B2B and Lead Generation-Focused Ad Networks.

B2B and Lead Generation-Focused Ad Networks: The 2026 Guide to Reaching Business Buyers

Introduction: Why B2B Advertising Is Fundamentally Different

If you’re advertising to consumers, you can often measure success in days or even hours. A click becomes a purchase, and the attribution is straightforward. In B2B, this is not how it works.

The typical B2B buyer journey now spans 211 days from first touch to closed deal, involves 6.8 buyer stakeholders across 3.7 channels, and requires 76 touches before purchase completion . Buyers conduct 62 sessions on average throughout their decision process . By the time a deal closes, months have passed, multiple people have influenced the decision, and your advertising has touched the prospect dozens of times across different platforms.

This complexity is why B2B advertising requires its own specialized toolkit. You cannot simply apply consumer advertising strategies to business buyers and expect results. The stakes are higher, the cycles are longer, and the measurement challenges are exponentially more difficult.

This guide provides a comprehensive overview of the B2B and lead generation-focused ad networks in 2026, examining the platforms, technologies, and strategies that actually deliver pipeline and revenue. Whether you’re targeting C-suite executives, IT decision-makers, or procurement professionals, understanding this ecosystem is essential for efficient B2B growth.

Part 1: The B2B Advertising Landscape in 2026

1.1 The Platform Hierarchy: Where B2B Budgets Flow

According to Dreamdata’s comprehensive analysis of hundreds of B2B companies, LinkedIn has emerged as the dominant platform for B2B advertising, capturing 39% of total B2B ad budgets . Google Search commands 37% , while Meta receives just 8% , with the remaining 9% distributed across other platforms .

This allocation reflects a strategic shift based on performance metrics:

| Platform | Budget Share | ROAS (12-month) | Key Strength |

|---|---|---|---|

| 39% | 113% | Professional targeting, early funnel influence | |

| Google Search | 37% | 78% | High-intent capture, bottom funnel |

| Meta | 8% | 29% | Scale, low surface costs |

The critical insight: While Meta offers clicks at 58% lower cost than LinkedIn, the professional platform delivers returns that justify its premium pricing . This is the fundamental reality of B2B advertising: surface-level metrics mislead; business outcomes matter.

1.2 Why LinkedIn Dominates: The Company-Level Advantage

LinkedIn’s effectiveness stems from its ability to target companies and roles rather than individuals. The platform’s firmographic targeting capabilities enable advertisers to reach decision-makers based on industry, company size, job function, and seniority—all within a professional context .

Dreamdata’s analysis reveals LinkedIn’s influence across the funnel:

29% of marketing qualified leads (MQLs) influenced

36% of sales qualified leads (SQLs) influenced

35% of new business deals influenced

By comparison, Google Ads influences 19% of MQLs, 21% of SQLs, and 25% of new business, while Meta shows minimal impact at 4% of MQLs, 3% of SQLs, and 2% of new business .

The cost efficiency tells a similar story: LinkedIn achieves €154 per company influenced, approximately 70% lower than Meta (€299) and 25% lower than Google Search (€222) .

Part 2: The Major B2B Advertising Platforms

2.1 LinkedIn Ads: The Indispensable Foundation

LinkedIn has evolved far beyond simple sponsored content. In 2026, the platform offers a comprehensive advertising suite tailored to B2B objectives :

Ad Formats:

Carousel ads: Interactive multi-slide ads for storytelling

Conversation ads: Direct messages with interactive choices

Lead Gen Forms: Pre-filled forms capturing prospect information directly on LinkedIn

Message ads: Direct outreach via LinkedIn messaging

Single image, video, and carousel feed placements

Spotlight ads: Focused promotion of specific products or services

Thought Leader Ads: Person-to-person content that achieves 2.3x higher click-through rates than standard image ads

Recent Enhancements (2024-2025):

Conversions API: Server-side tracking enabling 20% lower cost per acquisition and 31% more attributed conversions

Company Intelligence API: Organization-level engagement tracking across paid and organic touchpoints

Revenue Attribution Report: Company-level measurement from first touch to closed deal

Frequency capping: Control over ad exposure limits

Who should use LinkedIn: Any B2B company targeting professional audiences. LinkedIn’s targeting by industry, job title, and company size makes it essential for reaching decision-makers .

