Top Ad Networks for Gaming Websites and Apps.

Top Ad Networks for Gaming Websites and Apps in 2026

Introduction: Why Gaming Monetization Is Different

If you are developing a mobile game in 2026, you probably already know that ads are not just a side revenue stream—they can make or break your game’s monetization strategy. Consider this: two similar games with identical traffic and engagement levels can earn vastly different revenue depending on the ad networks they choose. Some developers have reported losing over 150 percent of potential eCPM revenue because they selected a network that did not align with their audience or game type .

Gaming is unique in the advertising ecosystem. Players are deeply engaged, sessions are frequent, and the interactive nature of games creates opportunities for ad formats that simply don’t exist elsewhere. A well-placed rewarded video can enhance gameplay by giving players extra lives or currency. A poorly timed interstitial can drive them away forever.

This guide evaluates the top ad networks for gaming websites and apps in 2026, examining their strengths, ideal use cases, and the specific ad formats they support. Whether you’re running a casual mobile game or a hardcore PC title, understanding these platforms will help you maximize revenue without compromising player experience.

Part 1: Understanding the Gaming Advertising Landscape

1.1 Market Size and Growth

The global game advertising platform market is substantial and growing rapidly. According to Global Info Research, the market generated approximately $8.845 billion in revenue in 2025 and is projected to reach $15.362 billion by 2032, representing a compound annual growth rate (CAGR) of 8.7% .

Mobile gaming dominates this landscape. In the first three quarters of 2025, global mobile game downloads reached 38.9 billion, a 7.4% year-over-year increase, while revenue hit $82.5 billion, growing 13.2% . This growth attracts intense competition, making efficient ad monetization critical for success.

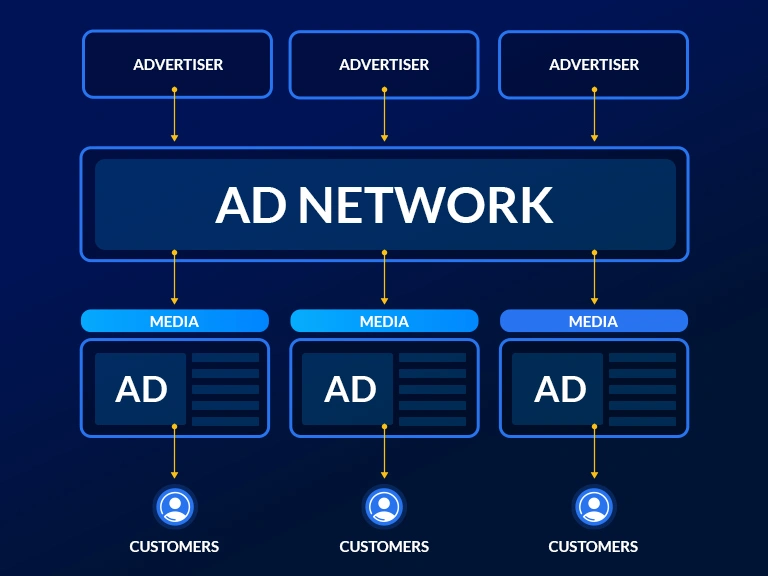

1.2 Why Gaming Networks Specialize

Mobile game ad networks are distinct from general advertising platforms because they are purpose-built for the gaming context . They focus on:

Demographic, interest, and genre-driven research to connect advertisers to relevant apps

Ad formats that complement gameplay rather than interrupt it

High engagement rates from players already in a receptive mindset

Strategies for targeting users based on in-game behavior

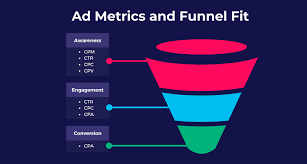

1.3 Key Metrics for Gaming Monetization

Understanding performance metrics is essential for optimizing ad revenue :

| Metric | Definition | Why It Matters |

|---|---|---|

| eCPM | Effective cost per thousand impressions | Shows revenue earned per 1,000 ad impressions; higher eCPM indicates strong advertiser demand |

| Fill Rate | How often an ad request returns an ad | Low fill rate means lost revenue opportunities |

| CTR | Click-through rate | Tracks player interaction; higher CTR can influence advertiser demand |

| User Retention Impact | How ads affect player behavior | Poorly timed ads reduce session length and daily active users |

| ARPDAU | Average revenue per daily active user | Combines ad and in-app purchase revenue to measure overall earnings per player |

Part 2: In-Game Ad Formats: A Complete Guide

Before examining specific networks, it’s essential to understand the ad formats these platforms deliver. Gaming offers unique formats that leverage player engagement .

