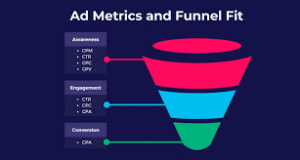

CPM vs. CPC vs. CPA: Understanding Ad Pricing Models.

CPM vs. CPC vs. CPA: Understanding Ad Pricing Models

The Language of Digital Money

If you have ever tried to run an online advertising campaign, you have encountered a alphabet soup of three-letter acronyms demanding immediate decisions. Do you pay per thousand impressions? Per click? Per sale? The choice you make at this moment is not merely technical—it is a fundamental expression of your business goals, your risk tolerance, and your faith in your own marketing.

CPM, CPC, and CPA are not interchangeable options. They are different currencies, and choosing the wrong one is like paying for a car in bus tokens.

This guide will provide a complete, rigorous breakdown of the three primary digital advertising pricing models. You will learn exactly how each model works, the mathematics behind their optimization, the strategic contexts where each excels, and—most importantly—how to choose the right one for your specific campaign.

By the end, you will never look at an ad pricing menu the same way again.

Part 1: The Core Concept—What Is an Ad Pricing Model?

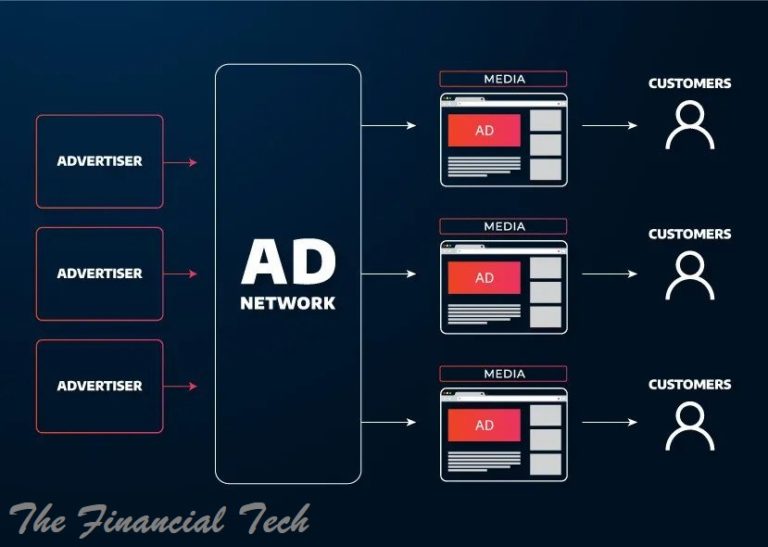

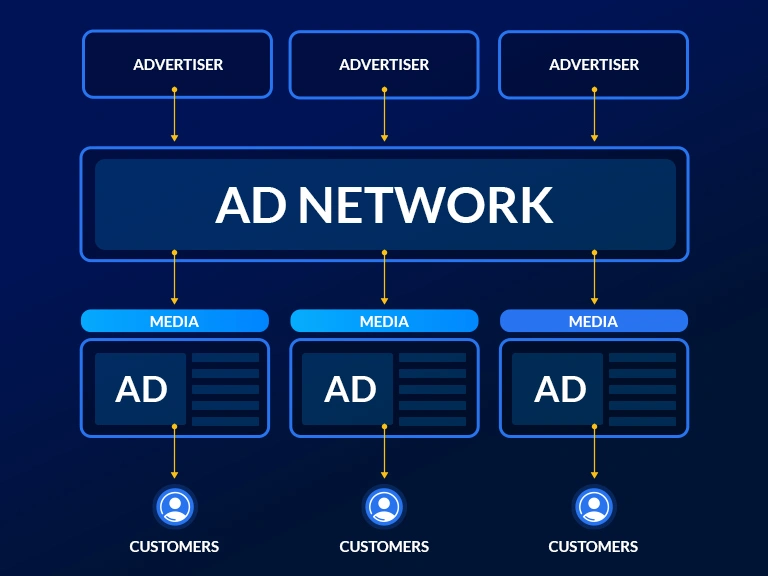

An ad pricing model is simply the method by which an advertiser pays a publisher (or an ad network, exchange, or platform) for delivering advertising inventory .

Think of it as a contract between buyer and seller. The seller agrees to provide something of value—an impression, a click, a sale. The buyer agrees to pay a predetermined amount when that something occurs.