2.2 Google Ads: Capturing Intent at the Bottom of the Funnel

Google remains indispensable for B2B advertising, primarily through its search network capturing users actively seeking solutions .

Key strengths:

Intent-based targeting: Users searching for specific solutions signal readiness to buy

Massive reach: 83% global search market share

Bottom-funnel efficiency: Google Search captures the 25% of new business deals that LinkedIn influences at the top

Google Display Network (GDN) offers B2B advertisers reach across 2+ million websites with contextual and audience targeting . While display generally performs weaker than search for direct response, it plays a valuable role in retargeting and awareness.

Who should use Google Ads: Every B2B company. Google captures the intent that LinkedIn cultivates.

2.3 Microsoft Advertising: The Underutilized Opportunity

Microsoft Advertising (formerly Bing) offers similar PPC capabilities with often lower competition and cost than Google . Its network includes:

Bing

Yahoo

DuckDuckGo

AOL

Ecosia

Outlook

MSN

Microsoft’s partnership with OpenAI has enhanced AI-powered search capabilities, creating additional opportunities for ad placement within conversational results .

Who should use Microsoft Advertising: B2B companies testing new keywords or seeking supplemental reach at lower CPCs. Many advertisers find Microsoft an effective testing ground before scaling to Google .

2.4 Meta for B2B: Niche but Viable

Meta’s massive audience (nearly 4 billion monthly users) and sophisticated targeting make it viable for certain B2B applications, though the platform’s 29% ROAS lags significantly behind LinkedIn and Google .

Effective B2B use cases:

Retargeting website visitors

Building brand awareness among broad professional audiences

Promoting thought leadership content

Recruiting talent

Formats to consider: Video, carousel, collection ads showcasing products or thought leadership .

Who should use Meta: B2B companies with visual products, strong brand stories, or targeting broad professional demographics rather than specific job titles.

Part 3: The Platform Performance Data You Need to Know

3.1 The 2025 LinkedIn Benchmarks Report

Dreamdata’s comprehensive analysis of 23 million sessions across 220,000+ customer journeys revealed critical benchmarks :

| Metric | Google Search | Meta | |

|---|---|---|---|

| Return on Ad Spend (ROAS) | 113% | 78% | 29% |

| Cost per Company Influenced | €154 | €222 | €299 |

| MQL Influence | 29% | 19% | 4% |

| SQL Influence | 36% | 21% | 3% |

| New Business Influence | 35% | 25% | 2% |

The takeaway: LinkedIn’s higher surface costs translate to superior business outcomes through better targeting precision and conversion quality .

3.2 The Buyer Journey Reality

The extended B2B cycle demands sustained engagement. Key findings :

211 days from first touch to closed deal

6.8 buyer stakeholders involved

3.7 channels touched per journey

76 touches before purchase

62 sessions on average throughout decision process

107 days between MQL and SQL stages (bottleneck before sales involvement)

Implication: Marketing teams carry responsibility for nurturing leads through extended periods before sales engagement begins .

3.3 Company Size Impact on Journey Length

| Company Size | Average Journey Length |

|---|---|

| Small (<50 employees) | 178 days |

| Medium (50-250 employees) | 224 days |

| Large (250+ employees) | 315 days |

Time in sales pipeline remains consistent (50-73 days) across segments, indicating that company size impacts marketing’s lead nurturing phase more than sales conversion .

3.4 The Attribution Insight

Including LinkedIn Ads engagement data in revenue attribution modeling increases measured ROI accuracy by 7.7 times . The timeline shows:

Impressions: 320 days before revenue

Engagement (clicks, video views): 235 days before revenue

Conversions: 219 days before revenue

Sixty-four percent of companies using LinkedIn’s Conversions API optimize campaigns toward pipeline and revenue rather than top-of-funnel metrics .

