The Consolidation of the Ad Tech Stack: What It Means for Publishers.

The Consolidation of the Ad Tech Stack: What It Means for Publishers in 2026

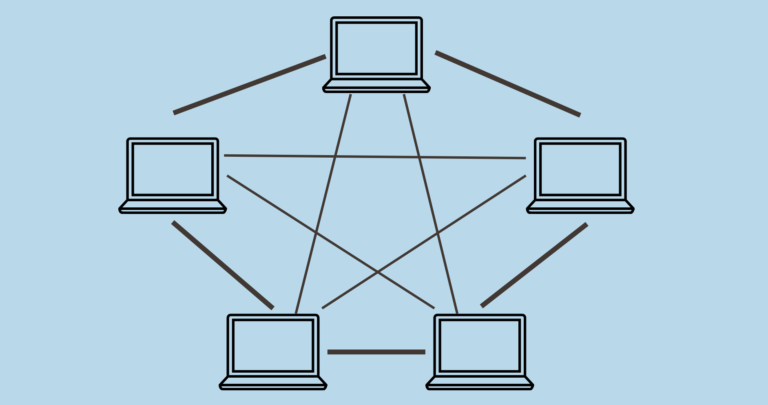

Introduction: The End of the “Franken-Stack” Era

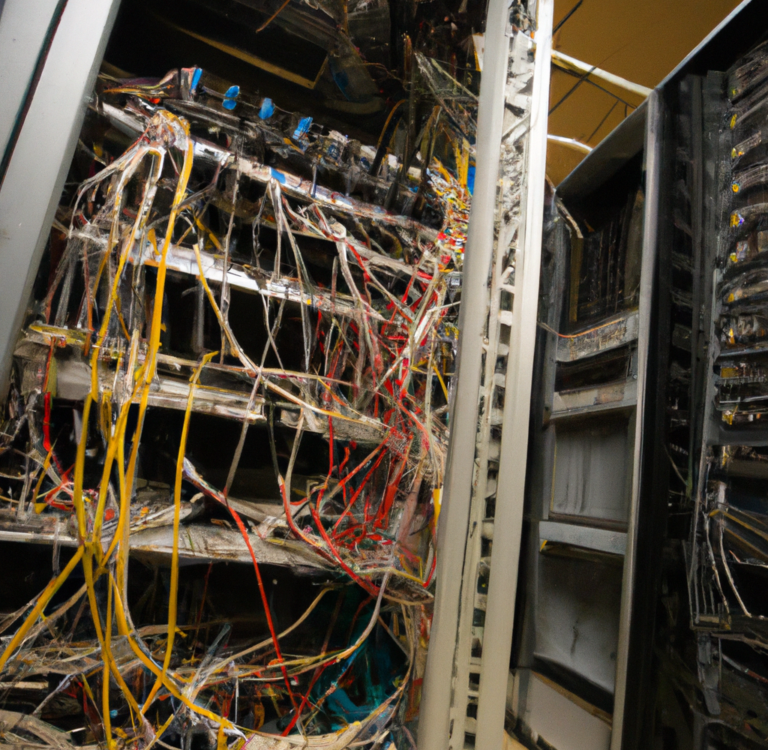

For more than a decade, the prevailing wisdom in digital publishing was “best-of-breed.” Publishers built their monetization infrastructure by assembling specialized point solutions—a CRM from one vendor, an order management system from another, a supply-side platform from a third, and analytics dashboards from yet another—then attempted to stitch them together through custom integrations and manual workflows. What started as innovation has, for many, become integration overload: a complex technology stack that is time-consuming to manage and difficult to optimize .

That era is ending.

Heading into 2026, innovative publishers are shifting away from “adding more” and moving toward “optimizing what matters.” Consolidation isn’t about cutting corners; it’s about choosing fewer, stronger partners who can do more for your business—partnerships that align with you strategically, not just technically .

This article examines the forces driving ad tech stack consolidation, what it means for publishers across the revenue ecosystem, and how forward-thinking organizations are positioning themselves for the next phase of digital monetization.