The three dominant models are:

| Model | Full Name | You Pay For… | Abbreviation Origin |

|---|---|---|---|

| CPM | Cost Per Mille | 1,000 ad impressions | “Mille” = Latin for thousand |

| CPC | Cost Per Click | Each individual click | — |

| CPA | Cost Per Action | A specified conversion (sale, sign-up, download) | Also called PPA (Pay Per Action) |

*Sources: *

The fundamental trade-off: As you move from CPM to CPC to CPA, you transfer risk from the advertiser to the publisher.

In CPM, the advertiser pays whether the user engages or not. The publisher bears little risk; they get paid for simply showing the ad.

In CPC, the advertiser pays only for engaged users. The publisher bears the risk that their audience may not click.

In CPA, the advertiser pays only for business results. The publisher bears the risk that their audience may not convert.

This risk transfer is not charity; it is reflected in the pricing. CPM rates are typically lower than CPC rates, which are lower than CPA rates, because the publisher must be compensated for assuming additional risk .

Part 2: CPM—Cost Per Mille (Cost Per Thousand Impressions)

How It Works

CPM is the oldest and conceptually simplest pricing model. The advertiser pays a fixed rate for every 1,000 times their ad is displayed, regardless of whether anyone clicks, engages, or buys .

The formula:

Total Cost = (Total Impressions ÷ 1,000) × CPM Rate

Example: A campaign runs at a $10 CPM. It delivers 50,000 impressions.

$10 × (50,000 ÷ 1,000) = $10 × 50 = $500 total cost

The advertiser pays $500, whether they receive 0 clicks or 5,000 clicks.

When CPM Dominates

CPM is the standard model for brand awareness campaigns. If your goal is to put your brand in front of as many eyes as possible, you care about impressions, not immediate actions .

Ideal use cases:

Launch campaigns for new products or rebranding efforts

Television-equivalent digital buys (homepage takeovers, premium display)

Retargeting (keeping your brand top-of-mind)

High-funnel awareness where direct response is not expected

Advantages and Disadvantages

| Pros for Advertiser | Cons for Advertiser |

|---|---|

| Massive reach at predictable cost | You pay for unengaged views |

| Simple, transparent pricing | No inherent performance guarantee |

| Premium inventory often CPM-only | Click fraud still costs you money |

| Brand safety controls are mature | Difficult to measure true ROI |

| Pros for Publisher | Cons for Publisher |

|---|---|

| Predictable, stable revenue | Limited upside from high-performing ads |

| No performance risk | Must maintain high viewability |

| Works for any traffic volume | — |

CPM in Practice: What Is a “Good” CPM?

CPM rates vary wildly by industry, format, and audience quality.

| Channel / Format | Typical CPM Range (2025) |

|---|---|

| Standard display (network) | $0.50 – $3.00 |

| Premium display (direct) | $10 – $40+ |

| Video (pre-roll, connected TV) | $15 – $50+ |

| Niche vertical (finance, legal) | $20 – $100+ |

| Programmatic guaranteed | Varies by deal |

Sources: Industry benchmarks vary; these are approximate ranges.

The key insight: CPM is not a measure of value; it is a measure of inventory scarcity and audience quality. A $50 CPM site is not “overpriced”; it is delivering an audience that the advertiser values at $50 per thousand.

Part 3: CPC—Cost Per Click

How It Works

CPC shifts the payment trigger from “ad shown” to “ad clicked.” The advertiser pays only when a user actively engages with the creative by clicking through to their landing page .

The formula:

Total Cost = Total Clicks × CPC Rate

Example: A campaign agrees to a $1.50 CPC. It receives 1,200 clicks.

$1.50 × 1,200 = $1,800 total cost

The advertiser pays $1,800. Impressions are free.

The Auction Dynamic

In most modern CPC platforms (Google Ads, Microsoft Advertising, social media ads), the advertiser does not negotiate a fixed CPC. Instead, they participate in a real-time auction where they set a maximum bid—the highest amount they are willing to pay for a click.

The platform’s algorithm determines the actual CPC, which is often lower than the maximum bid. This is the second-price auction dynamic: you pay one cent more than the next highest bidder, not your full bid amount .