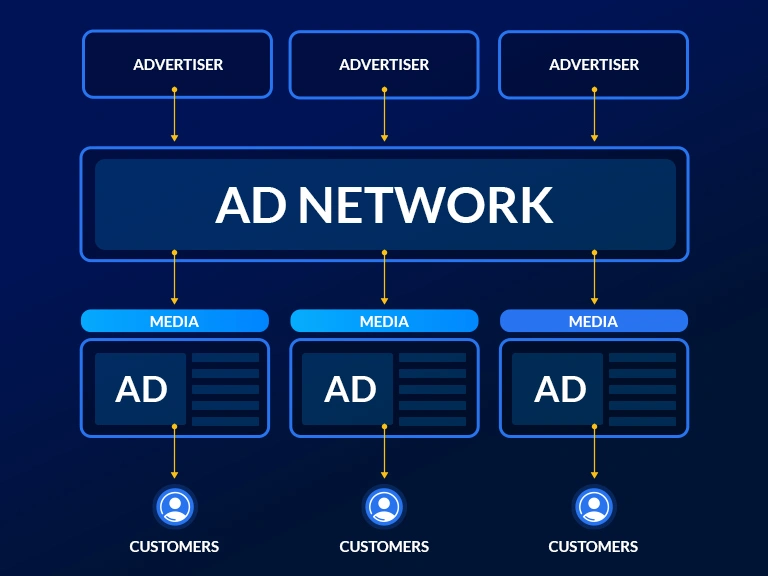

Part 4: The Demand-Side Platform (DSP) Layer for B2B

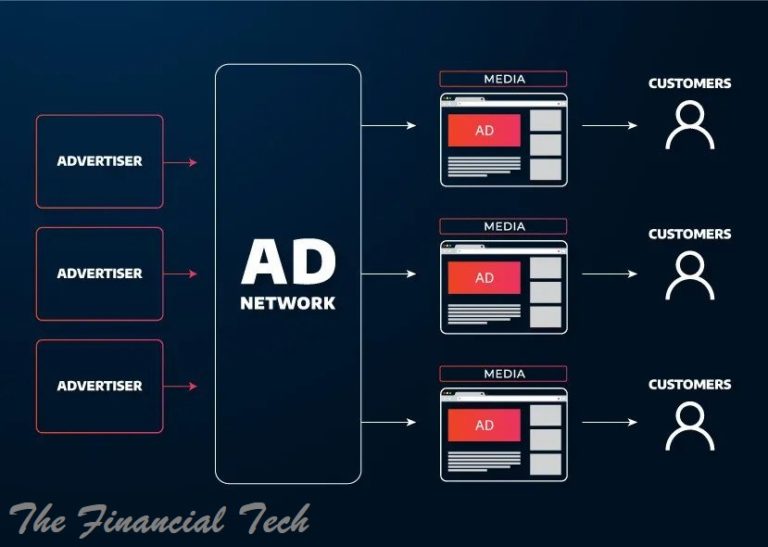

For sophisticated B2B advertisers, self-serve platforms like LinkedIn and Google are just the beginning. Demand-side platforms (DSPs) enable programmatic ad buying across multiple channels with unified audience logic and measurement.

4.1 What a DSP Does for B2B

A DSP helps B2B marketers manage digital ad buying across channels—display, video, connected TV (CTV), native—without juggling disconnected tools . When configured properly, it operates inside your go-to-market motion, using real activity signals to tie ad performance to pipeline with greater precision than channel-specific tools .

Key B2B DSP capabilities:

True account targeting based on CRM, firmographics, and buyer intent

Real-time campaign sync with Salesforce, HubSpot, or marketing automation

Full-format reach across display, video, CTV, native, and mobile

Multi-touch attribution built for long, complex B2B journeys

4.2 Leading B2B-Focused DSPs

ZoomInfo Marketing

ZoomInfo’s native DSP is built specifically for B2B advertising and ABM programs . It leverages ZoomInfo’s proprietary data—intent signals, firmographics, technographics, and real-time account insights—for precise account-based targeting across display and social inventory .

