Eco-System Decisions: Staying within Apple, Google, or Samsung’s ecosystem

Ecosystem Decisions 2026: Choosing Between Apple, Google, and Samsung

Introduction: Beyond the Single Device

For most of smartphone history, choosing a phone meant comparing cameras, processors, and screens. Today, that decision carries far more weight. When you buy an iPhone, a Pixel, or a Galaxy device, you’re not just selecting hardware—you’re choosing an entire digital ecosystem that will shape how you interact with technology for years to come.

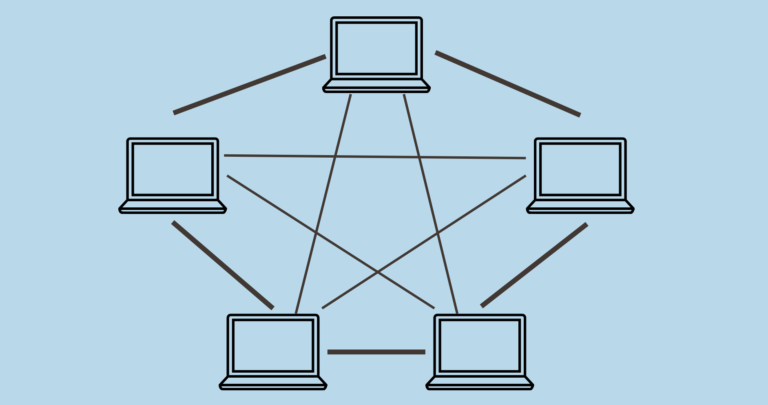

Each ecosystem has evolved into a sophisticated web of interconnected services: app stores that take a cut of every transaction , cloud storage that holds your memories, AI assistants that learn your habits, and wearables that monitor your health. Switching costs have never been higher, and the differences have never been more pronounced.

This guide examines the three dominant ecosystems in 2026—Apple, Google, and Samsung—and helps you decide which one deserves your long-term commitment.

Part 1: The Apple Ecosystem – Walled Garden, Premium Experience

The Business Model: Selling Hardware, Harvesting Services

Apple’s ecosystem is built on a simple premise: control everything, optimize everything, and extract maximum value from every user over time. The company’s latest financial results tell the story: iPhone revenue grew 13% year-over-year to $78 billion, driven by both unit growth (up 5%) and higher average selling prices (up 8%) . But the real story lies beneath the hardware numbers.

Apple’s services business—spanning App Store commissions, iCloud subscriptions, AppleCare, and search licensing deals—grew 14% and now represents a growing share of profits . The App Store alone functions as a highly efficient tax collection system, taking 30% from standard developers and 15% from small businesses . In markets with weaker regulatory oversight, this “Apple tax” remains remarkably stable and difficult to bypass .

The Glue: Seamless Integration

What keeps users locked in is the sheer seamlessness of the experience. AirDrop transfers files instantly between devices. Universal Clipboard lets you copy on iPhone and paste on Mac. Handoff passes calls and tasks between devices without thought. iMessage with its blue bubbles has become a social signal in itself.

This integration extends to accessories: AirPods pair instantly, Apple Watch unlocks your Mac, and AirTag tracking works across the entire ecosystem. Once you’re invested, leaving means rebuilding these connections from scratch.

The AI Strategy: Pragmatic Partnerships

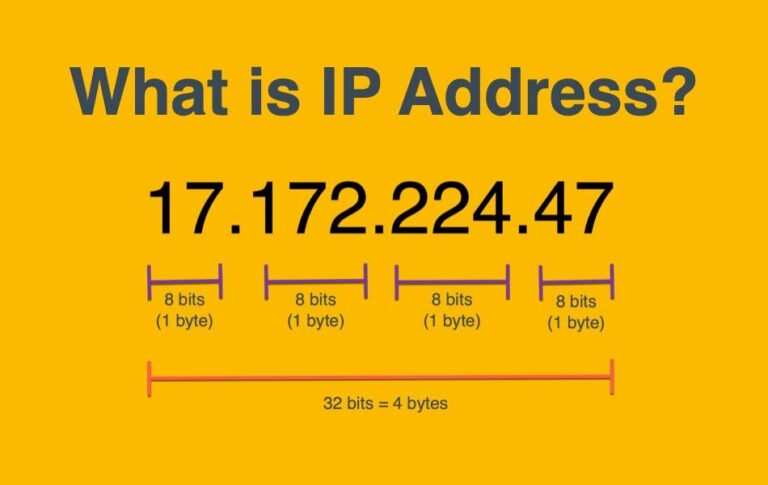

Apple’s approach to AI reveals both the strengths and limitations of its ecosystem philosophy. After internal struggles to develop competitive large language models—tests showed the new Siri correctly handling only 67-80% of user requests —Apple made a pragmatic decision.

