Connected TV (CTV) and Streaming Ad Networks: The New Frontier.

Connected TV (CTV) and Streaming Ad Networks: The New Frontier

Introduction: The Living Room Revolution

For generations, television advertising followed a simple, predictable formula: brands bought 30-second spots based on broad demographics, ran them during scheduled programming, and hoped viewers were watching. The living room was a black box—content entered, ads appeared, but what actually happened inside remained largely unknown.

That box has been cracked open.

Connected TV (CTV)—televisions connected to the internet that enable streaming content beyond traditional broadcast—has fundamentally transformed how viewers consume content and how advertisers reach them . What began as a convenience for cord-cutters has evolved into a media revolution that now commands advertising budgets once reserved for linear television’s dominance.

The numbers tell the story of a medium in hypergrowth. Global CTV advertising spending is projected to reach $199.6 billion in 2026, up from $175.5 billion in 2025, representing a compound annual growth rate of 13.7% . By 2030, the market is expected to hit $332.8 billion . In the United States alone, CTV ad spending will increase nearly 15% this year to reach $37.95 billion, with eMarketer forecasting it will surpass traditional TV advertising by 2028 .

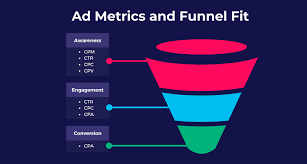

This is not merely a format shift from linear to streaming. It is a fundamental reimagining of television’s role in the marketing funnel—combining the emotional impact of the big screen with the precision targeting and measurability of digital. This article explores the CTV landscape in 2026, examining the key players, technological innovations, measurement challenges, and future trajectories that define this new frontier.

Part 1: Defining the CTV Ecosystem

1.1 What Is Connected TV?

Connected television refers to televisions connected to the internet, enabling users to access a diverse range of digital content beyond traditional broadcast or cable channels . This includes smart TVs with built-in streaming capabilities, as well as external devices—such as Roku, Amazon Fire TV, Apple TV, and gaming consoles—that “connect” traditional displays to streaming services.

The distinction between CTV and OTT (over-the-top) is subtle but important. OTT describes the content delivery method—video streamed directly to viewers bypassing traditional cable or satellite platforms. CTV describes the device through which that content is consumed . In practice, the terms are often used interchangeably, but CTV specifically captures the living room, big-screen experience that distinguishes it from mobile or desktop viewing.

