

Part 6: Building Your Own Diversification Strategy

6.1 Assessment Phase

Before launching new initiatives, publishers should:

Audit current revenue concentration: What percentage comes from each source? Where are the vulnerabilities?

Evaluate audience assets: What unique audience segments or engagement patterns can be leveraged?

Assess internal capabilities: Do you have the skills to execute new strategies, or will you need to hire or partner?

6.2 Prioritization Framework

Not every diversification opportunity fits every publisher. Consider:

| Opportunity | Best For | Investment Level |

|---|---|---|

| Events | Publishers with influential audiences, C-suite reach | High (logistics, talent) |

| Affiliate commerce | Content with purchase intent (reviews, lifestyle) | Low (technology integration) |

| Direct sales | Established brands with premium inventory | Medium (sales hires) |

| Donations | Mission-driven organizations, loyal audiences | Low (platform setup) |

| Video | Publishers with production capability | Medium to High |

| Subscriptions | Publishers with unique, must-have content | High (paywall tech, marketing) |

6.3 Technology Infrastructure

Diversification demands unified data and technology. As MGID notes, publishers need “cohesive consent management and user identity frameworks” to amalgamate signals across touchpoints . Decision engines powered by machine learning can determine in real time whether an impression should be monetized as an ad, a subscription prompt, or editorial content .

6.4 Team Alignment

When revenue streams split, teams must align around shared KPIs. Editorial, ad operations, audience development, and commercial teams need common goals and intelligence . The most durable publishers treat every audience interaction as a step toward a potential conversion, not just another impression.

Conclusion: The Resilient Publisher Model

The Associated Press’s transformation from a licensing-dependent organization to a diversified digital publisher offers a roadmap for others facing similar challenges. By investing in site quality, building direct sales capability, and experimenting with new formats like affiliate commerce and donations, the AP achieved 20% ad revenue growth while reducing reliance on any single stream.

But the AP’s story is just one chapter in a broader industry evolution. From The Atlantic’s event dominance to Semafor’s “events-first” model, from Condé Nast’s creator commerce platform to the Minnesota Star Tribune’s local summit strategy, publishers are discovering that diversification is not merely defensive—it is an offensive opportunity to build deeper audience relationships and unlock new value.

The common thread across all these examples is intentionality. Successful diversification does not happen by accident. It requires strategic clarity, investment, and a willingness to experiment. It demands unified technology that can optimize across revenue streams in real time. And it requires teams aligned around shared objectives rather than siloed metrics.

For publishers still reliant on a single revenue source, the message is clear: the time to diversify is now, before external forces make the choice for you. The AP proved that even a 178-year-old organization can pivot successfully. The question is whether others will follow.

Key Takeaways

Diversification requires investment in people, technology, and content—there are no shortcuts.

Site quality underpins all monetization; premium environments attract premium demand.

Multiple streams create resilience; no single channel should dominate.

Events can become substantial revenue engines with the right audience and format.

Affiliate commerce aligns naturally with editorial when integrated thoughtfully.

Direct sales relationships command higher CPMs and enable strategic partnerships.

Unified data and technology enable real-time optimization across revenue streams.

Team alignment around shared KPIs ensures coordinated execution.

The publishers who thrive in the coming decade will be those who treat every audience interaction as an opportunity—whether for advertising, subscription, commerce, or engagement—and have the infrastructure to capture that value without compromising the trust that brought users there in the first place.

OTHER POSTS