In January 2026, Apple announced a multi-year agreement to use Google’s Gemini models for core Siri functionality, reportedly paying around $1 billion annually . Crucially, Gemini runs on Apple’s private cloud servers in a white-label form—the user interface remains Apple’s, and data stays in Apple’s hands. Users never know Google is involved .

This arrangement protects the ecosystem’s integrity while addressing capability gaps. Google accepts relatively low payment because it secures strategic security—keeping OpenAI and Anthropic out of Apple’s ecosystem while maintaining its $20 billion Safari default search agreement .

Ecosystem Scorecard

| Dimension | Apple |

|---|---|

| Integration Quality | Exceptional—seamless across iPhone, iPad, Mac, Watch |

| Privacy Approach | Strict on-device processing; third-party AI in controlled cloud |

| Update Longevity | 5-7 years of iOS updates |

| Hardware Range | Premium only; no budget options |

| Lock-In Strength | Very high—iMessage, iCloud, accessories create friction |

| Best For | Users valuing simplicity, privacy, and ecosystem cohesion |

Part 2: The Google Ecosystem – AI-First, Open but Cohesive

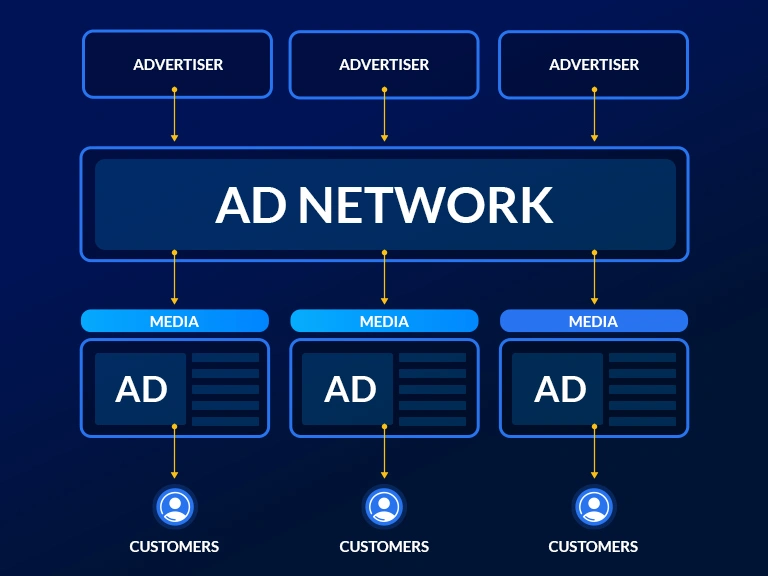

The Business Model: Advertising as Foundation

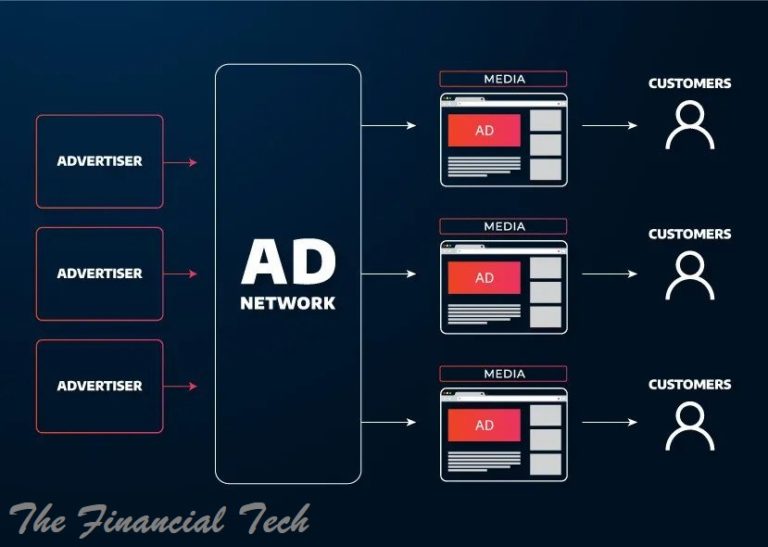

Google’s ecosystem operates on fundamentally different economics. While Apple sells hardware to enable services, Google offers services to enable advertising. Search and YouTube remain the core revenue drivers, but the company has successfully embedded AI across its products .

The challenge for 2026 is monetization. Generative AI changes user behavior—people receive answers faster, click less frequently, and complete tasks directly within interfaces. This threatens the traditional ad model built on queries and links. Google must prove that AI-enhanced experiences can actually increase revenue per user through better contextual understanding and richer intent signals .