Works for: ABM programs, B2B audience targeting, pipeline influence, buying-committee reach

The Trade Desk

Built for scale and control, The Trade Desk suits B2B teams running omnichannel campaigns across long buying journeys . While not B2B-only, teams achieve B2B precision by layering CRM data, intent signals, or partner segments on top of its targeting controls .

Works for: Omnichannel execution, enterprise targeting, multi-stage buying journeys

DV360 (Display & Video 360)

DV360 keeps Google-centric teams working inside one workflow for planning and buying media across the Google Marketing Platform . B2B audiences typically come from first-party data or external partners.

Works for: Google-first teams, integrated execution across GA4, YouTube, and Ads

RollWorks

RollWorks is an ABM platform with integrated programmatic ad buying, connecting ad delivery with CRM data, intent signals, and social activation .

Works for: ABM programs, CRM-connected campaigns, intent-driven targeting

Demandbase One

Demandbase combines an ABM platform and B2B data with built-in DSP capabilities, blending media execution with deeper buyer context so campaigns reflect where accounts are in the journey .

Works for: Enterprise GTM motions, buying committees, long-cycle account engagement

4.3 Evaluating B2B DSPs

Consider these factors when choosing :

Reach across the accounts and roles that influence revenue

Integrations with Salesforce, HubSpot, or your MAP supporting workflow without manual steps

Operational lift—the platform should reduce complexity, not add it

Format support matching your buyers’ actual channels

Attribution reflecting the full B2B journey

Operational requirements matching your team’s capacity

Part 5: Intent Data – The Fuel for B2B Advertising

5.1 What Is Intent Data?

Intent data reveals which companies are actively researching topics relevant to your solutions. It answers the question: “Who is in-market right now?” rather than “Who might be interested someday.”

5.2 Bombora: The Intent Data Pioneer

Bombora is the leading provider of intent and demographic data for B2B marketers . Its data aligns marketing and sales teams, enabling actions based on knowledge of what companies are in market for which products .

The source: Bombora’s Data Cooperative includes premium B2B media companies contributing content consumption and behavioral data about their audiences . From this, Bombora derives premium B2B digital audiences segmented by precise attributes .

Key capabilities :

Company Surge® Intent data revealing where accounts are in their buying journey

In-market account targeting with the right message at the right time

Omni-channel activation across display, video, CTV, audio, and mobile

Audience intelligence informing personalized ad creation

5.3 Informa TechTarget + Demandbase Integration

Informa TechTarget’s 1st-party account-level intent data combined with Demandbase’s 3rd-party intent signals enables advertisers to focus on companies actively researching solutions .

The advantage :

87% of B2B tech buyers agree independent expert content is crucial to decision-making

60% of companies leveraging B2B intent data struggle to identify the right decision-makers

Informa TechTarget’s directly observed, contextually relevant contact-level intent data pinpoints exact stakeholders and maps their interests

Results: Palo Alto Networks achieved “significant lift in identifying more cross-sell opportunities and larger overall deal sizes” using this combined approach .

Part 6: Native Advertising for B2B Lead Generation

6.1 The Role of Native in B2B

Native advertising—ads that match the form and function of the publisher’s content—has become increasingly important for B2B marketers seeking to build demand and scale thought leadership .

The native advertising market was estimated at over $100 billion in 2024 and continues strong growth as brands chase less intrusive, content-driven placements .

6.2 Strengths of Native for B2B

Pros :

High engagement with professionally targeted content

Quality placements on premium B2B publishers

Strong for mid-funnel nurturing and thought leadership

Less intrusive than display advertising

Cons :

Lower intent than search

Requires strong content to perform

Slower lead velocity than bottom-funnel channels

6.3 Best Practices for B2B Native

Focus on educational, value-driven content rather than sales pitches

Target publishers with professional audiences relevant to your industry

Use native for mid-funnel nurturing while search captures bottom-funnel intent

Measure assisted conversions, not just direct responses

Part 7: Case Studies – Real-World B2B Advertising Success

7.1 Tata Consultancy Services (TCS): Creative Standout in a Saturated Market

TCS sought to deepen connections with key business audiences navigating accelerated digital transformation . Building on successful LinkedIn campaigns targeting CFOs, TCS aimed to broaden impact across additional decision-maker segments.