Critical concept: Quality Score

In Google Ads, your actual CPC and ad position are not determined solely by your bid. Google calculates a Quality Score based on:

Expected click-through rate

Ad relevance

Landing page experience

A higher Quality Score can lower your actual CPC and improve your ad position simultaneously . This is Google’s mechanism for rewarding relevant, useful ads and penalizing intrusive or irrelevant ones.

When CPC Dominates

CPC is the standard model for direct response advertising where the desired outcome is traffic to a website .

Ideal use cases:

Content marketing (driving readers to articles or blog posts)

Lead generation forms on landing pages

E-commerce product pages (where the purchase happens on your site)

Any campaign where the click is the conversion event

Advantages and Disadvantages

| Pros for Advertiser | Cons for Advertiser |

|---|---|

| Pay only for engaged users | Click fraud is a real cost |

| Performance is immediately measurable | High CPCs can burn budget quickly |

| Auction model can be cost-efficient | Requires optimization expertise |

| Clear ROI when conversion value is known | No guarantee of post-click conversion |

| Pros for Publisher | Cons for Publisher |

|---|---|

| Potential for high revenue from engaging content | Revenue depends entirely on user action |

| Aligns incentives with quality content | Unsuitable for low-CTR placements |

| — | Must maintain audience relevance |

CPC in Practice: What Is a “Good” CPC?

CPC varies dramatically by industry because the value of a click depends on what that visitor might buy.

| Industry | Average Google Ads CPC (Search) | Average CPC (Display) |

|---|---|---|

| Legal | $6.00 – $9.00 | $0.50 – $2.00 |

| Finance/Insurance | $3.00 – $5.00 | $0.50 – $1.50 |

| Technology | $2.00 – $4.00 | $0.40 – $1.00 |

| E-commerce (general) | $1.00 – $2.00 | $0.30 – $0.80 |

| Travel/Hospitality | $0.50 – $1.20 | $0.20 – $0.50 |

| Media/Entertainment | $0.20 – $0.50 | $0.10 – $0.30 |

*Sources: WordStream, SpyFu benchmarks; approximate ranges for 2024-2025.*

The key insight: CPC is not inherently “good” or “bad.” A $50 click is cheap if it results in a $5,000 sale. A $0.50 click is expensive if it never converts. CPC must always be evaluated in the context of conversion rate and customer value.

Part 4: CPA—Cost Per Action

How It Works

CPA is the most performance-driven pricing model. The advertiser pays only when a user completes a specific, pre-defined action—typically a sale, a form submission, a sign-up, or an app install .

The formula:

Total Cost = Total Actions × CPA Rate

Example: A campaign agrees to a $20 CPA for newsletter sign-ups. It generates 150 sign-ups.

$20 × 150 = $3,000 total cost

The advertiser pays $3,000. Impressions and clicks are free.

The Risk Transfer Is Complete

In a pure CPA deal, the publisher bears nearly all the risk. They must invest in delivering traffic, and they only get paid if that traffic converts on the advertiser’s site—over which they have no direct control.

This is why pure CPA deals are typically negotiated directly with affiliate networks or specialized performance agencies, rather than offered as a self-service option in standard ad platforms . Google and Facebook offer “optimized” CPA bidding, but this is the advertiser instructing the platform to target a certain CPA, not a guaranteed rate.

When CPA Dominates

CPA is the standard model for affiliate marketing and performance-based partnerships .

Ideal use cases:

Affiliate programs (publishers promote products for a commission)

App install campaigns (CPI is a subset of CPA)

Lead generation where the lead value is well-understood

E-commerce with reliable conversion tracking and customer lifetime value models

Advantages and Disadvantages

| Pros for Advertiser | Cons for Advertiser |

|---|---|

| Zero risk of wasted spend | Usually highest cost per action |

| Aligns cost directly with revenue | Limited inventory; fewer publishers accept CPA |

| Simplifies ROI calculation | Requires robust conversion tracking |

| Scales with success | Attribution complexity |

| Pros for Publisher | Cons for Publisher |

|---|---|

| Uncapped earning potential | Complete financial risk |

| No inventory goes unsold | Dependent on advertiser’s site experience |

| — | Payment delays (net-30, net-60 common) |

| — | Subject to advertiser’s attribution rules |

CPA in Practice: What Is a “Good” CPA?