2.1 Rewarded Video Ads

What they are: Short video ads that players voluntarily watch in exchange for in-game rewards—extra lives, virtual currency, power-ups, or premium content.

Why they work: Players choose to engage, creating positive brand association. Rewarded videos consistently deliver the highest engagement rates and eCPMs in gaming.

Examples: Watching a 30-second ad to continue a game after losing, or doubling rewards by viewing an ad.

2.2 Playable Ads

What they are: Interactive mini-games or demos that let users experience a game before downloading. These ads capture attention with visually engaging, interactive content .

Why they work: Playable ads offer a preview of the gaming experience, encouraging downloads from users seeking new games. They are particularly effective for user acquisition campaigns.

2.3 Interstitial Ads

What they are: Full-screen ads that cover the entire interface of a host app, appearing at natural transition points—between levels, during loading screens, or when switching activities .

Why they work: Interstitials are highly viewable and immune to ad blockers. Research shows click-through rates are 18 times higher than banner ads . Approximately 57% of game publishers use interstitials to monetize mobile apps .

Best practice: Interstitials should complement the natural flow of gameplay. Google advises publishers to ask: “Will the user be surprised? Is this the right time?”

2.4 Banner Ads

What they are: Traditional display ads that appear as static or animated banners at the top or bottom of the game screen.

Why they work: Banners are non-intrusive and provide consistent, predictable revenue through impressions. However, they generate lower eCPM than video formats.

2.5 Native Ads

What they are: Ads designed to blend with the app’s existing content and visual design, creating a less intrusive experience .

Why they work: Native ads focus on target audiences with interests similar to those found in the original app, improving relevance and engagement.

2.6 Offerwall Ads

What they are: A dedicated section where players can complete activities—signing up for services, watching videos, or completing surveys—in exchange for in-game rewards .

Why they work: Offerwalls give players choice and control, often appealing to users who won’t make direct purchases but will engage with offers.

2.7 App Open Ads

What they are: Ads displayed when a user opens the app, appearing before the game loads.

Why they work: App open ads capture attention at the start of a session without interrupting active gameplay.

Part 3: Top Gaming Ad Networks in 2026

Based on market analysis, industry adoption, and platform capabilities, here are the leading ad networks for gaming websites and apps .

3.1 Unity Ads

Overview: Unity Ads is the network built specifically for games using the Unity engine. It provides ad formats that fit naturally inside games, making ads feel like part of the experience rather than interruptions .

Key Features:

Rewarded video ads and playable ads

Interstitial and banner ads

Support for Android and iOS through Unity’s SDK

Auction-based bidding for ad slots

Machine learning to help acquire users with higher lifetime value

Benefits for Developers:

Unity Ads requires minimal technical work if your game is built in Unity. Rewarded and playable ads give value to players, keeping retention higher while generating income .

Pros:

✅ Easy integration for Unity-based games

✅ Ad formats that match game flow, reducing player disruption

✅ Rewarded and playable ads deliver strong eCPM with proper targeting

Cons:

❌ In lower-demand regions or niche genres, fill rate or eCPM may be low

❌ Relying only on Unity Ads often limits maximum revenue potential

Best For: Unity-based mobile games, particularly casual and mid-core titles.

3.2 Google AdMob

Overview: Google AdMob is a leading mobile ad network designed specifically for app developers, backed by Google’s massive advertising ecosystem .