Part 1: The Drivers of Consolidation

1.1 The “Franken-Stack” Hits a Wall

The financial and operational burden of maintaining disconnected systems has become unsustainable. As Patrick O’Leary, CEO of Boostr, explains: “For a decade, we bought ‘best-of-breed’ point solutions and stitched them together. That bill has come due. Maintaining ten different fragile integrations isn’t a tech strategy anymore; it’s an operational tax on your margins” .

The symptoms are familiar to every publisher:

Sales teams working in one system, AdOps in another, Finance in a third

Manual “swivel-chair” workflows to move data between platforms

Frequent data discrepancies requiring reconciliation

Forecasts outdated by the time they’re presented

Revenue leakage from manual errors and delayed insights

The publishers who thrive in 2026 will be those who stop servicing the integrations and start servicing the client .

1.2 The Economic Imperative

Research from StackAdapt’s 2026 Programmatic Advertising Report reveals a stark reality: top-performing marketers are 4 times more likely to consolidate their technology stacks and use AI to drive growth . These leaders are pulling ahead by unifying workflows, consolidating technology, and embedding AI into execution—connecting creative, data, and media across the funnel .

The economic logic is compelling:

Reduced maintenance costs: Fewer integrations mean fewer expensive custom connections to maintain

Lower data reconciliation overhead: Single-source truth eliminates manual cross-checking

Improved margin control: Less revenue leakage through fragmented systems

Faster decision-making: Unified data enables real-time optimization rather than post-mortem analysis

According to Gartner’s 2025 Digital Commerce Hype Cycle, “in-house adtech modernization” is now one of the top strategic initiatives for large media and telecom groups seeking margin control and faster innovation .

1.3 The Regulatory Catalyst

Google’s ad tech dominance is facing its most significant challenge in decades. Recent DOJ court rulings mark the end of Google’s unchallenged control, with a penalty phase focused on remedies for its illegal monopoly in digital advertising . The DOJ is demanding that Google divest AdX and open-source its auction technology, exposing the depth of Google’s control.

As we look toward 2026, advertisers and publishers must prepare for a fundamentally different landscape—one where competition returns and strategic diversification becomes essential . The burden of change will fall primarily on Google, but the opportunity belongs to publishers who can operate across a more diverse, competitive ecosystem.

Testimonies from ad exchange CEOs during the remedies phase reveal deep frustration with Google’s grip over both the buy and sell sides of programmatic transactions . Whether through behavioral remedies or structural divestitures, this transition will bring both operational challenges and new opportunities for innovation.

Part 2: The Supply-Side Reset

2.1 Consolidation Over Volume

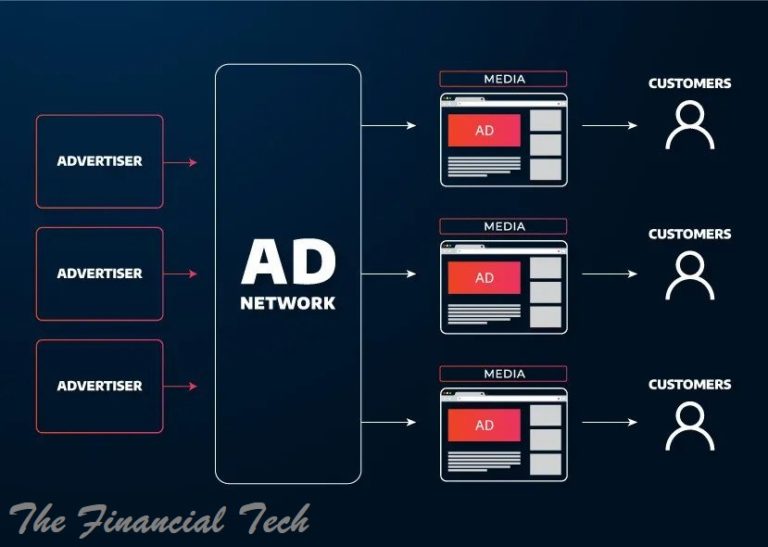

The SSP landscape in 2025-2026 is moving toward a concentrated model, with most publisher traffic flowing through a limited number of major platforms . After a decade of proliferation, the market is tightening as operational costs rise and demand paths become more selective.

