The Advertiser’s Guide: How to Use Ad Networks to Reach Your Audience.

The Advertiser’s Guide: How to Use Ad Networks to Reach Your Audience in 2026

Introduction: The Intermediary Advantage

In the fragmented digital landscape, reaching your target audience efficiently is both the greatest opportunity and the most persistent challenge for advertisers. Direct relationships with individual publishers are impractical for all but the largest brands. The solution—ad networks—has evolved from simple inventory aggregators into sophisticated, AI-driven platforms that connect advertisers with audiences across millions of sites, apps, and devices.

This guide is for the advertiser who wants to master those platforms.

Drawing on 2026 best practices, platform capabilities, and performance data, this comprehensive guide provides a strategic framework for using ad networks effectively. You will learn how ad networks operate, which targeting levers to pull, how to structure campaigns for machine learning optimization, and how to measure success beyond last-click attribution.

Whether you are launching your first campaign or refining a mature program, this is your complete playbook.

Part 1: What Are Ad Networks and Why Should Advertisers Use Them?

1.1 Defining the Ad Network

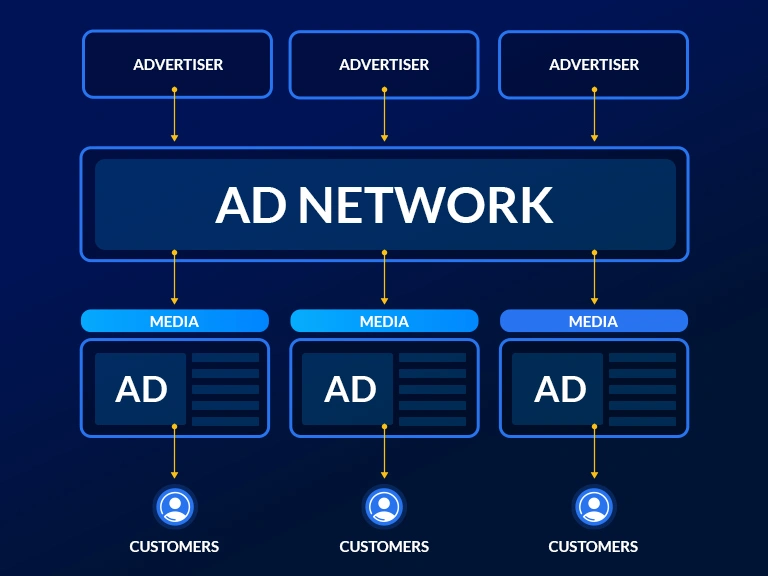

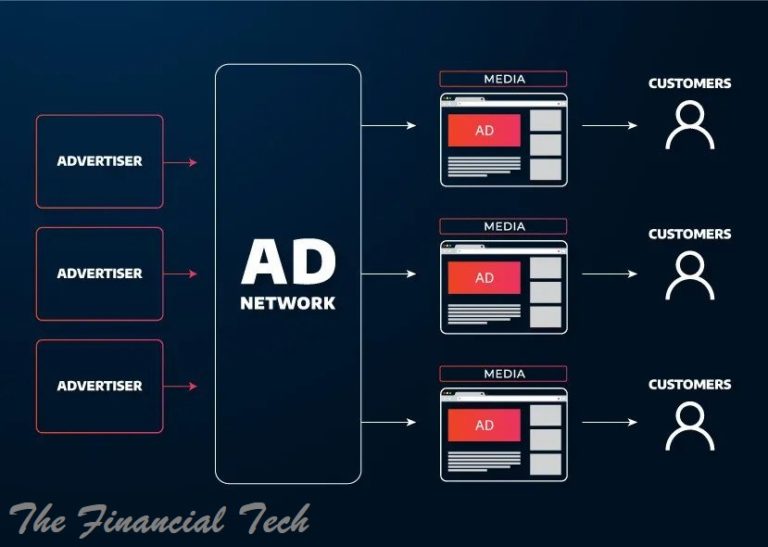

An ad network is a digital platform that acts as an intermediary between advertisers (who have messages to deliver) and publishers (who have ad space to sell) . Ad networks aggregate inventory from thousands or millions of publishers, bundle it by audience or context, and sell it to advertisers through a unified interface .

The core value proposition is simple: Instead of negotiating separate deals with hundreds of websites, you access massive reach through a single relationship, with consolidated reporting, payment, and optimization.