Key Features:

Multiple formats: banners, interstitials, rewarded video, native ads, app-open ads

Mediation support to combine multiple ad networks

Integration with analytics tools (Google Analytics, Firebase)

Global advertiser demand and broad geographical coverage

Real-time bidding where ad sources compete for each impression

Benefits for Developers:

AdMob provides stable monetization across many regions and player demographics. For games with global audiences, it ensures ad requests get filled more often. Analytics help understand user behavior and ad performance, supporting better optimization .

Pros:

✅ High fill rates and stable demand worldwide

✅ Wide selection of ad formats

✅ Strong analytics and reporting tools

✅ Works well for fallback supply when premium networks underperform

Cons:

❌ eCPM often lower compared to specialized gaming networks

❌ For premium games, results may feel average unless combined with other networks

Best For: Games with global audiences; excellent as a foundational network in a mediation stack.

3.3 AppLovin (MAX)

Overview: AppLovin is one of the few ad networks solely focused on mobile ads, offering all formats from banners to video. AppLovin MAX is a mediation and ad demand platform combining multiple ad sources .

Key Features:

Rewarded video, interstitial, banner, and native ads

Mediation layer aggregating demand from multiple networks

Analytics and IAP optimization tools

Global demand reach across many countries

Supports both CPI and CPC campaigns

Benefits for Developers:

AppLovin MAX helps maximize yield by increasing competition for ad slots, leading to higher eCPMs. Its combined revenue and user acquisition tools support growth alongside monetization .

Pros:

✅ High demand leads to frequent higher-paying ads

✅ Mediation protects against regional demand dips

✅ Flexible monetization strategies combining ads and in-app purchases

Cons:

❌ Requires more setup and ongoing management than single-network integration

❌ Poorly managed ad frequency can lead to ad fatigue

Best For: Games with sizable or international traffic seeking maximum yield.

3.4 ironSource (LevelPlay)

Overview: ironSource LevelPlay is a mediation platform designed for mobile games needing reliable monetization across multiple demand channels. It allows integration of many ad networks under one roof .

Key Features:

Support for rewarded video, interstitials, offerwalls, banners

Real-time analytics and reporting for each demand source

A/B testing to compare different ad networks or placements

Cross-promotion tools for developers managing multiple titles

Benefits for Developers:

ironSource reduces risk: if one network underperforms in a region, another demand source can fill instead. Real-time data and testing help identify which ad formats, networks, or placements perform best .

Pros:

✅ High flexibility and coverage across regions and ad sources

✅ Better revenue stability through mediation and fallback demand

✅ Offerwalls provide monetization options even if video supply is limited

Cons:

❌ Integration and configuration require effort and care

❌ Smaller games may not benefit significantly until volume increases

Best For: Games with global audiences needing reliable, diversified monetization.

3.5 Chartboost

Overview: Chartboost provides a programmatic marketplace for mobile game ads, with options for direct deals and real-time bidding. Owned by mobile game studio Zynga, it offers an average revenue share of 90% to game developers .

Key Features:

Real-time bidding and programmatic demand

Targeting by device/OS, region, in-app behavior, or user profile

Support for rewarded video, interstitials, and playable ads

CPI payment model

Benefits for Developers:

If your game targets a niche audience or specific demographic, Chartboost’s targeting and direct-deal options deliver more relevant ads, leading to higher engagement and eCPM .

Pros:

✅ Precise control over who sees ads and when

✅ Possibility of higher-paying direct deals

✅ Suitable for games with specific user profiles

Cons:

❌ Demand may be unstable if user base is small

❌ Requires manual optimization and possible negotiation for direct deals

Best For: Niche games with defined audiences where direct advertiser relationships are valuable.

3.6 Meta Audience Network

Overview: Meta Audience Network taps into advertising demand from Facebook and Instagram, using demographic and interest-based data to deliver ads matching player profiles .

Key Features:

Native ads, rewarded video, interstitials, banners

Targeting based on demographic data, interests, and behavior

Strong global advertiser base

Benefits for Developers:

For games with social or casual appeal, Meta Audience Network delivers ads that match player interests. Well-integrated native ads feel less intrusive, maintaining user experience while generating revenue .