1.2 The Fragmented Landscape

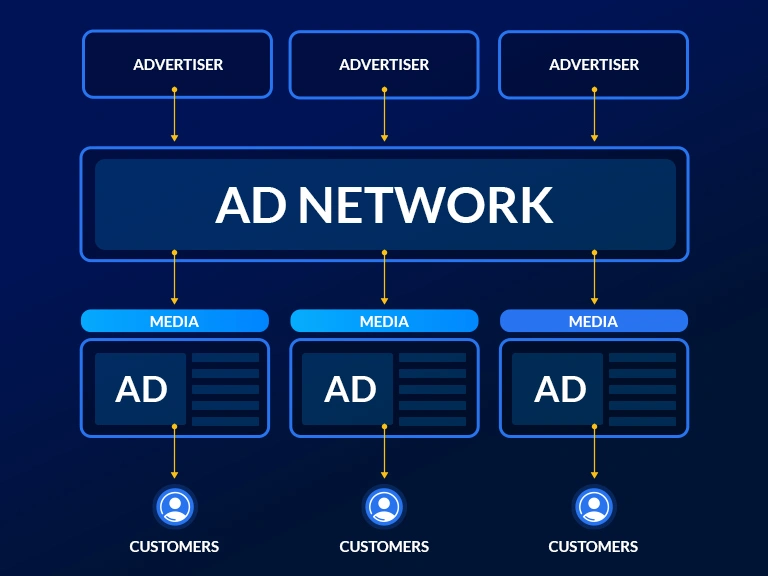

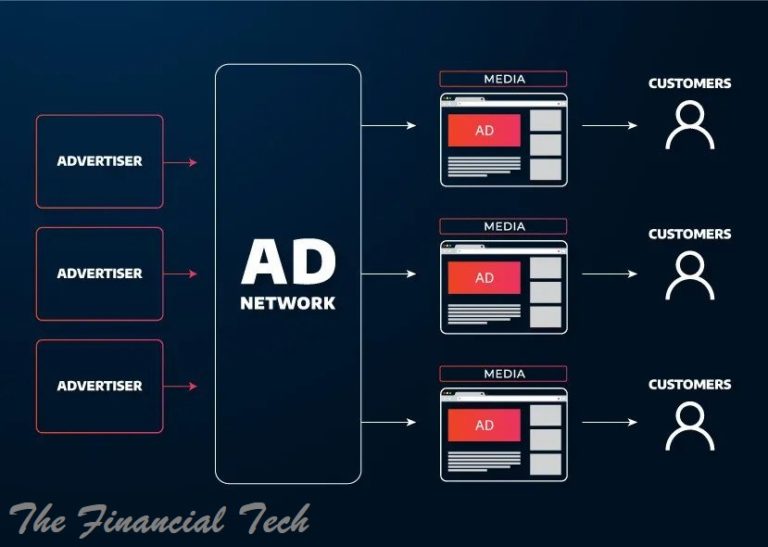

Unlike linear television’s handful of networks, the CTV ecosystem is notoriously fragmented. Content flows through multiple layers:

| Layer | Examples | Function |

|---|---|---|

| Smart TV Operating Systems | Samsung Tizen, LG webOS, Google TV, Roku OS | The foundational software that powers content discovery and app access |

| Streaming Devices | Amazon Fire TV, Apple TV, Chromecast | External hardware that enables streaming on non-smart TVs |

| Streaming Services | Netflix, Disney+, Hulu, Peacock, Samsung TV Plus | Content providers offering subscription, ad-supported, or hybrid models |

| FAST Platforms | Pluto TV, Tubi, Samsung TV Plus | Free ad-supported streaming television with linear-style channels |

This fragmentation creates both challenges and opportunities. For advertisers, it means navigating a complex web of platforms, each with its own data standards, measurement approaches, and buying mechanisms. For publishers and platforms, it creates opportunities to differentiate through curation, exclusive content, and superior ad experiences .

Part 2: The CTV Advertising Growth Story

2.1 By the Numbers

The CTV advertising market is experiencing extraordinary expansion across multiple metrics:

Global Market Size:

The global OTT and connected TV advertising market was valued at $1.26 trillion in 2025 and is projected to reach $1.39 trillion in 2026, with a compound annual growth rate of 9.54% through 2035

The CTV hardware and platform market specifically (excluding content spending) is projected to grow from $175.5 billion in 2025 to $199.6 billion in 2026

U.S. Market:

U.S. CTV ad spending will reach $37.95 billion in 2026, a 14.5% increase

By 2028, eMarketer forecasts U.S. CTV ad spending will reach $46 billion—outpacing traditional TV for the first time

Currently, 54% of marketers have increased their CTV budgets, and 66% of non-CTV advertisers are expected to enter the space within the next year

Audience Reach:

Samsung TV Plus alone has 100 million monthly users across 30 territories, offering over 3,500 AVOD and FAST channels

Over 48% of U.S. households now stream ad-supported content on smart TVs

Gen Z viewers, who largely avoid traditional television, stream an average of more than 1.5 hours daily on Samsung TVs in Europe

2.2 Drivers of Growth

Several factors are fueling this rapid expansion:

1. The Shift from Linear to Streaming:

Consumer viewing habits have fundamentally changed. Over 61% of advertising spending now targets connected TV rather than linear alternatives . This reflects broader audience migration—viewers are following content, and advertisers are following viewers.

2. The Rise of Ad-Supported Tiers:

Major streaming services that launched as ad-free subscription models have increasingly embraced advertising. Netflix, Disney+, and others now offer hybrid tiers, dramatically expanding available inventory. Approximately 47% of OTT users now prefer free, ad-supported content over paid subscriptions, increasing available impressions by 34% .

3. Targeting Precision:

Unlike traditional television’s reliance on broad demographics, CTV enables audience-based targeting. Approximately 39% of ad impressions on CTV are now based on audience rather than content, driving higher conversion rates . Advertisers running campaigns with targeted CTV placements report recall rates 21% higher than non-targeted alternatives .

4. Closed-Loop Attribution:

Perhaps most significantly, CTV offers something linear television never could: measurable outcomes. Partnerships like the one between Samsung TV Plus and Amazon DSP allow advertisers to see how big-screen ads actually drive sales on Amazon, creating a “closed-loop” view of performance .

Part 3: The Platform Power Players

3.1 The Smart TV Operating Systems

Smart TV manufacturers have transformed from hardware sellers into advertising platforms, leveraging their direct relationship with viewers in the living room.