1.2 The Scale Advantage

The largest ad networks operate at staggering scale. Google’s Display Network alone reaches over 90% of global internet users across more than 2 million websites and apps . Meta (Facebook and Instagram) commands 24% of global digital ad spend with its hyper-granular demographic targeting . Amazon, the third-largest ad platform, sees approximately 2.5 billion monthly site visitors, all with demonstrated purchase intent .

This scale matters because 61% of marketers now use third-party data and ad networks to reach broader audiences . The math is simple: more inventory means more opportunities to find your customers.

1.3 Why Advertisers Choose Networks

| Benefit | What It Means for Advertisers |

|---|---|

| Expanded reach | Access audiences across millions of sites, not just a few premium publishers |

| Precision targeting | Leverage user data and platform algorithms to reach specific demographics, behaviors, and intents |

| Cost efficiency | Programmatic auctions often deliver lower costs per impression than direct deals |

| Unified management | One interface, one invoice, one reporting dashboard for campaigns spanning thousands of placements |

| Optimization at scale | Machine learning algorithms continuously improve performance across all inventory |

Part 2: The Ad Network Ecosystem – How It All Fits Together

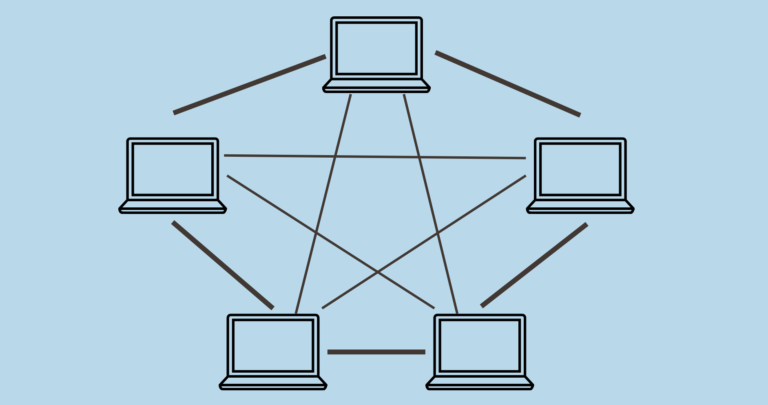

To use ad networks effectively, you must understand the broader ecosystem in which they operate. Modern digital advertising is powered by programmatic technology, where software automates the buying and selling of ad inventory.

2.1 Key Players in the Ecosystem

| Player | Role | Relationship to Advertiser |

|---|---|---|

| Demand-Side Platform (DSP) | Tool for advertisers to buy inventory across multiple exchanges and networks programmatically | Your buying interface; provides targeting, bidding, and optimization |

| Ad Exchange | Digital marketplace where inventory is auctioned in real-time | Connects DSPs with publishers; enables competitive bidding |

| Supply-Side Platform (SSP) | Tool for publishers to manage and sell inventory across exchanges | You don’t interact directly; SSPs make inventory available to your DSP |

| Ad Network | Aggregator of publisher inventory, often with proprietary targeting data | Your direct partner; may operate its own exchange or connect to others |

2.2 The Programmatic Flow

When a user visits a website, this sequence happens in milliseconds:

The publisher’s page sends a bid request to an ad exchange

The exchange broadcasts the request to multiple DSPs and networks

Your DSP evaluates the impression against your targeting criteria and places a bid

The highest bidder wins and their ad is served

The entire process completes before the page finishes loading

This real-time bidding (RTB) ecosystem now handles approximately two-thirds of all display advertising . For advertisers, it means your campaigns can compete for every relevant impression across millions of sites simultaneously.

Part 3: The Major Ad Networks – A Strategic Overview

3.1 Google Ads (formerly Google AdWords)

Google dominates digital advertising, accounting for nearly 30% of all digital ad spend . Its ad platform offers two primary campaign types:

Search Network: Text ads on Google search results pages. These capture users with active purchase intent—people searching for solutions your brand provides .

Display Network (GDN): Visual ads (images, responsive ads, video) across over 2 million websites, apps, and Google properties including YouTube and Gmail . This is a passive discovery channel ideal for building awareness and retargeting.