Pros:

✅ High targeting precision when audience profile is well known

✅ Wide demand pool across many countries

✅ Variety of ad formats

Cons:

❌ Performance varies by region and demographic alignment

❌ Demand fluctuates based on advertiser campaigns

Best For: Social, casual, and lifestyle-oriented games.

3.7 AdColony

Overview: AdColony is a mobile ad network known for high-definition video ad campaigns. It works with top companies including ABC News and Walmart, and reaches over 1.5 billion monthly users .

Key Features:

Instant-Play video technology

Aurora HD spatial design

Programmatic ad buying system

Customizable ads (color palette, fonts)

Supports CPI and CPC payment models

Benefits for Developers:

AdColony’s relationships with premium advertisers bring high-quality demand. Its HD video technology ensures excellent user experience.

Pros:

✅ Strong industry relationships with premium brands

✅ High-quality video ad experiences

✅ Third-party verified viewability rates

Cons:

❌ May not suit all game genres equally

Best For: Games seeking premium video advertising with strong brand alignment.

3.8 InMobi

Overview: InMobi is one of the largest mobile advertising platforms, reaching over 1.5 billion unique devices globally .

Key Features:

Appographic targeting (targeting based on specific app usage)

HD visuals for maximizing ROI

Supports interstitials, banners, rewarded video, native ads

CPM-based revenue model

Benefits for Developers:

InMobi’s appographic targeting strategy accurately reaches audiences using particular apps, then serves relevant HD mobile ads.

Pros:

✅ Massive global reach

✅ Sophisticated targeting capabilities

✅ Multiple format support

Cons:

❌ Revenue share not publicly disclosed

Best For: Games targeting specific app user bases with high-quality visual advertising.

3.9 Vungle

Overview: Vungle specializes exclusively in video ads for mobile game monetization .

Key Features:

Video ads only

Supports CPM, CPC, CPA, and CPI bidding models

Privacy-friendly platform

Reliable analytics for user acquisition tracking

Benefits for Developers:

Vungle’s focus on video allows deep optimization for this format, often delivering strong eCPM for games where video performs well.

Pros:

✅ Specialized expertise in video advertising

✅ Multiple pricing model options

✅ Strong privacy compliance

Best For: Games where video ads align well with gameplay and audience.

3.10 Digital Turbine

Overview: Digital Turbine helps game advertisers connect with mobile game developers to boost ad impressions. The company acquired AdColony in 2021, significantly expanding its reach .

Key Features:

Combines multiple mobile advertising platforms

Reach through AdColony’s 1.5+ billion monthly users

HD video technologies and rich media formats

Programmatic marketplace

Benefits for Developers:

Digital Turbine’s consolidated platform offers access to extensive demand through its acquisitions.

Pros:

✅ Massive combined reach

✅ Strong video capabilities through AdColony

✅ Global performance advertising business

Cons:

❌ Platform complexity from multiple integrated systems

Best For: Games seeking scale across multiple advertising properties through a single relationship.

3.11 StartApp

Overview: StartApp focuses primarily on interstitial ads while also offering app walls, native ads, video ads, and 360 apps .

Key Features:

Specializes in interstitial ad monetization

Connected with 220,000+ apps

Database of over 1.4 billion mobile users

100% fill rate guarantee

Benefits for Developers:

StartApp’s focus on interstitials and guaranteed fill rates provides reliable revenue from this high-performing format.

Pros:

✅ Strong interstitial ad specialization

✅ 100% fill rate guarantee

✅ Large user database

Cons:

❌ Focused primarily on specific formats

Best For: Games where interstitial ads are the primary monetization format.

3.12 TapJoy

Overview: TapJoy operates on a system of in-app virtual currency. Users earn currency by watching video ads, downloading promoted apps, or subscribing to services—currency that can then be used for in-app purchases .

Key Features:

Offerwall and rewarded video focus

Users earn virtual currency for engagement

Excellent for monetizing non-paying users

Benefits for Developers:

TapJoy offers an excellent option for publishers looking to monetize mobile apps without charging users directly .

Pros:

✅ Appeals to users who won’t make direct purchases

✅ Positive user experience through value exchange

✅ Strong for retaining engaged players

Cons:

❌ Requires integration with in-game economy

Best For: Games with robust virtual currency systems and economies.