The Glue: Services Across Devices

Google’s ecosystem is less about hardware lock-in and more about service continuity. Your Gmail, Google Photos, Google Drive, and YouTube history follow you across any device with a browser. Android serves as the foundation, but Google’s apps work on iPhones too.

The Pixel line represents Google’s vision of the ideal Android experience—clean software, first-in-line updates, and deep AI integration. The Pixel 10, launched in late 2025, is positioned as the first truly “AI-first” smartphone with on-device Gemini Ultra processing .

The AI Strategy: Platform Leadership

Google’s Gemini represents the company’s most ambitious technological bet. With the merger of Google Brain and DeepMind into Google DeepMind , the company has centralized its AI development. The latest Gemini models lead on several industry performance measures, prompting OpenAI CEO Sam Altman to issue an internal “code red” and accelerate GPT-5.2 development .

Google’s advantage lies in its unique combination of assets: the world’s largest search index, YouTube’s video library, Gmail’s communication data, and custom TPU infrastructure built since 2015 . No other company can match this data foundation for training general AI models.

Critically, Google is embedding Gemini across its entire ecosystem—Search, YouTube, Workspace, and Android. The “Google AI Pro” subscription model ($19.99/month) has seen strong adoption, creating recurring revenue beyond advertising .

The Samsung Partnership

Google’s ecosystem strength depends heavily on partnerships. Samsung, the world’s largest Android manufacturer, plans to double Gemini-powered devices from 400 million to 800 million in 2026 . Samsung’s TM Roh describes this partnership as essential: “We will apply AI to all products, all functions, and all services as quickly as possible” .

Ecosystem Scorecard

| Dimension | |

|---|---|

| Integration Quality | Strong across services; device experience varies by manufacturer |

| Privacy Approach | More data-dependent; privacy controls improving |

| Update Longevity | 7 years on Pixel; varies by manufacturer |

| Hardware Range | Pixel (premium), plus hundreds of Android partners |

| Lock-In Strength | Moderate—services work across platforms but integration deepens with Pixel |

| Best For | Users who want AI leadership and flexibility across devices |

Part 3: The Samsung Ecosystem – Hardware Excellence, Software Partnership

The Business Model: Hardware Scale with Platform Ambition

Samsung has historically been a hardware manufacturer first—producing panels, memory chips, and finished devices at enormous scale. But the company is deliberately shifting from hardware vendor to platform provider .

The strategic logic is compelling: global LCD manufacturing is now dominated by Chinese players with government subsidies. Competing on price alone is unwinnable. Samsung’s response is to redefine value—the display itself is no longer the product; the platform is .

The Glue: Tizen, Knox, and SmartThings

Samsung’s ecosystem revolves around three pillars:

Tizen OS: The operating system powering Samsung’s TVs, appliances, and increasingly its approach to connected devices

Knox: The security platform protecting Samsung devices across consumer and enterprise

SmartThings: IoT connectivity linking Samsung phones, watches, TVs, and home appliances

At CES 2026, Samsung emphasized “AI on Device” complemented by “AI in the Cloud,” with a platform that continuously evolves over device lifespans. The company now guarantees seven years of operating system and security updates for its smartphones—exceeding EU requirements and setting a new industry benchmark .

The Hardware Strategy: Focus and Discipline

Samsung’s 2025 was marked by product proliferation—the S25 Edge, Z Flip 7 FE, and other variants that confused customers and diluted focus. The S25 Edge, launched to compete with Apple, suffered poor sales and was heavily discounted before production was reduced . Samsung has reportedly scrapped plans for the S26 Edge entirely .

For 2026, analysts urge Samsung to maintain a tight lineup: flagship S26 series, next-generation foldables (Z Flip 8 and Z Fold 8), and affordable A-series devices. This focus would let Samsung concentrate on what it does best—building high-quality hardware while letting Google handle software .

The AI Strategy: Pragmatic Partnership

Samsung has its own AI development—the Gauss model—but has pragmatically chosen to partner deeply with Google for consumer AI features. The Galaxy S25 series delivered one of the best AI implementations by letting Google handle software while Samsung focused on hardware .

This relationship will deepen in 2026, with Samsung doubling Gemini-powered devices to 800 million units . The partnership gives Google massive distribution while letting Samsung focus on hardware differentiation and ecosystem integration across TVs, appliances, and the upcoming Galaxy XR headset.

The Future Bets: TriFold and XR

Samsung faces significant challenges in convincing consumers about two new form factors:

Galaxy Z TriFold: A three-panel foldable likely priced well over $2,000. Critics question whether this is a genuine innovation or a gimmick, especially given that foldables themselves haven’t gone mainstream .