Why advertisers use Google:

Unmatched scale and reach

Sophisticated keyword, demographic, and interest targeting

Performance marketing focus with reliable ROI tracking

Integration with Google Analytics for cross-channel attribution

3.2 Meta Ads (Facebook and Instagram)

Meta commands 24% of global digital ad spend, making it the second-largest ad platform . Its strength lies in granular demographic and interest targeting based on real user profile data.

Key capabilities:

Target by location, age, gender, interests, behaviors, and connections

Create hyper-specific audiences (e.g., “cyclists in Minneapolis aged 18–30”)

Native ad formats (images, videos, carousels, collection ads) that blend into user feeds

2x higher user engagement and 3x user retention compared to standard banners

Recent 2025–2026 enhancements: Meta has expanded AI-powered tools for value-based optimization, allowing advertisers to optimize for profit margins, subscription value, or custom business goals rather than just conversions . New attribution options include incremental measurement and custom attribution integrated with third-party analytics.

3.3 Amazon Ads

Amazon has grown into the third-largest ad platform, generating over $30 billion annually . Its unique advantage: shoppers arrive with intent to buy.

Key offerings:

Sponsored Products, Sponsored Brands, and display ads across Amazon properties

Product targeting—show ads to users searching for or viewing similar items

Powerful ROAS reporting showing exactly how much incremental revenue ads generate

Amazon’s audience is composed almost entirely of people close to or at the buying stage, making it essential for e-commerce advertisers.

3.4 Specialized and Niche Networks

Beyond the triopoly, specialized networks offer access to unique audiences:

| Network | Strengths | Best For |

|---|---|---|

| Professional demographics; target by company, job title, industry | B2B marketing, recruiting, professional services | |

| Twitter (X) | Real-time conversation targeting; reach followers of specific accounts or users engaging with keywords | Brand awareness, news, entertainment, topical relevance |

| Visual discovery; high-intent users planning purchases | Lifestyle, fashion, home decor, food, DIY | |

| TikTok | Short-form video; massive Gen Z and Millennial reach | Youth-focused brands, viral campaigns, entertainment |

3.5 Commerce Media Networks

A rapidly growing category is commerce media networks (CMNs)—retailers and marketplaces opening their first-party data and inventory to advertisers . These include Walmart Connect, Instacart Ads, Uber Eats Ads, and countless others.

What makes CMNs unique:

Access to transactional first-party data—actual purchase history, not inferred behavior

High-intent audiences already in shopping mode

Entity-based targeting (specific products, categories, or brands)

For advertisers, CMNs represent the intersection of audience precision and purchase intent.

Part 4: Targeting Strategies – Finding Your Audience Across Networks

Modern ad networks offer a rich palette of targeting options. The key is matching the right strategy to your campaign objective.

4.1 The Targeting Taxonomy

| Targeting Method | Description | Best For |

|---|---|---|

| Demographic | Age, gender, income, education, parental status | Broad qualification; rarely sufficient alone |

| Geographic | Country, region, city, radius around a location | Local businesses, regional campaigns, language targeting |

| Contextual | Ads placed on pages with relevant content (keywords, topics, categories) | Brand safety, relevance without user data |

| Interest/Affinity | Users with demonstrated long-term interests | Awareness campaigns, broad prospecting |

| In-Market | Users actively researching or intending to purchase | Mid-funnel engagement, conversion-focused campaigns |

| Behavioral | Based on browsing history, past purchases, engagement patterns | Precision targeting, performance campaigns |

| Keyword | Trigger ads based on search queries or page content | Search and contextual campaigns |

| Custom Segments | Advertiser-defined audiences based on keywords, URLs, or apps | Highly precise intent targeting |

| Lookalike/Similar | Users behaviorally similar to your existing customers | Scalable prospecting from first-party data |

| Remarketing | Users who previously visited your site or app | Conversion campaigns, highest-intent audiences |

| Customer Match | Uploaded email lists of known customers | Privacy-resilient targeting, loyalty programs |

| Entity-Based | Target specific products, categories, or brands (commerce media) | Retail media, e-commerce |

4.2 Layered Audiences: The Precision Strategy

The most sophisticated advertisers use layered audience targeting—combining multiple criteria to narrow focus and eliminate waste .

How it works: Instead of relying on a single targeting dimension (e.g., “interested in fitness”), you layer multiple signals:

Demographics: age 25–40

Geography: within 25 miles of your stores

Behavior: visited competitor sites in last 30 days

Context: reading articles about marathon training

Each additional layer increases relevance but reduces reach. The art is finding the right balance for your objective.