Part 4: Platform-Specific Considerations

4.1 Regional and Niche Specialists

Beyond the major platforms, several networks excel in specific regions or verticals :

| Network | Specialization | Best For |

|---|---|---|

| Mintegral | Asian markets, programmatic | Games targeting China, Japan, Korea, Southeast Asia |

| Pangle | ByteDance global gaming network | Access to TikTok/Douyin audience |

| Moloco Gaming Ads | Machine learning-powered | Performance-focused campaigns |

| Bidstack | Native in-game advertising | PC and console games with native placements |

| Anzu | 3D in-game advertising | Immersive 3D game environments |

| Admix (Landvault) | In-game virtual billboards | Real-world brand placements in games |

4.2 Chinese Gaming Market

For games targeting the Chinese market, local platforms dominate. Key players include Tencent Ads, Bytedance (Douyin), Baidu, and Kuaishou, alongside major SSPs like Mintegral . These platforms offer access to massive domestic audiences with targeting tailored to local user behavior.

Part 5: Strategic Recommendations by Game Type

5.1 Casual and Hyper-Casual Games

Casual and hyper-casual games thrive on high ad volume and broad reach.

Recommended Primary Networks:

Unity Ads: Seamless integration with Unity-based casual games

ironSource LevelPlay: Reliable mediation for global audiences

AdMob: Strong fill rates across all regions

Recommended Strategy: Focus on rewarded video and interstitials at natural break points. Use mediation to maximize competition for each impression.

5.2 Mid-Core and Strategy Games

Mid-core games attract more engaged players with longer sessions.

Recommended Primary Networks:

AppLovin MAX: Sophisticated yield optimization

Chartboost: Niche targeting for specific player profiles

Meta Audience Network: Social integration for engaged communities

Recommended Strategy: Balance rewarded video for engaged players with interstitials during natural transitions. Use offerwalls for non-paying users.

5.3 Hardcore and PC/Console Games

Hardcore games require premium, non-intrusive advertising.

Recommended Primary Networks:

Bidstack: Native in-game placements

Anzu: 3D environment advertising

AdColony: Premium video ads with strong brands

Recommended Strategy: Focus on native and immersive formats that maintain game atmosphere. Prioritize brand-safe, high-CPM placements over volume.

5.4 Regional Targeting

| Target Region | Recommended Networks |

|---|---|

| North America/Europe | AdMob, AppLovin, Unity Ads, Meta Audience Network |

| Asia-Pacific | Mintegral, Pangle, InMobi |

| China | Tencent Ads, Bytedance, Baidu |

| Latin America | AdMob, ironSource, AppLovin |

Part 6: Integration Strategies for Maximum Revenue

6.1 The Mediation Advantage

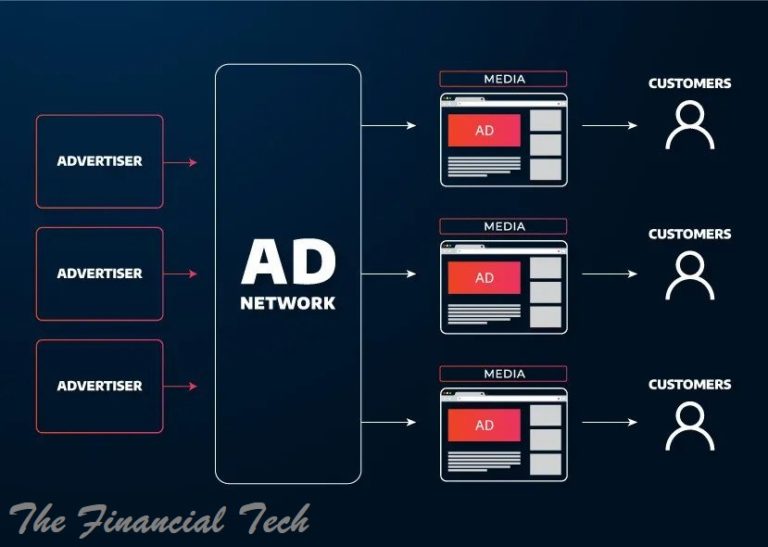

Relying on a single ad network caps your revenue potential. Mediation platforms like AppLovin MAX, ironSource LevelPlay, or AdMob Mediation allow you to integrate multiple networks and let them compete for each impression .