Large SSPs are absorbing or shutting down smaller competitors, pruning an overcrowded marketplace. DSPs are cutting the number of supply integrations they maintain, prioritizing clarity over quantity . At the same time, publishers are reassessing their monetization stacks, questioning the value of partners that add volume but not efficiency.

For years, the industry assumed that more supply and more connections would translate into better revenue. That assumption no longer holds. Rising infrastructure costs, supply duplication, and signal loss have all exposed the limits of scale for its own sake .

2.2 What Changes When Publishers Consolidate

Publishers are no longer distributing requests across a wide set of vendors. Instead, they are choosing partners that can demonstrate :

Architectural transparency

Predictable auction behavior

Straightforward controls over how impressions travel

Verifiable efficiency rather than sheer scale

This shift marks a broader change in strategy: the coming year will reward publishers who choose stability over reach. Reducing the number of intermediaries lowers noise in auctions, improves buyers’ signal quality, and reduces the risk of unintended resale .

For publishers, the benefit is a stack that is easier to monitor and less vulnerable to performance volatility.

2.3 Direct Paths Regain Relevance

Direct integrations between DSPs and SSPs are reemerging as a strategic response to the rising costs of supply chain complexity . As publishers streamline their monetization stacks and buyers seek clearer insight into how impressions travel, the appeal of minimized intermediary layers is growing.

This development does not signal a return to the fragmented setups of the early 2010s. Instead, it reflects a form of controlled decentralization built on standardized protocols, stronger authentication, and more rigorous monitoring . The modern direct path is governed rather than improvised.

Buyers gain a clearer view of supply origins and performance patterns, while publishers see fewer hidden fees and routing anomalies. As consolidation compresses the landscape, the value of fewer but stronger links becomes more apparent .

Part 3: The Operational Imperative

3.1 From Automation to Autonomy

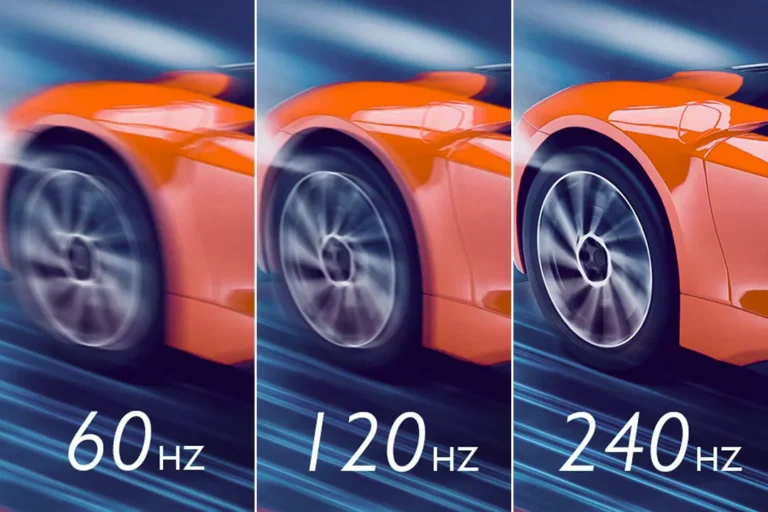

Throughout 2024 and 2025, the industry was obsessed with Generative AI—using tools to write emails or summarize RFPs. While useful, these are passive tools waiting for human input .

The forecast for 2026 is the rapid rise of Agentic AI: systems designed not just to create, but to execute complex workflows autonomously . Examples include:

Re-allocating underperforming inventory

Adjusting pricing floors in real-time based on demand signals

Reconciling delivery discrepancies without human intervention

The problem? An autonomous agent cannot navigate a disconnected tech stack. As O’Leary warns: “Let’s say you want an AI agent to automatically optimize a campaign that is under-pacing. If the delivery data sits in an ad server, the customer data sits in a CRM, and the inventory rules sit in a separate OMS, the AI is effectively paralyzed” .