Why layering matters:

Filters out irrelevant traffic automatically

Reduces exposure to fraudulent clicks (bots rarely match consistent audience signals)

Improves ad spend efficiency—every impression reaches a well-defined prospect

Strengthens brand safety by narrowing delivery to trusted contexts

4.3 Remarketing and Dynamic Remarketing

Remarketing (showing ads to users who previously visited your site) consistently delivers the highest conversion rates of any targeting method .

Standard remarketing: Show generic ads to all site visitors.

Dynamic remarketing: Takes personalization further by showing users the exact products or services they viewed . If a user looked at a specific pair of shoes on your site, dynamic remarketing serves an ad featuring those shoes, often with current pricing.

Implementation requirements:

Site-wide tagging with parameters capturing viewed products

Product feed (for e-commerce) or custom parameters (for lead generation)

Dynamic ad creative in your campaign

Dynamic remarketing consistently delivers 2–3x higher CTRs and 30–50% lower CPAs than generic remarketing.

4.4 Navigating the Cookieless Future

With third-party cookies deprecated, advertisers must adapt their targeting strategies. The platforms are evolving:

First-party data becomes paramount: Customer Match and similar audiences built from your own customer lists are privacy-resilient and increasingly valuable

Contextual targeting returns: Placing ads based on page content rather than user identity is making a comeback

Cohort-based approaches: Google’s Topics API, Meta’s aggregated event measurement

Universal IDs: Partnerships with identity solutions (Trade Desk’s UID2, LiveRamp) make authenticated inventory addressable

The advertisers who invest in collecting and activating first-party data will maintain targeting precision in the cookieless era.

Part 5: Campaign Structure – Setting Up for Success

5.1 The Three-Campaign Framework

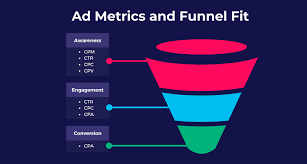

The most disciplined advertisers separate campaigns by funnel stage, each with its own targeting, bidding, and creative approach.

| Campaign Type | Objective | Targeting | Bidding | Creative |

|---|---|---|---|---|

| Awareness | Reach new audiences at scale | Affinity, demographics, broad contextual | CPM, vCPM | High-impact, emotionally resonant |

| Consideration | Drive engagement (clicks, video views, site visits) | In-market, custom segments, similar audiences | Maximize Clicks, tCPA (for micro-conversions) | Educational, benefit-focused |

| Conversion | Generate sales, leads, sign-ups | Remarketing, Customer Match, high-intent custom segments | tCPA, tROAS, Maximize Conversions | Specific, urgent, action-oriented |

Do not mix objectives within campaigns. Conflicting optimization signals confuse the platform’s algorithms and degrade performance .

5.2 Ad Group Structure: One Theme Per Group

Within each campaign, organize ad groups by single targeting themes :

Campaign: GDN_Conversions_Remarketing ├─ Ad Group: Cart_Abandoners │ └─ Targeting: Website visitors who added to cart but didn't purchase ├─ Ad Group: High_Intent_Page_Viewers │ └─ Targeting: Visitors to pricing page, demo page, or reviews └─ Ad Group: Past_Purchasers_CrossSell └─ Targeting: Customer Match list (existing customers)

This structure allows you to tailor creative and bids to each audience segment’s specific intent level.

5.3 Creative Formats: Collaborating with Machine Learning

In 2026, ad creative strategy is a human-machine partnership . You provide raw materials; the platform’s algorithms assemble, test, and optimize combinations.

Responsive Display Ads (RDAs) are the default choice for most display campaigns. You upload multiple assets—headlines, descriptions, images, logos, videos—and Google dynamically combines them into various formats and sizes, testing winning combinations .

Asset requirements for optimal performance:

5+ headlines (vary length and angle: benefit-driven, question-based, urgency)

5+ descriptions (elaborate on value propositions)

3+ images (mix product shots, lifestyle shots, branded graphics)

2+ logos (ensure brand consistency)

1+ video (if available; video-enabled RDAs outperform image-only)

Uploaded image ads (static or HTML5) are reserved for situations requiring strict brand control or specific interactive elements .

5.4 The Power of Video

Video ads consistently outperform static display. Video CPMs can be 2–3x higher than display, but the engagement and conversion uplift often justifies the premium .