There is no universal benchmark for CPA because it is directly tied to the economics of the advertiser’s business.

The fundamental equation:

Maximum Acceptable CPA = Customer Lifetime Value (LTV) × Acceptable Margin

If a customer typically spends $500 over their lifetime, and you are willing to spend 20% of that to acquire them, your target CPA is $100.

Industry averages (approximate):

| Vertical | Typical CPA Range |

|---|---|

| SaaS (subscription) | $50 – $200+ |

| E-commerce (high-ticket) | $30 – $100 |

| E-commerce (low-ticket) | $5 – $20 |

| Lead generation (insurance) | $50 – $150 |

| Lead generation (home services) | $20 – $60 |

| Mobile app install | $1 – $5 (varies by region) |

The key insight: CPA is not a cost to be minimized; it is a metric to be optimized against LTV. A lower CPA is not always better if it comes from lower-quality traffic that churns faster or spends less.

Part 5: The Comparison Matrix

| Factor | CPM | CPC | CPA |

|---|---|---|---|

| What you pay for | 1,000 impressions | Each click | Each conversion |

| Risk bearer | Advertiser | Shared | Publisher |

| Typical campaign goal | Awareness, reach | Traffic, engagement | Sales, leads, sign-ups |

| Measurement focus | Impressions, viewability | CTR, CPC, bounce rate | Conversion rate, ROAS, LTV |

| Inventory availability | Ubiquitous | Very high | Limited (affiliate/performance) |

| Advertiser control | High (placement targeting) | Medium (audience + keyword) | Low (results only) |

| Optimization complexity | Low | Medium | High |

| Fraud vulnerability | Impression fraud | Click fraud | Conversion fraud (less common) |

| Typical cost level | Lowest per unit | Medium | Highest per unit |

*Sources: *

Part 6: The Decision Framework—How to Choose

You are not choosing between CPM, CPC, and CPA in the abstract. You are choosing based on your specific campaign objective, your data maturity, and your risk tolerance.

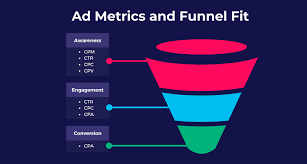

Decision Rule 1: Start with Your Goal

| If your goal is… | Your primary model should be… | Why |

|---|---|---|

| Brand awareness | CPM | You care about reach, not immediate actions. |

| Website traffic | CPC | You want visitors; you pay per visitor. |

| Sales/Conversions | CPA (or CPA-targeted CPC) | You want results; you should pay for results. |

| Retargeting | CPM or CPC | Context matters; both can work. |

| Product launch | CPM (initial) → CPC/CPA (scaling) | Awareness first, then performance. |

Decision Rule 2: Consider Your Data Maturity

If you have no historical conversion data: Start with CPC. You need to learn which audiences, creatives, and placements generate clicks before you can optimize for conversions.

If you have conversion tracking and historical CPA data: Move to CPA-focused bidding. You know what a customer is worth; let the platform optimize toward that target.

If you are a sophisticated direct-response marketer: Layer CPM into your mix for upper-funnel prospecting, then retarget those exposed users with CPC or CPA campaigns.

Decision Rule 3: Assess Your Risk Tolerance

Low risk tolerance (advertiser): CPA. You pay only for results. You will pay a premium for this safety.

Medium risk tolerance (advertiser): CPC. You pay for engaged traffic but not for unqualified impressions.

High risk tolerance (advertiser): CPM. You pay for reach and trust your creative and landing page to convert.

For publishers, the risk calculation is inverted. You prefer CPM (guaranteed revenue) over CPC (performance-dependent) over CPA (completely variable).

Part 7: Advanced Topics—Beyond the Trinity

vCPM—Viewable CPM

A refinement of CPM where advertisers pay only for impressions that are measurably viewable (according to the IAB standard: at least 50% of pixels visible for at least one second, or two seconds for video) .

This addresses the long-standing problem of ads served “below the fold” that users never actually see.

oCPM / tCPA—Optimized and Target-Based Bidding

Modern platforms (Google, Meta, Amazon) now offer automated bidding strategies that blur the lines between models .

oCPM (Optimized CPM): The advertiser pays per impression, but the platform uses machine learning to serve those impressions only to users predicted to convert.

tCPA (Target CPA): The advertiser sets a desired cost per acquisition; the platform automatically adjusts bids in real-time to attempt to hit that target.