How mediation works:

Your game sends a single ad request to the mediation platform

The platform requests bids from all integrated networks simultaneously

The highest bid wins the impression

Competition drives up eCPMs across all demand sources

6.2 Header Bidding for Gaming Websites

For gaming websites (rather than apps), header bidding enables similar competition. Platforms like Ezoic, Publift, and MonetizeMore can significantly increase RPMs by creating auction pressure across multiple demand sources.

6.3 A/B Testing and Optimization

Continuous testing is essential :

Test different ad placements within your game

Compare network performance across regions

Experiment with frequency caps to prevent ad fatigue

Monitor retention impact alongside revenue metrics

6.4 AI-Powered Optimization

Leading networks increasingly use AI for optimization :

Predictive modeling to identify high-value users

Dynamic creative optimization matching ads to player preferences

Automated bid adjustments based on real-time performance

Part 7: Budget Allocation and Channel Mix

According to XMP’s analysis of over $10 billion in managed ad budgets :

Meta consistently leads advertising expenditure for gaming

Mintegral and AppLovin are significant choices for game advertisers

Google Ads and Apple Ads remain primary platforms for many game advertisers

60% of top-five media channels showed year-over-year spending growth

80% of channels ranked 6-10 achieved spending growth—a strong indicator of diversification

7.1 Creative Format Distribution

Among mobile game advertising creatives :

Video ads: 81% dominance

Image ads: 14%

Playable ads: 5%

This distribution highlights the continued importance of video, with playable ads representing a growing niche for high-engagement user acquisition.

Part 8: Best Practices for Implementation

8.1 Timing Is Everything

For interstitial ads especially, placement timing determines success or failure :

Place ads at natural transition points (between levels, after game completion)

Avoid interrupting active gameplay

Consider user state—are they likely to be surprised or frustrated?

8.2 Frequency Capping

Prevent ad fatigue by setting reasonable frequency limits. Monitor retention metrics alongside revenue—if daily active users drop, your frequency may be too high.

8.3 User Experience First

The most successful games treat advertising as part of the experience, not an interruption:

Rewarded videos let players choose engagement

Offerwalls provide value exchange

Well-timed interstitials feel like natural breaks

8.4 Testing New Platforms

As the Chinese market analysis notes , advertisers should allocate budget with a “mainstream foundation, incremental testing” approach. Test emerging platforms while maintaining core spend on proven performers.

8.5 AI-Enhanced Creative

AI tools now enable rapid creative iteration and localization . Use AI to:

Generate region-specific ad variations

Test different creative angles

Identify high-performing elements

Scale successful concepts

Conclusion: Building Your Optimal Gaming Ad Stack

The gaming advertising landscape in 2026 offers unprecedented opportunity—but also unprecedented complexity. Success requires:

For Mobile Games:

A well-constructed mediation stack typically includes:

A primary demand source (Unity Ads, AdMob, or AppLovin)

Supplementary networks (Chartboost, ironSource, Vungle) for competition

Regional specialists (Mintegral for Asia, Pangle for TikTok audiences)

Premium formats (rewarded video, playable ads) for engaged users

For Gaming Websites:

Header bidding platforms like Ezoic or Publift to maximize competition

Video-first networks for high-CPM placements

AdSense or Media.net for contextual display

The Bottom Line:

Two similar games with identical traffic can earn dramatically different revenue based on network selection . The winning strategy combines:

Diversified demand through mediation

Format optimization matching ad types to gameplay

Continuous testing of placements, networks, and creatives

Regional intelligence tailoring your stack to audience geography

The game advertising ecosystem rewards those who treat monetization as a strategic function, not an afterthought. Choose your networks wisely, test relentlessly, and always balance short-term revenue against long-term player retention.

Your players are engaged. Your traffic is valuable. The right ad stack will prove it.

OTHER POSTS