Samsung TV Plus:

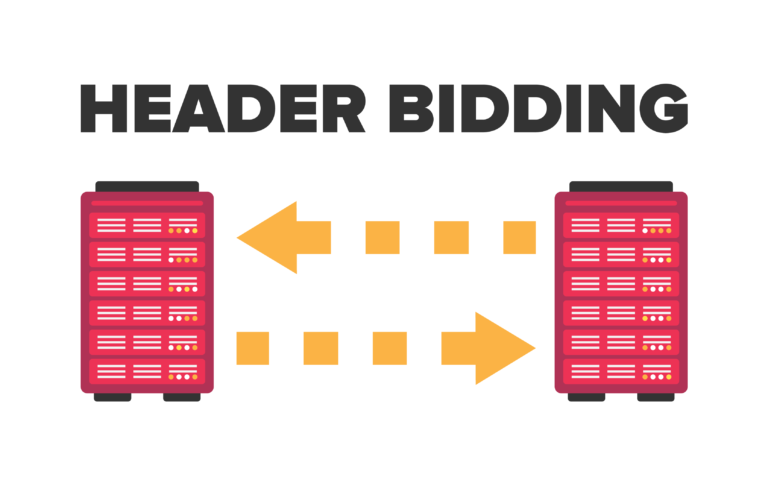

As a connected TV leader, Samsung TV Plus has built a massive FAST (free ad-supported streaming television) business with 100 million monthly active users and over 3,500 channels globally . The platform’s recent integration with Amazon DSP across Europe and North America represents a significant milestone, giving advertisers direct programmatic access to premium CTV inventory .

This partnership addresses two critical industry challenges: fragmentation and Gen Z reach. Europe’s television landscape is notoriously fragmented, making frequency management difficult. The Amazon DSP integration allows brands to manage everything in one place while accessing Gen Z viewers who stream extensively on Samsung devices but avoid traditional TV .

Google TV:

Google’s smart TV platform has partnered with Teads to expand CTV HomeScreen inventory globally . The Google TV Masthead placement appears as the first visual impression on Google TV devices across major markets including the US and UK, reaching a highly engaged audience during content discovery moments .

The platform brings together 400,000+ movies and shows from across 10,000+ apps, creating a unified content discovery layer that captures significant viewer attention .

LG Electronics:

LG has integrated Prime Video into its in-vehicle content platform, extending CTV beyond the living room . This expansion into automotive entertainment represents a new frontier for CTV reach, capturing audiences during travel.

3.2 The Streaming Services

Disney’s Streaming Empire:

Disney has emerged as an aggressive innovator in CTV advertising. The company recently expanded its relationship with Brightline, a tech company specializing in interactive CTV advertising, to bring interactive ads to Disney+, live sports on Fubo TV and Hulu + Live TV, and programmatic inventory across Hulu and ESPN Unlimited .

This expansion marks Brightline’s first premium programmatic partnership at scale, extending interactive, performance-driven experiences into premium streaming inventory . As Jamie Power, SVP of addressable sales at Disney Advertising, notes: “By bringing remote-control interactive formats across our streaming supply and into programmatic, we’re giving advertisers more control in activation, deeper engagement with viewers, and outcomes you can actually measure” .

At CES 2026, Disney also announced “Disney Compass,” an AI-driven planning tool that provides advertisers unified brand performance views and market opportunity insights, alongside video generation tools helping brands create CTV-optimized ads from existing assets .

Peacock’s Technical Leadership:

NBCUniversal’s Peacock has positioned itself as a technical standard-setter, becoming the first streaming platform to fully adopt Dolby’s advanced audio-visual technologies. Live sports programming, including Sunday Night Football, NBA, and MLB coverage, now features Dolby Vision 2 and Dolby AC-4 technology, delivering more immersive picture quality and clearer dialogue .

ABEMA’s “Beyond the Frame” Vision:

Japan’s ABEMA platform, approaching its 10th anniversary with approximately 30 million weekly active users, has launched “ABEMA-X”—a new brand representing its evolution beyond traditional commercial breaks .