The challenge: Digital channels had become increasingly saturated with business messaging. To stand out, the campaign needed bold, creatively-driven execution .

The solution: A campaign built around LinkedIn lead gen forms and third-party content syndication, underpinned by a human-centered creative concept using arresting animal imagery to draw parallels between species’ adaptation and business challenges .

The results :

Exceeded lead generation target by 50%

Reached and engaged all 1,200+ priority accounts

Significantly boosted brand visibility across key decision-maker audiences

Won multiple industry awards including ANA B2 Award Silver and Drum Advertising Awards B2B category

7.2 CyVers: $23 Cost-Per-Lead Through Multi-Channel Outreach

CyVers, a Web3 security company, faced challenges common to emerging technology providers: a saturated market with numerous competitors and difficulty reaching high-level decision-makers .

The campaign: Infinite, a B2B lead generation agency, deployed targeted campaigns across LinkedIn and email channels over 12 months .

The results :

692 qualified leads generated

13,729 prospects reached in blockchain and DeFi sectors

7.04% lead rate

$23 cost per lead

37% connection rate

28% response rate from established connections

Half of engaged prospects converted to sales opportunities

“We went from chasing leads to closing deals,” said CyVers’ CEO. “Infinite didn’t just bring us prospects, they brought us growth. We gained dozens of new B2B customers” .

Part 8: Channel Strategy – Allocating Budget Across Platforms

8.1 The Multi-Channel Imperative

No single channel drives all B2B results. The most effective programs tie multiple platforms together with strong tracking, content-led journeys, and continuous optimization .

8.2 Recommended Budget Allocation

A starting point for B2B campaigns in 2026 :

| Channel | Budget Allocation | Primary Role |

|---|---|---|

| Google Search | 40-50% | Capture intent, bottom-funnel |

| LinkedIn (Social) | 30-40% | Target decision-makers, nurture accounts |

| Native Advertising | 10-20% | Create demand, thought leadership |

| Display/Programmatic | 10-15% | Retargeting, awareness |

Adjust based on results: if search CPL spikes, shift portion to social retargeting and native content that nurtures leads until they convert on search .

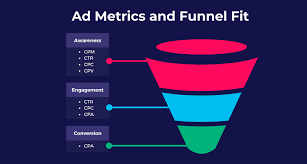

8.3 Funnel Integration Strategy

Top of Funnel (Awareness):

LinkedIn Thought Leader Ads and video content

Native advertising on premium B2B publishers

Programmatic display with intent data targeting

Middle of Funnel (Consideration):

LinkedIn Lead Gen Forms with content offers

Retargeting across display and social

Email nurturing sequences

Bottom of Funnel (Decision):

Google Search capturing high-intent queries

LinkedIn message ads to engaged prospects

Account-based display targeting decision-makers

8.4 Measurement Framework

Track more than just CPL. Essential metrics for B2B :

SQL and opportunity conversion rates

Cost per opportunity

Pipeline velocity

Revenue attribution by channel

Return on ad spend (ROAS) with appropriate attribution windows

These metrics give a realistic picture of lead quality and contribution to revenue .

Part 9: Platform Selection Guide – Matching Networks to Objectives

| Objective | Primary Platforms | Secondary Options |

|---|---|---|

| Brand awareness among professionals | LinkedIn Video, Native Ads | Programmatic display (The Trade Desk, DV360) |

| Lead generation (top-of-funnel) | LinkedIn Lead Gen Forms, Content Syndication | Native advertising, Demandbase |

| Intent capture (bottom-funnel) | Google Search, Microsoft Advertising | LinkedIn message ads |

| Account-based targeting | LinkedIn Matched Audiences, RollWorks, Demandbase | ZoomInfo Marketing, programmatic ABM |

| Thought leadership distribution | Native advertising, LinkedIn Sponsored Content | Industry publication direct buys |

| Retargeting | Google Display Network, LinkedIn Retargeting, Meta | Programmatic display |

| Niche industry targeting | Industry-specific publications, LinkedIn | Native networks with vertical expertise |

| Global enterprise reach | LinkedIn, Google, The Trade Desk | Regional platforms (Mintegral in Asia) |