These are not new pricing models; they are bidding strategies applied to existing models .

Hybrid Models

Some sophisticated affiliate deals use base CPM + CPA bonus structures. The publisher receives guaranteed revenue for impressions/clicks, plus a commission for any sales generated. This shares risk and reward more equitably.

Part 8: Common Beginner Mistakes and Misconceptions

“CPC is always better than CPM because you only pay for clicks.”

False. If your click-through rate is high, CPM can be far more cost-efficient than CPC. A $5 CPM with a 5% CTR yields an effective CPC of $0.10—far below market rates. Always calculate eCPC (effective CPC) and eCPM (effective CPM) to compare apples to apples.

“CPA is the only model that guarantees ROI.”

False. CPA guarantees you pay only for actions, but it does not guarantee those actions are profitable. You must still ensure that your CPA is less than your customer lifetime value. Paying $50 for a $40 customer is a loss, even though you paid “per action.”

“Higher CPM means better quality.”

Not necessarily. High CPM often reflects scarce inventory or aggressive publisher pricing, not inherently superior performance. Always test.

“I should use the same model across all campaigns.”

False. Upper-funnel awareness campaigns should use CPM. Mid-funnel consideration campaigns should use CPC. Lower-funnel conversion campaigns should use CPA or tCPA. Using the wrong model at the wrong funnel stage is inefficient.

Part 9: The Mathematics of Comparison—eCPM and eCPC

To fairly compare performance across different pricing models, you must normalize them to a common metric.

eCPM (effective Cost Per Mille) tells you what you are effectively paying for 1,000 impressions, regardless of your actual pricing model.

eCPM = (Total Spend ÷ Total Impressions) × 1,000

eCPC (effective Cost Per Click) tells you what you are effectively paying per click.

eCPC = Total Spend ÷ Total Clicks

Example: You run a $500 CPA campaign that generates 100,000 impressions, 2,000 clicks, and 25 conversions.

Your CPA is $20 ($500 ÷ 25)

Your eCPM is $5 ($500 ÷ 100,000 × 1,000)

Your eCPC is $0.25 ($500 ÷ 2,000)

Now you can directly compare this campaign’s efficiency against a CPM campaign ($5 eCPM) or a CPC campaign ($0.25 eCPC).

Part 10: The Future—Pricing Models in an Cookieless World

The deprecation of third-party cookies and increasing privacy regulation is forcing a reevaluation of performance advertising. If you cannot track users across sites, how do you measure clicks and conversions?

Emerging trends:

Contextual CPM: A return to paying for impressions based on the content of the page, not the identity of the user .

Cohort-based buying: Google’s Topics API, Meta’s aggregated event measurement—paying for reach within anonymized groups .

Increased reliance on first-party data: Advertisers with strong direct customer relationships will have advantages in all pricing models .

The fundamental shift: The industry is moving away from user-level attribution toward aggregated measurement. This will likely strengthen CPM as the default model and make accurate CPA targeting more challenging.

Conclusion: The Right Tool for the Job

CPM, CPC, and CPA are not competing philosophies. They are not ranked from “worst” to “best.” They are different tools in a sophisticated marketer’s toolkit, each suited to specific objectives, audiences, and stages of the customer journey.

CPM is for reach. Use it when you need to be seen.

CPC is for traffic. Use it when you need visitors.

CPA is for results. Use it when you need sales.

The expert marketer does not ask, “Which model is better?” They ask, “Which model is better for this specific campaign, given this specific goal, with this specific audience, at this specific point in the funnel?”

Answer that question correctly, and you are no longer a beginner. You are an advertiser who understands the language of digital money.

Appendix: Quick Reference Card

| Model | Payment Trigger | Best For | Risk | Typical Channel |

|---|---|---|---|---|

| CPM | Per 1,000 impressions | Brand awareness, reach, retargeting | Advertiser | Display, video, programmatic |

| CPC | Per click | Traffic, engagement, prospecting | Shared | Search, social, native |

| CPA | Per conversion | Sales, leads, app installs | Publisher | Affiliate, performance networks |

Always calculate:

eCPM to compare cost efficiency

eCPC to evaluate traffic cost

CPA against customer LTV to determine profitability

OTHER POSTS