The platform’s strategy rests on three pillars:

Premium Reach MAX: Seamless formats like “ABEMA LiveScreen Ad” that don’t interrupt viewing, combined with AI-powered contextual targeting based on content emotion and context

Fandom Heat MAX: Leveraging program-specific enthusiasm through integrated creative and sponsorship formats

Partner UX: AI agents supporting planning through analysis, with evolving management interfaces

ABEMA’s self-serve “AAA” (ABEMA Advanced Ads) platform has grown to over twice its previous size, demonstrating strong advertiser demand for accessible CTV buying .

3.3 The FAST Revolution

Free ad-supported streaming television (FAST) platforms represent one of the fastest-growing segments in CTV. Services like Pluto TV, Tubi, and Samsung TV Plus offer linear-style channel experiences without subscription fees, monetized entirely through advertising.

Samsung TV Plus has expanded its live and creator-led offerings with live Bundesliga football coverage and channels from globally recognized creators including LADbible, Dhar Mann, and Mark Rober . This blend of professional sports and creator content attracts diverse audiences while providing advertisers premium inventory environments.

Part 4: The Interactive and Shoppable Revolution

4.1 The Rise of Engagement-Led Advertising

Interactive advertising has emerged as one of the fastest-growing segments in digital marketing. The global interactive advertising market is valued at $42 billion, with shoppable streaming ad spending projected to hit $69.3 billion in 2026—more than doubling since 2021 .

This growth reflects a fundamental shift in how advertisers think about CTV creative. Rather than treating the big screen as a passive broadcast medium, brands are increasingly using interactivity to transform viewers into participants.

BrightLine’s interactive formats, now expanded across Disney’s streaming properties, enable advertisers to engage viewers without interrupting programming . These opt-in experiences let viewers request more information, browse products, or even make purchases—all while remaining within the streaming environment.

4.2 The 3D Creative Frontier

Teads has pioneered 3D creative formats for CTV home screens, transforming standard video assets into dynamic, interactive experiences that boost attention and recall . The company’s work with Michelin on the “Motion for Life” campaign demonstrates the potential: leveraging the home screen’s high-impact canvas, Teads Studio built a 3D creative execution that delivered +7% brand favorability, +8% perception of safety, and +6% brand consideration .

Since launching its CTV HomeScreen offering in 2023, Teads has activated over 4,000 campaigns reaching 500+ million unique devices for premium brands including Cartier, Nestlé, and Air France .

4.3 Shoppable Advertising Integration

The convergence of content and commerce is accelerating. Over 31% of U.S. advertisers have now embedded interactive features—including shopping links and voice commands—into their CTV creative .

The strategic logic is compelling: viewers are already in a receptive, lean-back state. Adding the ability to act on inspiration immediately, without reaching for a second device, captures intent at its peak moment. Partnerships like the Samsung-Amazon DSP integration enable advertisers to connect CTV exposure directly to purchase data, closing the loop from impression to transaction .

Part 5: The AI Revolution in CTV

5.1 From Buzzword to Backbone

Artificial intelligence in CTV has matured from experimental creative demos to foundational infrastructure. As Dan Larkman, CEO of Keynes Digital, observes: “AI is not a differentiator. Every company has some type of AI in their business. What matters is the data you feed it” .

This perspective reflects a crucial insight: AI won’t fix broken foundations. Poor identity inputs, weak signals, and fragmented data still produce unreliable outcomes regardless of algorithmic sophistication.

5.2 Standardization Through AI

One of the most significant AI developments in 2026 is the industry’s work on AdCP—an open framework giving AI systems a shared way to interpret context. As Tony Marlow, CMO of LG Ad Solutions, explains: “As AdCP gains traction, AI can better understand the nature of an impression, the surrounding content, and suitability signals, thereby improving creative alignment and making the entire ecosystem more interoperable” .

This standardization is critical for scaling CTV effectively. When AI systems share common frameworks for understanding context, advertisers can deploy campaigns across platforms with greater confidence in placement quality and relevance.

5.3 Democratizing CTV Access

AI is simultaneously broadening CTV’s advertiser base. Historically, producing high-quality video creative was prohibitively expensive for all but the largest brands. AI-generated video ads are changing this dynamic.

“We’ll see the continued rise of AI-generated video ads on CTV, not just from national brands but also from an increasing number of small and local advertisers,” says Sara Sinclair, VP of ad platforms at TVIQ. “These ads will become more tailored to specific audiences and DMAs as creative automation becomes more accessible” .

Platforms like Disney’s new video generation tools help brands rapidly create CTV-optimized ads from existing assets, dramatically reducing production barriers .