In 2026, the competitive advantage isn’t having AI—it’s having the unified data foundation that allows AI to actually work.

3.2 Signal Starvation and the Accuracy Crisis

After years of privacy changes creating “signal starvation” around consumer targeting, media companies are wrestling with the next chapter of signal starvation—this time, an internal problem . Getting consistent, timely visibility across an increasing number of channels and formats is taxing the organization.

For RevOps leaders, this has turned forecasting into a nightmare. Most organizations struggle to aggregate, normalize, and automate forecasts. At best, this information is available once a week, and it’s often out of date or riddled with inaccuracies, impairing decisions about resource allocation .

According to Boostr’s analysis, the inability to forecast accurately in a volatile environment is the single biggest threat to publisher profitability in 2026 . The publishers who win won’t necessarily be the ones with the most data, but the ones with the most accurate view of their own reality.

3.3 The Governance Layer

As regulatory pressure intensifies and auction mechanics evolve, governance is becoming a structural requirement in the programmatic supply chain . New standards such as the GPP, OpenRTB 2.6, and expanded transparency fields are redefining how data is declared, transferred, and audited.

For SSPs, this shift raises the bar. Platforms are now judged not just by their auction logic or traffic capacity but by a broader set of criteria . They must enforce compliance rules at every stage of request processing and ensure that consent, privacy parameters, and contextual declarations remain intact as impressions move across the chain.

Protocol accuracy is becoming a shared responsibility with legal and operational consequences. Mismanaged signals can lead to downstream bidding errors, loss of demand, or violations of regional data laws .

Part 4: Measuring Supply Quality

4.1 The Shift from Audience to Supply Quality

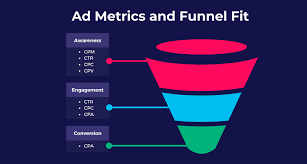

Privacy shifts and attribution limits are reducing the volume of user-level data available for real-time decisioning. As this continues, contextual signals gain weight, and the definition of performance moves away from audience targeting and toward supply quality metrics .

Buyers want to understand:

How impressions originate

How they move through the chain

Whether the environment supporting them is free from manipulation

Publishers are responding by adopting practices that make quality measurable rather than assumed .

4.2 Essential Quality Controls

Reliable traffic scanners are now a baseline requirement for identifying non-human activity before it enters the auction . IP mismatch control helps detect routing anomalies that often indicate masking or unauthorized reselling.

On the demand side, systematic bidstream audits allow publishers to check whether DSP behavior aligns with declared policies and whether any hidden routes appear in the data . Cookie sync processes are also becoming more selective. Syncing only with verified partners protects signal integrity and reduces leakage of identifiers into uncontrolled environments.

Together, these methods form a framework that converts quality from a vague promise into a set of observable metrics .

Part 5: The Path Forward for Publishers

5.1 Questions Every Publisher Should Ask

As you evaluate your digital ecosystem heading into 2026, consider these questions :

Is our technology stack working together, or against us? Fragmented data and reporting can drain time and resources while hindering accurate ROI measurement. Look for solutions that integrate seamlessly across channels, giving your sales team clarity and confidence in every pitch.

Are our partners evolving with us? The best partners aren’t vendors; they’re collaborators who anticipate industry shifts, provide education, and grow with your needs—especially as AI, automation, and new ad formats reshape the landscape.

Can we measure, prove, and scale our digital performance easily? In today’s market, visibility equals value. If your teams are spending more time compiling reports than selling, it’s time to explore a more unified, seamless approach.

5.2 From “Managed Chaos” to “Agentic Efficiency”

The mandate for media sales and RevOps leaders is clear: move from “managed chaos” to “agentic efficiency” . By consolidating the tech stack, preparing for autonomous workflows, and ensuring data accuracy, publishers can stop fighting their own systems and start focusing on what matters: maximizing yield and deepening advertiser relationships.