Part 10: The 2026 Outlook – Trends Shaping B2B Advertising

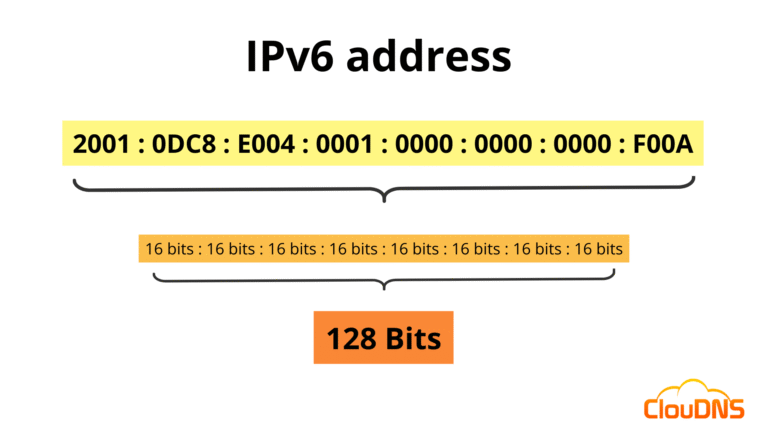

10.1 First-Party Data as Foundation

With third-party cookies deprecated, B2B advertisers are rebuilding targeting on first-party data from CRM, marketing automation, and intent partners . Teams that maintain strong data discipline continue to outperform .

10.2 Connected TV (CTV) for B2B

B2B buyers are spending more time on connected screens during research and evaluation. Teams treating CTV as part of the journey are seeing stronger engagement where it matters .

10.3 Revenue Operations Integration

Paid media data now feeds earlier stages of revenue planning by revealing buyer movement before any owned-channel conversion happens . When ad engagement is treated as a revenue signal rather than a marketing metric, GTM teams get a clearer view of demand forming upstream .

10.4 AI Doesn’t Fix Broken Inputs

While AI shows up in every platform pitch, it doesn’t fix broken foundations. When CRM data or segments are misaligned, AI reinforces those errors rather than improving performance . Data quality remains the critical differentiator.

10.5 Company-Level Measurement

LinkedIn’s Company Intelligence API and similar capabilities from other platforms enable organization-level engagement tracking . This addresses B2B’s fundamental difference from consumer marketing by measuring influence on entire companies rather than individuals .

Conclusion: Building Your B2B Advertising Stack

B2B advertising in 2026 is not about choosing the single “best” platform—it’s about building an integrated stack that addresses the full complexity of the buyer journey.

The winning formula combines:

LinkedIn as the foundation for professional targeting, top-of-funnel influence, and account-based reach

Google Search to capture intent from buyers ready to engage

Intent data (Bombora, TechTarget) to prioritize accounts showing active research

DSPs (The Trade Desk, DV360, Demandbase) for programmatic scale across channels

Native advertising for thought leadership and mid-funnel nurturing

Multi-touch attribution that accounts for 211-day journeys and 6.8 stakeholders

The data is clear: surface-level metrics like CPC and CPM mislead in B2B. LinkedIn’s higher costs deliver 113% ROAS while cheaper alternatives deliver far less . The most sophisticated advertisers optimize toward pipeline and revenue, not clicks.

As Steffen Hedebrandt, CMO at Dreamdata, notes: “Marketing teams now maintain responsibility for nurturing leads through extended periods before sales engagement begins, requiring orchestration across multiple touchpoints and stakeholder groups rather than isolated campaign optimization” .

Your advertising stack must reflect this reality. Choose platforms that reach decision-makers in professional contexts, fuel them with intent data, measure across the full journey, and optimize toward business outcomes—not yesterday’s clicks.

The right B2B ad network isn’t the one with the lowest CPC. It’s the one that delivers revenue months later, when the deal finally closes.

OTHER POSTS