5.4 The Consumer Paradox: AI Fatigue

Despite platform enthusiasm for AI integration, consumer response has been mixed. On social media platforms like Reddit,明显的 “AI fatigue” has emerged, with users complaining that algorithmic recommendations feel intrusive and disrupt normal viewing . Some consumers are deliberately circumventing smart TV systems—using external devices like Apple TV or Mini PCs to treat their televisions as “dumb displays” free from built-in AI and data collection .

This tension between platform capabilities and consumer preferences will shape how aggressively AI features are deployed in living room environments.

Part 6: The Measurement Challenge

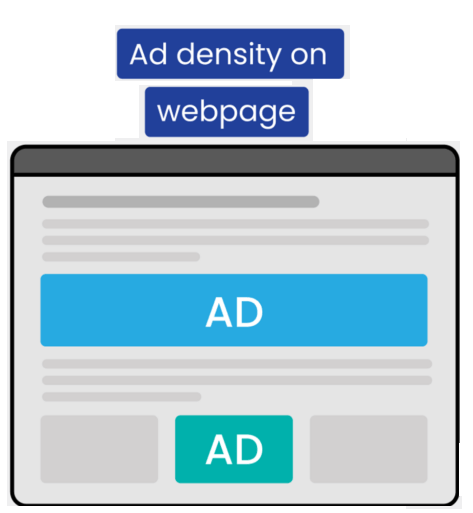

6.1 The Transparency Problem

Despite CTV’s explosive growth, the channel continues to struggle with transparency across inventory, data, and measurement . A primary barrier is the lack of industry-wide standardization in how data signals are shared from publishers through the bidstream.

Without consistent standards, advertisers struggle to determine exactly where their ads appear—by channel, multi-channel app, or content genre. This ambiguity increases the risk of misrepresented inventory and misplaced ads, undermining efficiency and trust .

6.2 The Fragmentation Headache

The fragmented CTV ecosystem creates significant operational challenges:

43% of advertisers struggle to execute unified campaigns across CTV devices due to platform fragmentation

36% of viewers use multiple devices to access the same content, complicating message consistency

21% of brands find it challenging to maintain creative consistency and attribution across smart TVs, mobile apps, and gaming consoles

Publishers and walled gardens often compound this issue by providing incomplete data within the bidstream, such as omitting show-level insights. This fragmentation clouds visibility and hinders frequency management and campaign optimization .

6.3 The Shift to Media Mix Modeling

A significant measurement trend in 2026 is the shift from multi-touch attribution (MTA) to media mix modeling (MMM). As Dan Larkman notes: “The biggest overlooked trend is the shift from MTA to media mix models, and the fact that most teams don’t know how to set up CTV inside those models” .

This transition reflects growing recognition that last-click attribution inadequately captures CTV’s upper-funnel impact. However, the technical expertise required to properly configure CTV within MMM frameworks remains scarce.

6.4 Ad Fraud and Verification

CTV is not immune to the fraud challenges plaguing digital advertising. Approximately 23% of OTT ad fraud cases involve bot-generated impressions, affecting cost efficiency and ROI—particularly for health and wellness advertisers seeking accurate engagement data .

Industry initiatives to combat fraud include third-party verification partnerships. Major platforms increasingly work with measurement providers like DoubleVerify and Integral Ad Science to validate impressions and combat invalid traffic.

6.5 The Path to Standardization

Industry bodies are actively working to address measurement fragmentation. The Interactive Advertising Bureau (IAB) is developing industry-wide standards for CTV, while companies like RRD advocate for transparency as “essential if CTV is to mature into a trusted, performance-driven channel” .

Key priorities include:

Standardized reporting frameworks across publishers

Consistent definitions of viewability and engagement

Show-level transparency within the bidstream

Third-party verification as a baseline requirement

As Mary Brooks, Product Manager for Connected TV at RRD, concludes: “Transparency leads to confidence, allowing clients to trace every dollar from the bid request to the living room screen” .

Part 7: Privacy and Addressability

7.1 Beyond the Household Proxy

For decades, television advertising relied on the “household proxy”—targeting the location rather than the viewer. This blind spot resulted in significant wasted ad spend, ineffective frequency capping, and a migration of budget toward digital platforms offering individual targeting .

CTV changes this dynamic by enabling person-level addressability within privacy-compliant frameworks.