Galaxy XR Headset: Samsung’s extended reality device lacks clear use cases and app support. The company must demonstrate why consumers need this device .

Ecosystem Scorecard

| Dimension | Samsung |

|---|---|

| Integration Quality | Strong across Samsung devices; improving with AI and IoT |

| Privacy Approach | Knox security; data practices improving |

| Update Longevity | 7 years (flagships) |

| Hardware Range | Unmatched—from budget to premium foldables to appliances |

| Lock-In Strength | Growing through SmartThings, Knox, and device diversity |

| Best For | Users wanting hardware choice and cross-category integration |

Part 4: The Comparison Matrix – Three Ecosystems, Three Strategies

| Dimension | Apple | Samsung | |

|---|---|---|---|

| Core Business | Hardware + Services | Advertising + Cloud | Hardware + Components |

| AI Strategy | Pragmatic partnership (Gemini) | Platform leadership (Gemini) | Hardware focus + Google partnership |

| Ecosystem Integration | Seamless across Apple devices | Strong across services, device-agnostic | Deep across Samsung product family |

| Update Commitment | 5-7 years | 7 years (Pixel) | 7 years (flagships) |

| Hardware Philosophy | Premium only, controlled | Reference design (Pixel) + partners | Full range, market-leading |

| Lock-In Strength | Very high | Moderate | Growing |

| Regulatory Exposure | App Store scrutiny in multiple markets | DOJ antitrust remedies, AdTech case | Less targeted, but global scale brings scrutiny |

Part 5: Which Ecosystem Should You Choose?

Choose Apple If:

You value simplicity, privacy, and seamless integration across devices

You’re already invested in Apple products (Mac, iPad, Apple Watch)

You appreciate consistent, premium hardware and long-term software support

You don’t mind paying premium prices for a curated experience

You want an ecosystem where “everything just works” without configuration

Choose Google If:

You want the absolute best AI capabilities and earliest access to new features

You value flexibility and want services that work across different devices

You’re interested in Pixel’s “AI-first” vision

You prefer Google’s apps and services (Gmail, Photos, Drive)

You want long-term updates (7 years) on Pixel devices

Choose Samsung If:

You want maximum hardware choice—from budget to premium to foldables

You’re building a smart home with Samsung appliances and TVs

You value the combination of Samsung hardware with Google’s AI software

You want the broadest ecosystem spanning phones, tablets, watches, and home devices

You appreciate cutting-edge hardware innovation (foldables, future XR)

The Hybrid Reality

It’s worth noting that ecosystems aren’t as exclusive as they once seemed. Apple now uses Google’s Gemini for AI . Samsung partners deeply with Google while building its own platform . Google’s services run on iPhones and Samsung devices.

The question isn’t which ecosystem you’ll use exclusively—it’s which ecosystem will be your primary home, where your most important data lives and where your daily experience is optimized.

Part 6: The Future – What’s Coming Next

Apple’s 2026-2027 Roadmap

Apple is expected to launch its first foldable iPhone in 2026 , followed by the iPhone 18/Air 2 in 2027, potentially shifting to twice-yearly releases. The deeper integration of Gemini into Siri (expected with iOS 26.4) will bring better contextual understanding, and 2027 should see Siri evolve into a true chatbot capable of extended back-and-forth exchanges .

Google’s AI-Native Evolution

Google enters 2026 as an “AI-native” company . The challenge is proving that AI investments translate into durable profits . Google Cloud’s operating margins expanded from 17.1% to 23.7% in 2025, and the company must sustain this trajectory. Waymo, with over 14 million paid rides in 2025, is transitioning from moonshot to commercial reality .

Samsung’s Platform Pivot

Samsung’s seven-year update guarantee sets a new industry standard . The company must execute on its platform vision while maintaining hardware leadership. The TriFold and XR headset represent high-risk, high-reward bets that will test whether Samsung can create new categories rather than just participate in existing ones .

Conclusion: The Ecosystem Era

The smartphone industry has matured past the point where hardware specifications alone determine winners. Today, the most important decision isn’t which phone you buy—it’s which ecosystem you commit to.

Apple offers the most polished, integrated experience—a walled garden where everything works beautifully but leaving is hard. Google offers AI leadership and service continuity across devices, with Pixel representing the purest expression of its vision. Samsung offers hardware diversity and cross-category integration, partnering with Google for AI while building its own platform.

Each has strengths. Each has trade-offs. The right choice depends on what you value most—seamlessness, AI innovation, hardware choice, or some combination.

In 2026, you’re not just buying a phone. You’re choosing a digital home. Choose wisely.

OTHER POSTS