Video ad options:

In-stream: Pre-roll, mid-roll, post-roll on YouTube and partner sites

Out-stream: Video ads that appear within display placements, auto-playing in view

Bumper: Six-second, non-skippable videos for reach and frequency

Discovery: Video ads on YouTube search and watch next pages

Part 6: Bidding and Budget – Smart Strategies for 2026

6.1 Bidding Strategies by Objective

| Objective | Recommended Bidding | Why |

|---|---|---|

| Brand awareness | Target CPM (tCPM) or Viewable CPM (vCPM) | You’re buying visibility, not actions |

| Website traffic | Maximize Clicks | Simplest alignment with engagement goal |

| Conversions (with history) | Target CPA (tCPA) or Target ROAS (tROAS) | Platform AI optimizes to your financial goal |

| Conversions (limited history) | Maximize Conversions | AI learns without strict cost constraints |

| Value optimization | Maximize Conversion Value | Prioritizes revenue over volume |

Recent developments: Meta now offers profit-based ROAS optimization, allowing advertisers to send profit margin data and optimize for profitable sales, not just revenue . This represents a significant evolution in value-based bidding.

6.2 Budget Management

Daily budget: Divide your monthly budget by 30.4 (average days per month)

Start conservative: Allow campaigns 7–14 days for the learning phase before significant adjustments

Monitor “Search Lost IS (Budget)”: If you’re losing impressions due to budget and ROAS is healthy, increase spend immediately

6.3 Cost Benchmarks (2026)

| Channel | Typical CPC | Typical CPM |

|---|---|---|

| Google Display Network | $0.50 – $1.50 | $0.50 – $5.00 |

| Google Search | $2.00 – $5.00+ | N/A |

| Meta (Facebook/Instagram) | $0.50 – $2.00 | $5.00 – $15.00 |

| $5.00 – $10.00 | $20.00 – $40.00 | |

| Amazon Sponsored Products | $0.50 – $2.00 | N/A |

Note: Actual costs vary significantly by industry, competition, and targeting.

Part 7: Optimization – The Continuous Improvement Cycle

7.1 Regular Optimization Cadence

Create and follow an optimization schedule :

| Frequency | Tasks |

|---|---|

| Weekly | Review performance by campaign, ad group, placement; pause underperformers |

| Bi-weekly | Check search term/placement reports; add negatives/exclusions |

| Monthly | Asset performance review; refresh creative; adjust bids |

| Quarterly | Long-term keyword/audience review; test new bidding strategies |

7.2 Asset Testing and Refinement

For Responsive Display Ads, platforms provide asset-level performance ratings (Low, Good, Best) :

Pause “Low” assets and replace with new variations

Create more assets similar to “Best” performers

Ensure asset diversity—different lengths, angles, and appeals

7.3 Placement Management

Underperforming placements are budget leaks. Regularly review placement reports and exclude sites, apps, or YouTube channels that generate high impressions but zero conversions .

Key metrics to monitor:

Viewability: Aim for 70%+; exclude placements below 50%

Invalid traffic: Watch for suspicious click patterns; use fraud detection tools

Conversion rate by placement: Shift budget to proven performers

Case study: Car rental firm Avis conducted a traffic audit and discovered 17% of paid clicks were invalid. After implementing automated exclusions, they achieved a 32% reduction in invalid traffic, 123% increase in conversions, and 27% decrease in CPA within three months .

7.4 Network Performance Review

For platforms offering multiple networks (e.g., Google Search Partners), check performance by network using the Segment feature . Search partner networks can be volatile—sometimes performing well, other times generating bot traffic. If a network consistently underperforms, consider excluding it.

7.5 Recommendations: Evaluate, Don’t Auto-Apply

Both Google and Microsoft provide optimization recommendations. Some are valuable; others serve platform interests. Turn off auto-apply for recommendations and review them manually .

That said, the Recommendations tab can be a source of ideas—new keywords, ad copy variants, bidding strategies—that you might not have considered .

Part 8: Measuring Success – Beyond Last-Click Attribution

8.1 The Attribution Blind Spot

Last-click attribution—still default in many organizations—systematically undervalues upper-funnel channels like display advertising. Display ads rarely close sales; they initiate relationships.