7.2 Privacy-First Solutions

Companies like Covatic have launched solutions specifically designed to unlock individual addressability for CTV while respecting privacy. Covatic Sense, announced in January 2026, delivers true person-level targeting and measurement through a privacy-first approach .

Early results demonstrate the potential: Covatic’s Audience Retargeting delivered 0.17% click-through rate for Cancer Research UK’s Race for Life campaign—three times the industry standard benchmark—demonstrating exceptional cross-platform engagement precision .

7.3 The Identity Landscape

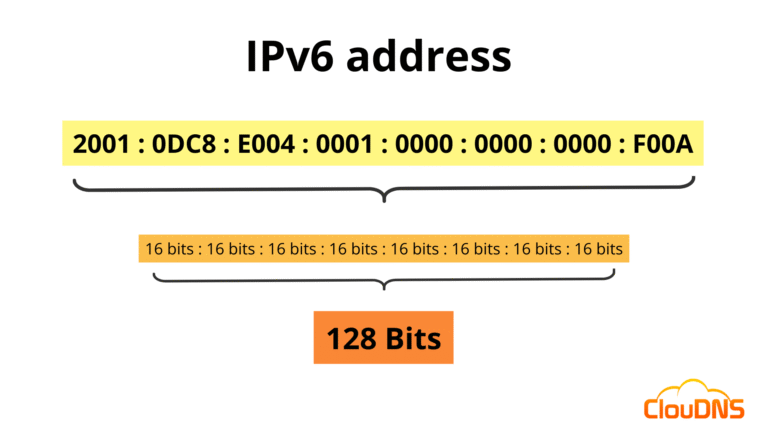

With third-party cookies deprecated, CTV is increasingly reliant on alternative identity frameworks:

Universal IDs: Solutions like Unified ID 2.0 enable addressability without cookies

Publisher log-in data: Streaming services’ authenticated user bases provide valuable first-party signals

Device graphs: Smart TV manufacturers can connect viewing across household devices

Probabilistic modeling: AI-powered approaches infer audience characteristics from behavioral patterns

The key advantage for CTV is that television has never relied on cookies. The shift to addressability represents an addition of capability rather than a replacement of existing infrastructure.

Part 8: The Home Screen as Real Estate

8.1 The First Impression Advantage

One of the most significant developments in CTV advertising is the emergence of the home screen as premium inventory. As consumers spend meaningful time browsing before selecting content, the home screen has become a critical moment of influence—one that blends discovery, personalization, and monetization .

Tony Marlow of LG Ad Solutions explains: “Consumers spend meaningful time browsing the Home Screen before they settle on what to watch. That moment is becoming a valuable frontier for performance and brand impact” .

8.2 Google TV Masthead

The Google TV Masthead, now available through Teads’ partnership, represents a prominent example of home screen inventory. Appearing as the first visual impression on Google TV devices, this placement captures viewer attention during the content discovery phase .

With Google TV bringing together content from over 10,000 apps, the Masthead reaches viewers in a premium environment where they’re actively deciding what to watch—a moment of high engagement and receptivity.

8.3 Curation as Strategy

For publishers without the scale of major platforms, curation has emerged as a key competitive advantage. As Sara Sinclair advises: “Publishers should lean heavily into curated audience packages as a mechanism to unlock premium demand” .

Contextual clusters, lookalike content groupings, and cross-FAST retargeting help smaller publishers compete more effectively against walled gardens. By packaging inventory around specific themes, audiences, or contexts, publishers can offer advertisers precision without requiring massive scale.

Part 9: Key Trends Shaping 2026 and Beyond

9.1 Measurement Maturity

According to eMarketer’s industry analysis, 2026 will be defined by measurement discipline . After years of rapid audience growth, brands now demand proof that CTV delivers on its promise.

“If you want CTV to behave like a performance channel, you have to measure it with the same discipline you’d apply to anything that affects revenue,” notes Dan Larkman. “That means structuring tests correctly, validating incrementality, and making sure CTV isn’t judged on short-term expectations built for social” .

This year will mark the transition from experimentation to accountability, with consistent, comparable definitions of quality, reach, and lift becoming standard requirements.

9.2 Curation’s Center Stage

As the CTV ecosystem matures, curation is emerging as a critical differentiator. The assumption that short, transparent supply paths are inherently more efficient doesn’t always hold in practice . If buyers truly want to support publishers, the industry needs mechanisms that intentionally prioritize smaller, direct paths rather than defaulting to scale-driven buying behaviors.