The 2026 priority is tech stack consolidation. By syncing pre-sales and post-sales data in a single platform, RevOps can provide executive teams with accurate forecasts and actionable insights .

5.3 Owning the Stack, Owning the Auction

For publishers ready to advance beyond consolidation, the next frontier is auction ownership. When publishers move from GAM or self-serve SSPs to their own platform, they typically just repeat the default auction order: PG deals first, then PMPs, and finally Open Auction . However, this rigid prioritization leads to long-term problems.

In a hybrid auction, every deal and bid is evaluated for its real contribution to total value. Strategic constraints like delivery commitments, pacing, buyer quality, and incremental revenue guide competition among Open, PMP, and PG .

Owning the auction lets publishers detect and address bidding pattern shifts early, protect key demand, smooth delivery, and prevent changes that may cause buyers to seek alternative supply routes . This reduces dependence on a narrow set of demand sources and makes the supply path more resilient.

5.4 The Human Element

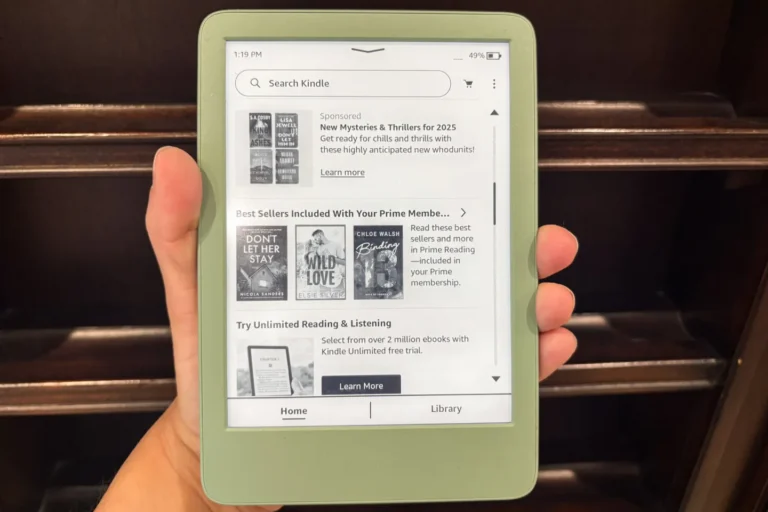

It’s not all about machines. 2026 will also see intensified pressure from agencies acting as “principal” buyers—purchasing inventory upfront at bulk discounts and reselling it. This threatens to commoditize publisher inventory and distance them from the advertiser relationship .

How do publishers fight back? By elevating their sales teams from order-takers to consultative partners. But sales reps can’t be strategic if they are buried in administrative work .

As O’Leary argues: “As buying becomes more automated and commoditized, premium value shifts back to the human connection—the creative strategy, the custom partnership, the trust. We shouldn’t automate workflows to replace people; we must automate them so our best sellers can stop acting like data-entry clerks” .

Conclusion: The New Equilibrium of Trust

The reset unfolding in 2025 and 2026 is not a market failure. It is a structural reboot that brings the ad supply chain back to fundamentals after years of expansion without proportional oversight . Consolidation, governance layers, and the rise of direct paths all point to the same conclusion: the ecosystem is moving toward cleaner architecture built on validated signals and accountable relationships.

In this environment, the publishers who apply principles of transparency, control, and compliance will not only withstand the transition but also emerge stronger. Buyers increasingly reward partners who can demonstrate where impressions originate, how data is processed, and which mechanisms ensure that auction behavior matches declared policies .

Clearer supply paths reduce price distortions and improve the reliability of publishers’ revenue streams. At the same time, compliance frameworks protect both sides from regulatory exposure and signal loss.

As the industry consolidates around fewer and more dependable relationships, a shared understanding is taking hold: rebooting the offering is not about reducing partners, but about restoring trust. And this trust becomes the foundation of the new equilibrium that will define the coming years .

The mandate for 2026 is clear: simplify, consolidate, and strengthen your digital partnerships. The publishers who do will be better equipped to capture new revenue, improve efficiencies, and future-proof their publishing businesses

OTHER POSTS