Metrics you must track:

| Metric | Definition | Why It Matters |

|---|---|---|

| View-through conversions (VTC) | User sees a viewable display ad, doesn’t click, later converts via another channel | Captures the “billboard effect” |

| Assisted conversions | Display appears in conversion path but isn’t last click | Quantifies display’s supporting role |

| Cross-device conversions | User sees ad on mobile, converts on desktop | Essential for accurate attribution |

| Brand lift | Survey-measured increase in awareness, ad recall, consideration | Direct measure of upper-funnel impact |

8.2 Platform-Specific Measurement Tools

Google: Ensure “View-through conv.” and “Cross-device conv.” are included in reporting columns

Meta: Incremental attribution functions optimize in real-time for conversions that wouldn’t have happened otherwise

Amazon: ROAS reporting shows incremental revenue from ad spend

8.3 Integrating Google Analytics 4 (GA4)

GA4 provides cross-channel attribution modeling essential for accurate evaluation:

Model comparison: Compare last-click vs. data-driven attribution

Audience creation: Build remarketing audiences from GA4 conversion events

Path analysis: Understand how display interacts with search, social, and direct traffic

Verify your ad platform and GA4 accounts are linked at the product level.

Part 9: Protecting Your Campaigns – Fraud, Brand Safety, and Quality

9.1 The Scale of the Problem

Ad fraud is projected to cost advertisers $172 billion annually by 2028, up from $88 billion in 2023 . Currently, fraud consumes 20–30% of digital ad spend—roughly $1 lost for every $3 invested .

Mobile apps are particularly vulnerable, with some reporting 28.5% invalid traffic (IVT) .

9.2 Quality Pillars

| Pillar | Definition | Action |

|---|---|---|

| Viewability | Ads visible for at least 1–2 seconds | Set benchmarks (50%+ in-view); exclude low-viewability placements |

| Brand safety | Ads not appearing on inappropriate sites | Use content exclusions; maintain exclusion lists |

| Contextual relevance | Alignment with user interests and intent | Monitor placement relevance; refine targeting |

| Traffic authenticity | Eliminating fraudulent impressions | Use verification tools; monitor for suspicious patterns |

9.3 Protective Measures

Maintain exclusion lists: Regularly update lists of low-performing or unsafe domains

Use negative keywords: Avoid unsafe categories and irrelevant content

Verify with third-party tools: DoubleVerify, Integral Ad Science, ClickPatrol

Monitor for anomalies: Sudden spikes in clicks from specific geographies or IPs may indicate fraud

Part 10: The Advertiser’s 2026 Playbook – Key Takeaways

10.1 Start with Clear Objectives

Every campaign needs a single, well-defined objective. Structure your account accordingly: separate campaigns for awareness, consideration, and conversion .

10.2 Embrace Layered Targeting

Combine demographics, behaviors, and context to narrow focus and eliminate waste. Use remarketing for your highest-intent audiences .

10.3 Feed the Algorithms

Provide rich creative assets (multiple headlines, descriptions, images) and clear conversion signals. Let machine learning optimize combinations and bids .

10.4 Test Continuously

A/B test creative variations

Experiment with new bidding strategies

Try new ad formats and networks

10.5 Measure Full Value

Include view-through conversions, assisted conversions, and cross-device activity in your reporting. Use data-driven attribution where available .

10.6 Protect Your Spend

Regularly audit placements for quality and authenticity. Maintain exclusion lists. Use fraud detection tools .

10.7 Never Stop Learning

The platforms evolve constantly. Stay current with new features (like Meta’s profit-based optimization), test them thoughtfully, and incorporate what works .

Conclusion: Ad Networks as Strategic Partners

Ad networks in 2026 are not mere inventory aggregators. They are sophisticated, AI-driven platforms that, when used strategically, can deliver unprecedented reach, precision, and efficiency.

The expert advertiser’s mindset:

Architect by objective. Separate campaigns for each funnel stage.

Target with precision. Layer criteria to reach the right users in the right contexts.

Collaborate with AI. Feed the algorithms rich inputs and clear goals.

Measure holistically. Value display’s full contribution, not just last clicks.

Protect relentlessly. Guard against fraud and brand safety threats.

Optimize continuously. Testing and refinement are never “done.”

The question is not whether ad networks “work.” It is whether you are working them correctly.

Your audience is out there, across millions of sites and apps, waiting to discover your brand. Ad networks are the bridge. This guide is your map. Now cross it.

OTHER POSTS