Curated audience packages, contextual clusters, and cross-platform targeting will enable advertisers to access quality inventory while supporting diverse publisher ecosystems.

9.3 The Unified Experience

Industry leaders increasingly emphasize that viewers don’t distinguish between subscription VOD, ad-supported VOD, FAST, and home screens. They move fluidly across all parts of the ecosystem . The opportunity for marketers lies in understanding how these surfaces work together to create cohesive audience experiences.

This unified perspective requires rethinking campaign planning, measurement, and optimization across the full CTV landscape rather than treating each format as a siloed channel.

9.4 The In-Vehicle Frontier

LG’s integration of Prime Video into its in-vehicle content platform signals an important expansion: CTV beyond the living room . As autonomous driving technology advances and connectivity becomes standard in vehicles, the car is emerging as a new screen for streaming content—and therefore, a new canvas for advertising.

This expansion into automotive entertainment represents the next frontier for CTV reach, capturing previously untapped viewer moments.

Part 10: What This Means for Advertisers

10.1 Strategic Implications

For brands and advertisers, the CTV revolution requires fundamental strategic adjustments:

| Strategic Area | Implication |

|---|---|

| Budget Allocation | CTV deserves dedicated, growing budget—not experimental leftovers |

| Creative Development | Interactive and shoppable formats require new creative capabilities |

| Measurement Framework | Move beyond last-click to incrementality and media mix modeling |

| Platform Strategy | Balance scale platforms with curated, high-quality inventory |

| Data Integration | Connect CTV exposure to downstream conversion data |

| Privacy Compliance | Embrace privacy-first addressability solutions |

10.2 Practical Next Steps

Advertisers seeking to capitalize on CTV’s potential should consider:

1. Test Interactive Formats:

With shoppable streaming ad spending projected to hit $69.3 billion in 2026, advertisers should experiment with engagement-led creative that transforms passive viewing into active participation .

2. Embrace Programmatic Access:

Partnerships like Samsung TV Plus with Amazon DSP demonstrate that premium CTV inventory is increasingly available through programmatic channels, enabling more sophisticated buying and optimization .

3. Demand Transparency:

Advertisers should insist on content-level reporting, third-party verification, and consistent measurement standards. As RRD notes, transparency is essential for CTV to mature into a trusted channel .

4. Prepare for AI-Driven Optimization:

AI is becoming infrastructure, not feature. Advertisers should ensure their data foundations are solid enough to feed AI systems effectively .

5. Think Beyond the 30-Second Spot:

The most effective CTV strategies integrate home screen placements, interactive formats, and shoppable experiences alongside traditional video creative.

Conclusion: The Living Room, Reimagined

Connected TV has evolved from a convenient alternative for cord-cutters to the central battleground for consumer attention and advertising investment. With global spending approaching $200 billion in 2026 and projected to surpass traditional television within two years, CTV is no longer an emerging channel—it is the present and future of video advertising .

The transformation underway is multidimensional:

Technologically, AI is moving from experimental novelty to foundational infrastructure, enabling smarter context understanding, creative optimization, and measurement . Interactive and shoppable formats are turning passive viewers into active participants, with spending in this category doubling since 2021 .

Structurally, the ecosystem is navigating the tension between fragmentation and consolidation. Smart TV manufacturers, streaming services, and FAST platforms compete for attention while partnerships like Samsung-Amazon and Teads-Google TV create new pathways for advertisers to reach audiences at scale .

Measurably, the industry is demanding transparency and standardization after years of rapid growth. Advertisers now expect CTV to deliver the same accountability as performance channels, driving adoption of media mix modeling, incrementality testing, and consistent reporting frameworks .

Creatively, the canvas has expanded beyond the 30-second spot. Home screen placements capture viewers during discovery moments . Interactive formats enable engagement without interruption . 3D creative transforms standard assets into memorable experiences .

Privately, the industry is addressing the challenge of addressability without compromising user trust. Solutions like Covatic Sense demonstrate that person-level targeting is possible within privacy-first frameworks, moving beyond the household proxy that has limited television for decades .

The experimentation phase is over. CTV’s next chapter is about clarity, quality, and consistency . Advertisers who embrace this new reality—investing in creative innovation, demanding transparent measurement, and integrating CTV into full-funnel strategies—will capture the living room’s reimagined potential.

The screen is connected. The audience is engaged. The question is no longer whether CTV works, but how well you’re working it.

OTHER POSTS